Register for our DAC6 email updates

Last May, the European Union created the 6th Directive on Administrative Cooperation (the “DAC6”). Under this new law tax intermediaries are required to report certain cross-border arrangements that contain at least one of the hallmarks as defined in DAC6.

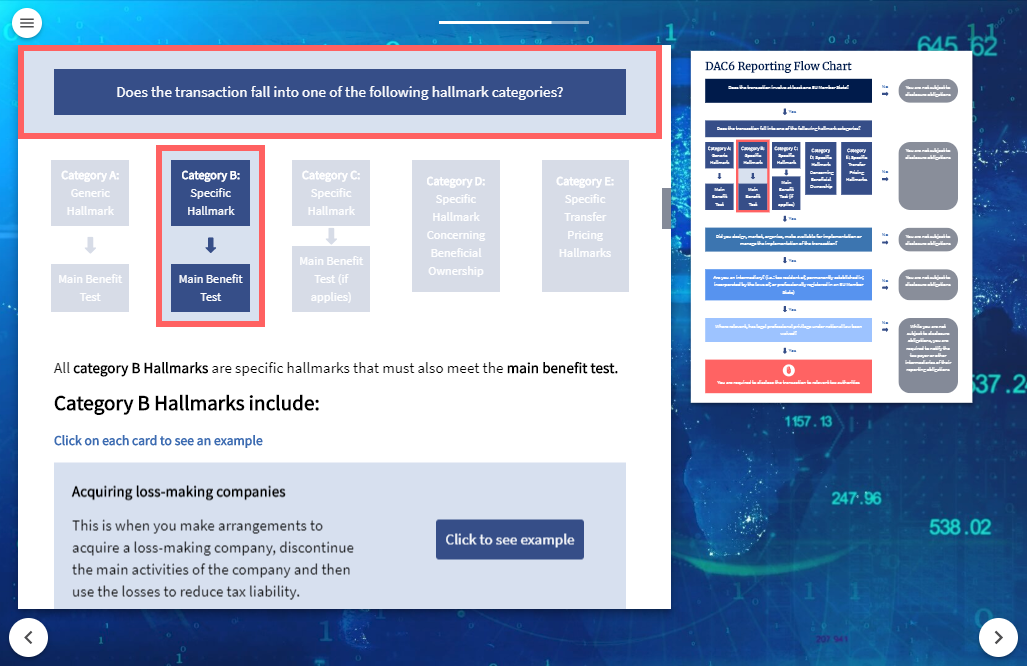

DAC6 contains five different hallmark categories that represent an indication that a transaction may have a potential risk of tax avoidance.

This blog will focus on the category E hallmarks which are classified as generic hallmarks, and may include one of the following:

1. Unilateral Harbour Rules – Arrangements involving unilateral safe harbour rules.

2. Hard-to-value intangibles – Arrangements involving intangibles or rights in intangibles where no reliable comparable exist at the time of transfer, therefore it is hard to predict their worth.

3. Intra-group cross border transfers – Arrangement involving intra-group cross-border transfers of functions and/or risks and/or assets if the Earnings Before Interest and Tax (EBIT) during the three years after the transfer are less than 50% of the EBIT if the transfer had not been made.

An example of a category E hallmark would be if a construction company residing in France, sells all of its income-generating assets to an affiliate company residing in Italy.

If you or your organisation fails to report a transaction under DAC6, you could face huge fines. VinciWorks has created an online training and reporting solution to help you and your company understand and comply with this new and complex law.