Register for our DAC6 email updates

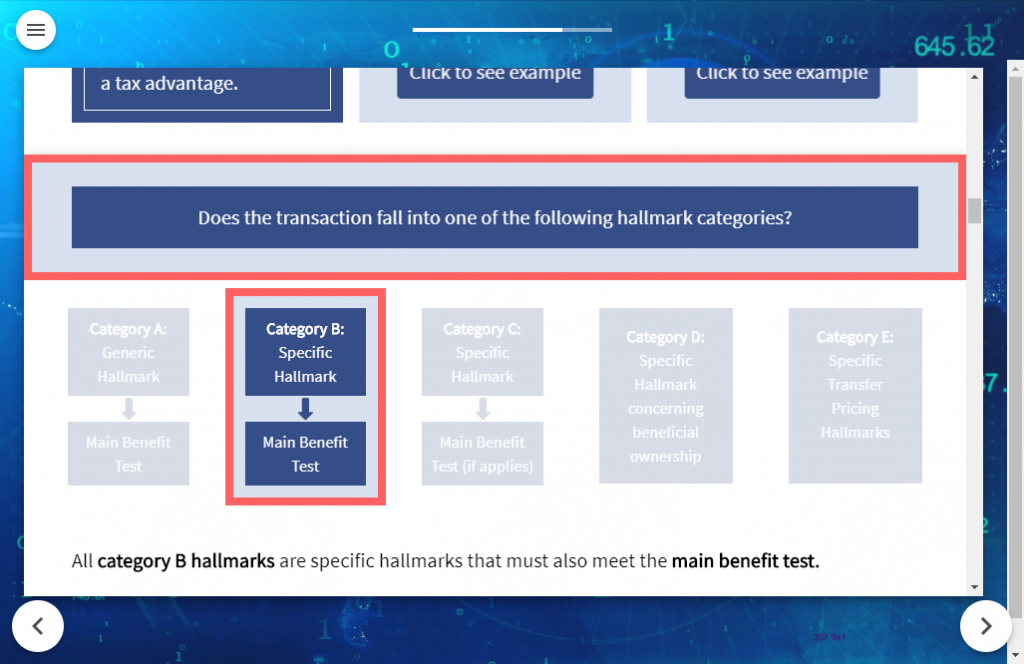

The Economic and Financial Affairs Council of the European Union (ECONFIN) has adopted the 6th Directive on Administrative Cooperation (“DAC6”), requiring tax intermediaries to report certain cross border arrangements. Under DAC6, intermediaries may be required to submit all cross-border transactions and backdate them when member states publicise their requirements.

In this webinar, Legal and Research Executive Ruth Cohen and Director of Best Practice Gary Yantin helped dissect the new regulation and gave guidance on reporting and training requirements under DAC6.

Continue reading

When your organisation is using third parties, it is essential to complete your own due diligence equal to the risk faced from the said relationship. With businesses and partnerships around the world growing, it is essential to make sure all your relationships and third parties are legal and legitimate. VinciWorks’ guide to risk based third party due diligence will give you a clearer understanding of how to conduct a detailed and genuine risk assessment.

When your organisation is using third parties, it is essential to complete your own due diligence equal to the risk faced from the said relationship. With businesses and partnerships around the world growing, it is essential to make sure all your relationships and third parties are legal and legitimate. VinciWorks’ guide to risk based third party due diligence will give you a clearer understanding of how to conduct a detailed and genuine risk assessment.