Register for our DAC6 email updates

Editors note: HMRC announced on 31 December that as part of the Brexit agreement there will be major changes in the UK’s approach to DAC6. The changes restrict reporting obligations to only those arrangements that would be reportable under the OECD’s MDR, namely arrangements included in the Category D hallmark of DAC6. You can learn more about the changes here.

13 months ago, the Economic and Financial Affairs Council of the European Union (ECOFIN) adopted the 6th Directive on Administrative Cooperation (the “DAC6”). This new directive requires tax intermediaries to report specific cross-border arrangements that contain at least one of the hallmarks that are defined in DAC6.

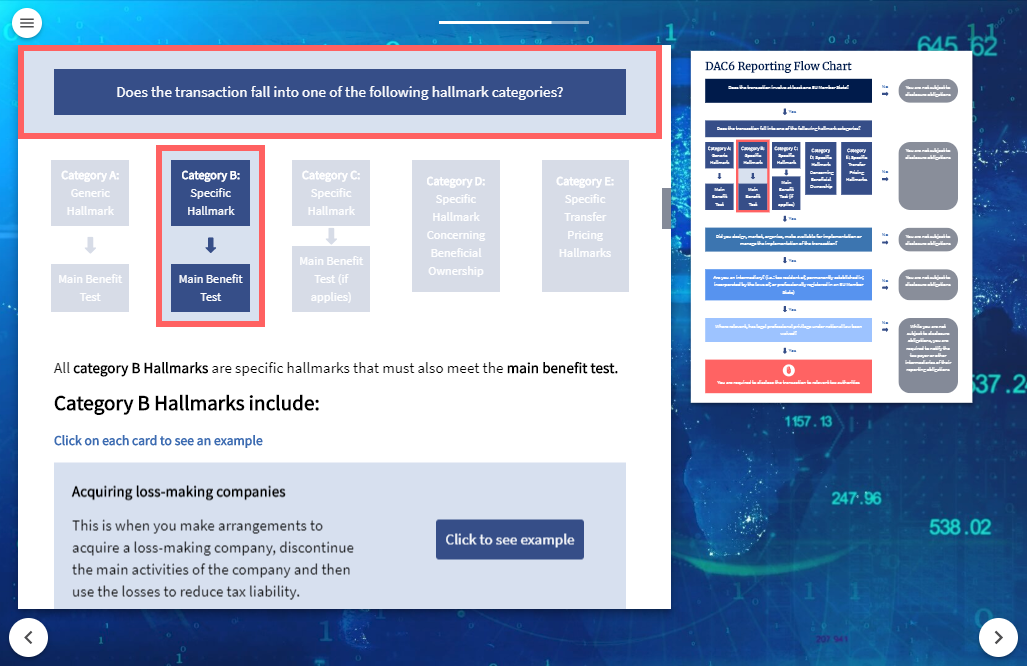

Within DAC6, there are five different hallmark categories that represent an indication that a transaction may have a potential risk of tax avoidance.

This blog focuses on the category D hallmarks which are classified as generic hallmarks and may include one of the following:

1. Arrangements undermining reporting obligations – This could include those arrangements undermining European Union legislation, other equivalent agreements which take advantage of the lack of legislation or agreements in place.

2. Ownership Chains – Arrangements involving non-transparent legal or beneficial ownership chains.

An example of a category D hallmark would be if a German taxpayer transfers money to a relative in Chile, a country that does not have a treaty enabling it to automatically exchange Financial Account information with Germany.

DAC6 reporting and training requirements

If you do not report a cross-border transaction under DAC6, you could face harsh and problematic penalties. VinciWorks has released a DAC6 reporting and training solution to help businesses reach full compliance with DAC6. This includes a secure, enterprise-wide data management portal for recording all cross-border tax transactions and two new courses:

- DAC6 reporting portal — Record all cross-border tax transactions that may require reporting according to DAC6

- DAC6: Advanced course — Follow an interactive flow-chart navigation to help establish which transactions you are required to report

- DAC6: Fundamentals course — Interactive training for staff, providing an overview of the key elements of the Directive