Register for our DAC6 email updates

One of the big challenges that intermediaries face in reporting transactions under DAC6 is what to do when things change. Client projects which may have been deemed non-reportable, or which may not even have involved any cross-border elements at the outset, may transform into a potentially reportable arrangement later on. The delay between starting work for a client and the matter becoming reportable may be months or even years.

Download a guide to DAC6 compliance

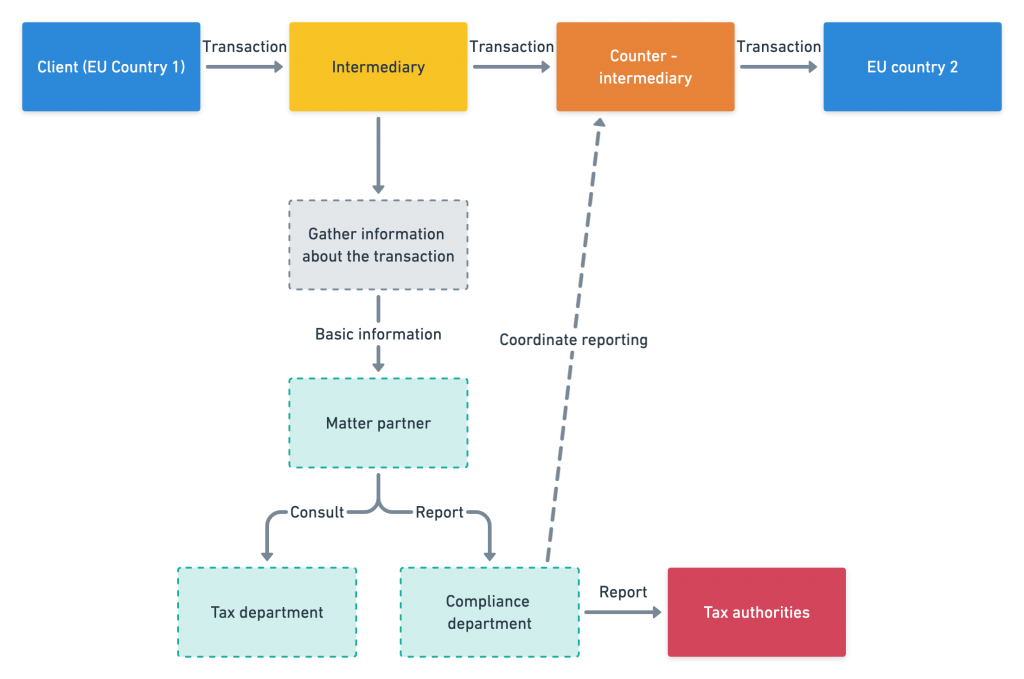

VinciWorks’ DAC6 solution, powered by Omnitrack, guides intermediaries through the process of determining whether a transaction is reportable. It also integrates with existing client and matter management tools via its open API standard. And it now has pre-built integrations with leading matter management tools, such as Intapp Intake, for seamless onboarding of new transactions. However, if a transaction becomes reportable much later on, how should this be handled?

This question can be broken down into two parts:

- How should I deal with changing transactions from a technical perspective in Omnitrack?

- How should I deal with changing transactions from a personnel perspective in terms of getting people to be aware of what they need to do?