Register for our DAC6 email updates

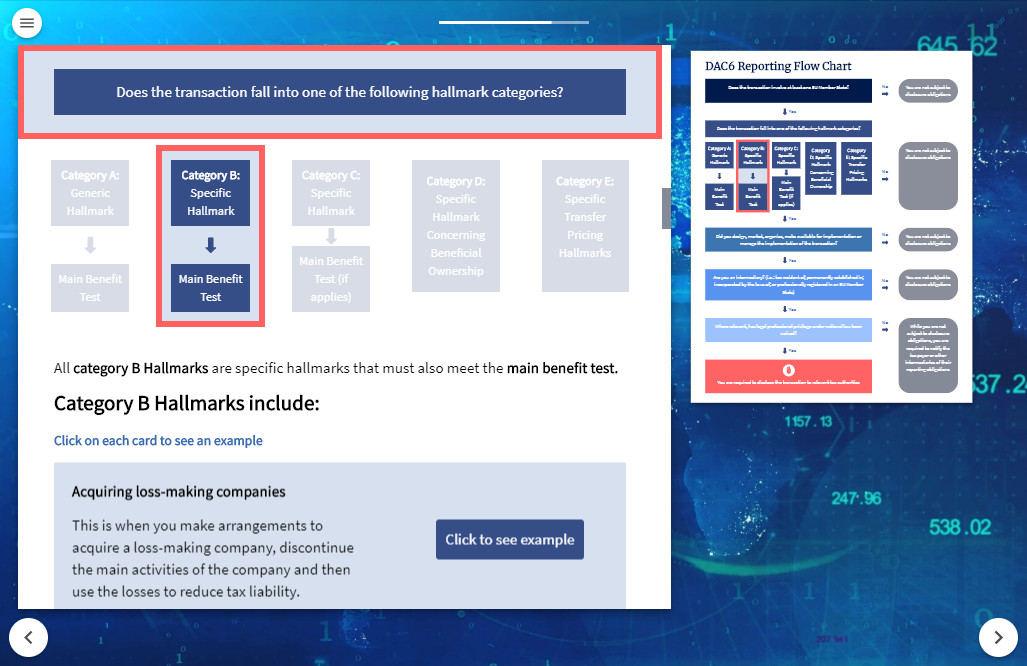

HMRC has just released its draft regulations on implementing the 6th Directive on Administrative Cooperation, known as DAC6, into UK law. From 1 July 2020, taxpayers and their advisers are required to report details of certain cross-border arrangements that could be used to avoid or evade paying tax to HMRC. The UK has been lagging behind their European counterparts in producing draft DAC6 legislation.

HMRC has been engaging with interested parties over the last year to identify the best approach for implementing this measure, and HMRC released its first written consultation on this issue (the “Consultation”) on 22 July 2019. HMRC has opened up a 12 week consultation period which will close on 11 October 2019.

The Consultation includes a list of 22 questions for which HMRC are seeking input. The key questions which the Consultation discusses include:

- How can we gain more clarity when an arrangement involves multiple jurisdictions?

- Who is considered to be an intermediary?

- How proportionate is the definition of the main benefit test?

- Will the HMRC draft legislation prevent over-reporting?

- Are the hallmark definitions clear enough?

- Which parts of the legislation should HMRC provide more guidance on?

As the leading provider of DAC6 training and reporting software, VinciWorks will be hosting further discussions on the practical applications of this consultation, including an opportunity for interested parties to contribute to a joint response to this consultation.

How can you get involved?

VinciWorks held a successful DAC6 core group meeting last month, with over 20 firms in attendance. We will be holding another roundtable discussion in September to discuss HMRC’s draft DAC6 legislation and the Consultation, with the aim of sending a collaborative response to HMRC.

If you would like to get involved, please complete this short form and we will update you on the time and location of the forthcoming meeting.