Navigating the Ethics, Risks and Opportunities

Today, we are meeting the challenges of the AI revolution head-on with the launch of our new AI Compliance eLearning collection.

Amid the wave of AI transformation, businesses grapple with understanding both the potential advantages and risks it presents. A recent poll by VinciWorks revealed that 63% of respondents do not currently have internal AI policies implemented within their organisations. With the International Monetary Fund (IMF) forecasting AI’s impact on nearly 40% of global jobs—either replacing or complementing them—there is a pressing need for companies to adapt proactively to the evolving AI landscape.

Designed to empower professionals across industries with essential insights into AI, the latest collection is a key addition to the Information Security and Data Protection suite, comprising seven comprehensive courses. As AI continues to reshape the way we work, this collection offers a thorough overview, beginning with foundational principles and clarifying the core aspects of AI. The courses delve into best practices for workplace AI usage, ethical challenges, and associated risks. The new courses include:

Understanding AI – Opportunities and Risks

This course addresses the surge in AI’s disruptive impact on the business world, providing insights into opportunities and clarifying misconceptions. It explores optimal uses of AI tools for office productivity and examines the legal and moral challenges and the risks associated with AI on a global scale.

AI and Data Privacy

This course focuses on businesses’ challenges in reconciling technological innovation with preserving personal privacy rights. It objectively explores fundamental concepts related to data privacy laws and AI technologies, offering insights into effectively managing associated complexities.

AI and Intellectual Property

This course covers fundamental AI concepts and legal considerations for intellectual property rights, challenging users to navigate grey areas in IP ownership. It addresses legal and ethical dilemmas surrounding AI-generated works and guides organisations to mitigate intellectual property compliance risks.

AI and Discrimination

This course tackles the rising dependence on AI models for crucial decisions affecting various aspects of life. It examines the potential consequences of poorly designed AI models, uncovering inherent biases that may result in unfair treatment. It focuses on recognising biases and discusses strategies for rectification, ensuring accuracy and fairness.

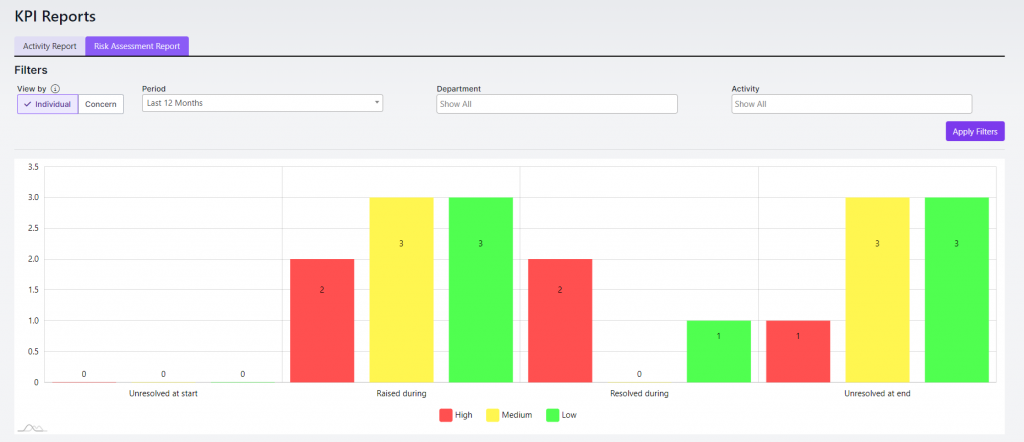

AI and Conducting an Effective Risk Assessment

This course addresses the rapid disruption caused by AI and emerging technologies, emphasising the critical need for companies to adapt swiftly. It focuses on AI-related risks, guiding users in crafting thorough risk assessments and exploring ways to leverage AI tools for enhanced risk-control strategies.

AI and Cybersecurity

This course guides users through the changing landscape of AI and cybersecurity, providing a vision for what to expect as attacks get more complex and how to stay a step ahead. This video-based course provides insights from subject matter expert Richard Merrygold, Director and Infosec Lead Consultant at iStorm, on understanding and navigating this environment.

Plagiarism in the Age of AI

In academia, plagiarism concerns grow with AI usage. This course delves into higher education foundations, stressing the severe consequences of plagiarism. It explores how AI exacerbates this issue, navigating potential risks students face when resorting to copied content.

The new AI eLearning collection is available in various learning formats, including case studies, videos, and full and short courses, targeting a global audience. The VinciWorks in-browser editing tool enables HR and learning and development teams to tailor courses in real-time, with visible edits and easy sharing capabilities via a unique link.

Nick Henderson-Mayo, Director of Learning and Content at VinciWorks, commented, “Embracing the transformative power of AI in the workplace demands not only awareness but proactive education. Our AI Compliance eLearning Collection is not just about understanding the intricacies of artificial intelligence; it’s a navigational guide through the ethical considerations, potential risks, and untapped opportunities. In a landscape where adaptability is paramount, this new collection of AI compliance training courses empowers professionals to harness the full potential of AI responsibly.”

To support compliance professionals’ comprehension of AI, VinciWorks is offering a complimentary AI and Compliance guide. For more information on VinciWorks’ AI training collection, click here.