Register for our DAC6 email updates

The Economic and Financial Affairs Council of the European Union (ECONFIN) adopted the 6th Directive on Administrative Cooperation (“DAC6”) requiring tax intermediaries to report certain cross border arrangements.

The new EU rules which aim to clamp down on aggressive tax planning are set to impose a huge compliance burden on taxpayers and their advisers, potentially even in circumstances where there is no tax benefit at all.

VinciWorks’ DAC6 course, DAC6: Fundamentals, will help all entities who may be considered tax intermediaries develop an understanding of DAC6. The course follows a flow-chart navigation and includes example scenarios to help users understand DAC6. VinciWorks also offers a DAC6 reporting tool to help intermediaries easily keep track of and report cross-border transactions.

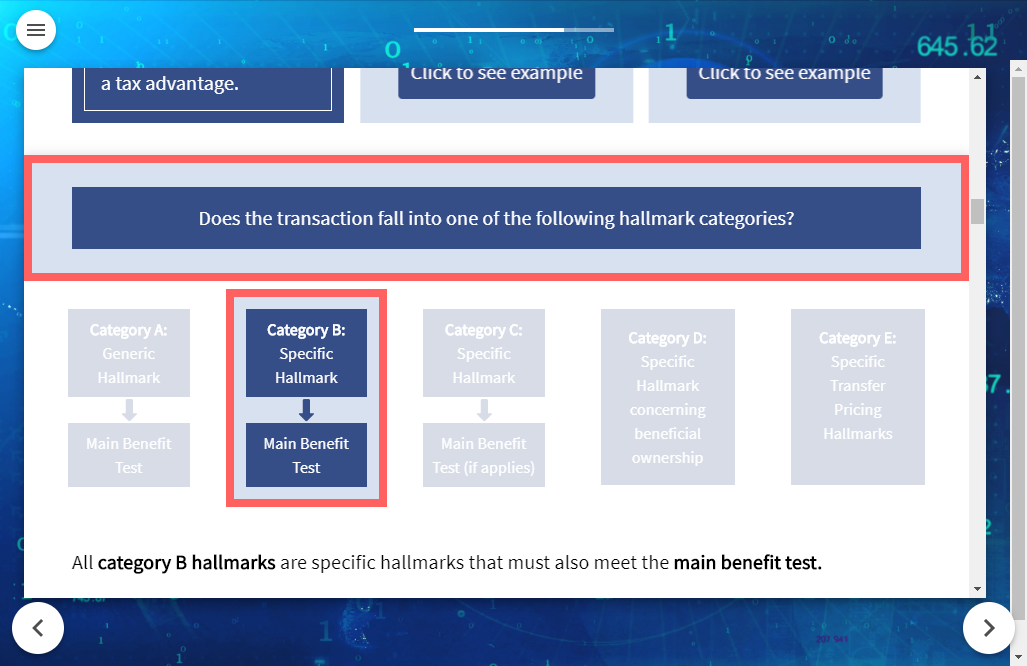

DAC6 reporting flowchart

The course is structured around a DAC6 reporting flowchart, which guides the user through the DAC6 reporting process. For each stage in the flowchart, there are clear explanations and examples to demonstrate reportable activities.

The course covers:

- Introduction and background

- History

- What are the hallmarks?

- What is the main benefit test?

- Who is an intermediary?

- Which tax events require reporting?

- What is covered by legal professional privilege?

- Test Scenarios

- Printable DAC6 materials

In order to enhance the learning experience, the course also contains a number of unique special features.

- Flow chart navigation for an easy reference tool

- Detailed examples of each hallmark

- Interactive scenario questions to ensure understanding of the DAC6 reporting process

- A guide to the DAC6 reporting flowchart that users can download at the end of the course

Course outcomes

- Understand what is included in DAC6

- Learn which specific hallmarks apply to different tax incidents

- Apply DAC6 to example scenarios

- Gain the necessary tools to apply the DAC6 flowchart to real-life situations

DAC6 reporting tool

VinciWorks’ DAC6 reporting portal is a secure, enterprise-wide data management portal for recording all cross-border tax transactions that may require reporting according to DAC6. The fully-customisable template collects and records the transactions’ relevant data points in an easily accessible register.

DAC6 guide to compliance

To help businesses get to grips with DAC6, VinciWorks has published a guide to DAC6 compliance. The guide covers the scope and purpose of DAC6, who the Directive is relevant to, guidance on complying with DAC6 and more. You can download the guide here.