Register for our DAC6 email updates

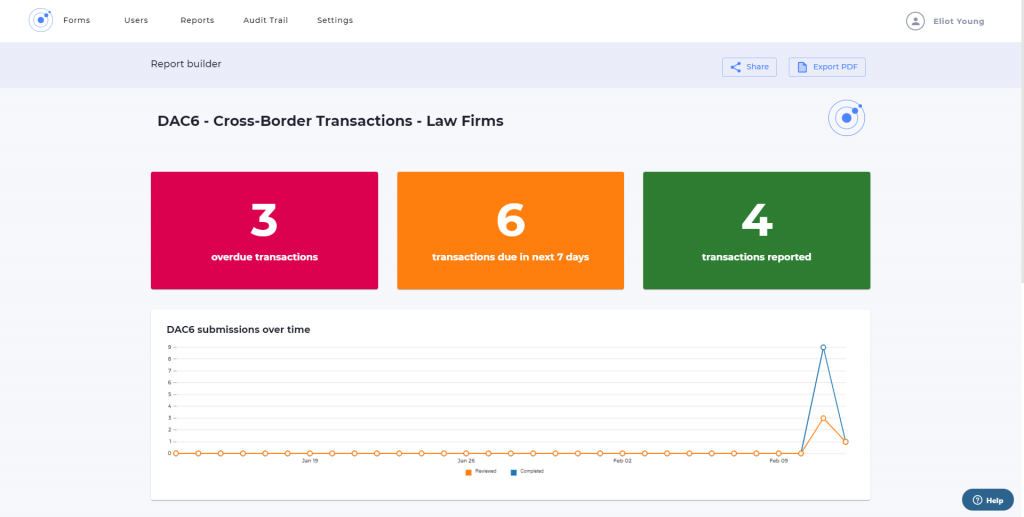

DAC6 is an EU Directive that aims to strengthen tax transparency and fight against aggressive tax planning. Anyone who is involved in a cross-border arrangement including certain characteristics might fall within the scope of DAC6. This might include banks, trust companies, insurance companies, holding companies, group treasury functions, consultants, accountants, financial advisors and lawyers (including in-house).

On 13 January 2020, HMRC laid the UK’s DAC6 legislation before the House of Commons in the form of the International Tax Enforcement (Disclosable Arrangements) Regulations 2020, Statutory Instrument 2020 No. 25. The legislation will come into force on 1 July 2020. Reporting will be required for transactions in which the first step of implementation was carried out on or after 25 June 2018.

In this webinar, we were joined by Director of Best Practice Gary Yantin and Research and Legal Executive Ruth Cohen to share the key findings of HMRC’s final legislation and its consultation and give guidance on best practice to firms on their reporting requirements under DAC6.

The webinar will include:

- A summary of HMRC’s implementation of DAC6

- Examples of how different countries have implemented DAC6

- A summary of our findings from core group meetings with leading international firms

- Practical application of DAC6 in your firm

- Answering questions from attendees

Watch now

Continue reading