Register for our DAC6 email updates

DAC6 is an EU Directive that aims to strengthen tax transparency and fight against aggressive tax planning. Anyone who is involved in a cross-border arrangement including certain characteristics might fall within the scope of DAC6. This might include banks, trust companies, insurance companies, holding companies, group treasury functions, consultants, accountants, financial advisors and lawyers (including in-house).

On 13 January 2020, HMRC laid the UK’s DAC6 legislation before the House of Commons in the form of the International Tax Enforcement (Disclosable Arrangements) Regulations 2020, Statutory Instrument 2020 No. 25. The legislation will come into force on 1 July 2020. Reporting will be required for transactions in which the first step of implementation was carried out on or after 25 June 2018.

In this webinar, we were joined by Director of Best Practice Gary Yantin and Research and Legal Executive Ruth Cohen to share the key findings of HMRC’s final legislation and its consultation and give guidance on best practice to firms on their reporting requirements under DAC6.

The webinar will include:

- A summary of HMRC’s implementation of DAC6

- Examples of how different countries have implemented DAC6

- A summary of our findings from core group meetings with leading international firms

- Practical application of DAC6 in your firm

- Answering questions from attendees

VinciWorks has hosted several webinars on topics such as GDPR, health and safety, whistleblowing and more. You can view all of our webinars on-demand and sign-up for upcoming webinars here.

About our experts

As Director of Best Practice at VinciWorks, Gary Yantin works with professional service firms of all sizes to provide the best compliance learning experience for their staff. He was previously an in house lawyer and a solicitor in private practice. Gary has hosted many webinars and workshops for VinciWorks on a wide range of risk and compliance topics including GDPR and the SRA’s new approach to ongoing learning.

Legal and Research Executive and Data Protection Officer Ruth Cohen holds an LLB specialising in International Commercial Law. Ruth has experience in both the public and private sectors, having consulted for many Fortune 500 companies. She has expert-level knowledge across a wide range of areas including corporate finance, DAC6, GDPR, information security, commercial law and regulatory compliance.

VinciWorks’ DAC6 reporting and training solution

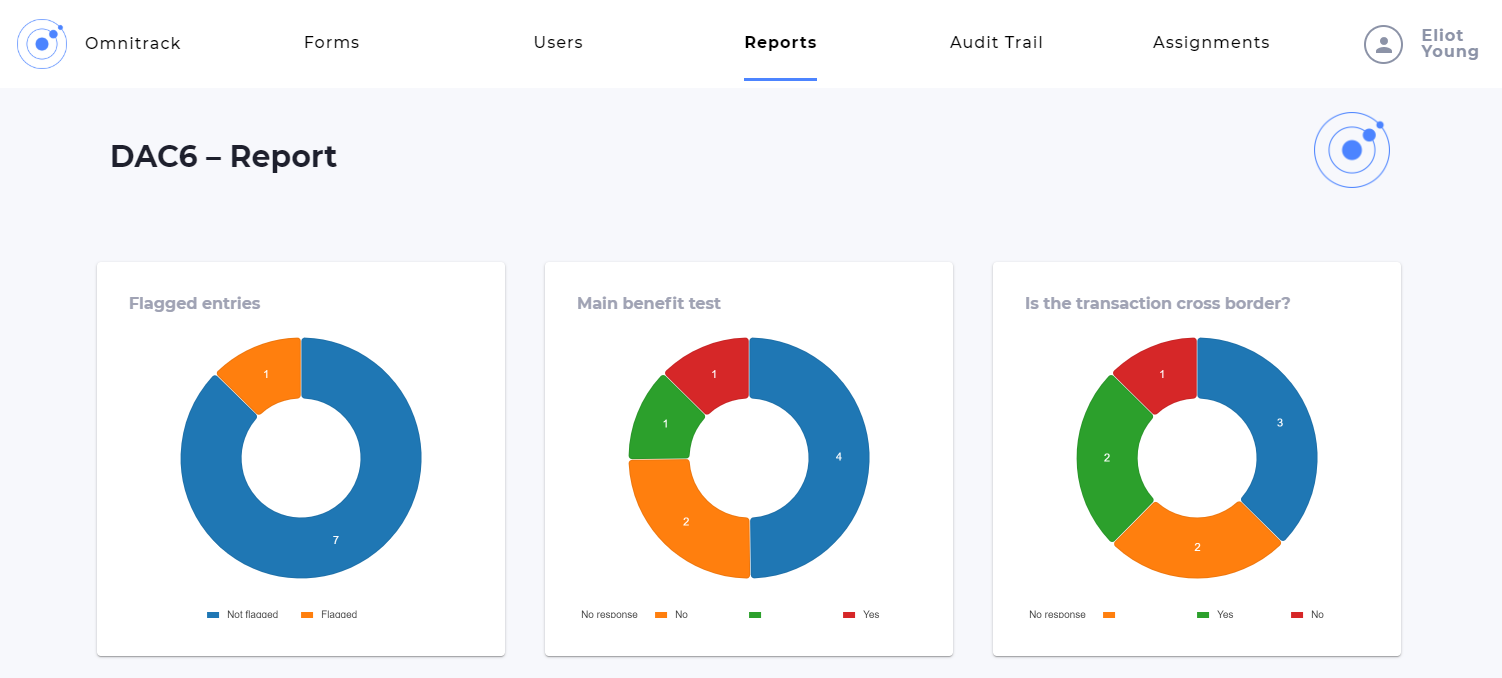

VinciWorks has built a DAC6 reporting and training solution to help businesses reach full compliance with the Directive. This includes a secure, enterprise-wide data management portal for recording all cross-border tax transactions and two courses.

DAC6 reporting tool key features

- Record all cross-border tax transactions that may require reporting

- Fully integrated with Intapp API to provide an end-to-end solution.

- Links to DAC6 training to review specific hallmarks and reporting requirements

- Integrated flowchart to identify whether a specific transaction requires reporting

- Customisable ready-to-go form template library