Register for our DAC6 email updates

Back in May 2018 the Economic and Financial Affairs Council of the European Union (ECOFIN) adopted the 6th Directive on Administrative Cooperation (“DAC6 Directive”). This new directive requires tax intermediaries to report specific cross-border arrangements.

In July 2019, HMRC released their draft DAC6 legislation together with their consultation document. These documents indicate that HMRC intends to align its reporting requirements with the DAC6 Directive, and HMRC will require intermediaries to report any additional information.

Download a guide to DAC6 compliance

Who needs to report?

Any entity that acts as an intermediary for a cross-border transaction involving an EU Member State may have an obligation to report this to HMRC or a different EU tax authority.

Who is exempt from reporting?

Exemptions from reporting may be available for intermediaries who have evidence that the information that they would have been required to report has already been reported by another intermediary or relevant taxpayer.

In order for the exemption to apply, the intermediary would need to satisfy themselves that a report had been made to the relevant tax authority including all the information they themselves would have been required to report.

How will HMRC record that a cross border transaction has reported?

Once a cross-border transaction is reported to a tax authority for the first time, a unique reference number known as an Arrangement Reference Number (ARN) will be assigned to that arrangement. If an arrangement is first reported to HMRC, HMRC will be the tax authority who will issue the ARN.

The practical arrangements for the process of allocating the ARN and for those with whom the reporting obligation lies to inform the other parties of this number have not yet been set out.

If a different entity has reported the cross-border arrangement, how can an intermediary ensure the correct information has been reported?

HMRC currently is of the view that where an intermediary is provided with a correct arrangement reference number (ARN), that will be sufficient evidence that a report has been made.

Even if an intermediary is aware that another entity has reported the cross border arrangement to HMRC or another tax authority, they themselves would still need to be satisfied that the information that they themselves would have been required to report has been captured in the report that was made.

An example of this would be where the intermediary who made the report was only involved in a part of the wider arrangement, they might not have knowledge of the detail of the arrangement as a whole. Therefore another intermediary, who had knowledge that the first reporting intermediary did not have, would still need to report.

What information must be reported?

The information that reporting intermediaries need to provide to HMRC is aligned with the DAC6 Directive, this includes the following information:

Identification of intermediaries and relevant taxpayers, including:

1. Identification of intermediaries and relevant taxpayers, including:

a. name

b. date

c. place of birth (in the case of an individual),

d. residence for tax purposes,

e. TIN (Tax Identification Number)

f. the persons that are associated enterprises to the relevant taxpayer (where appropriate)

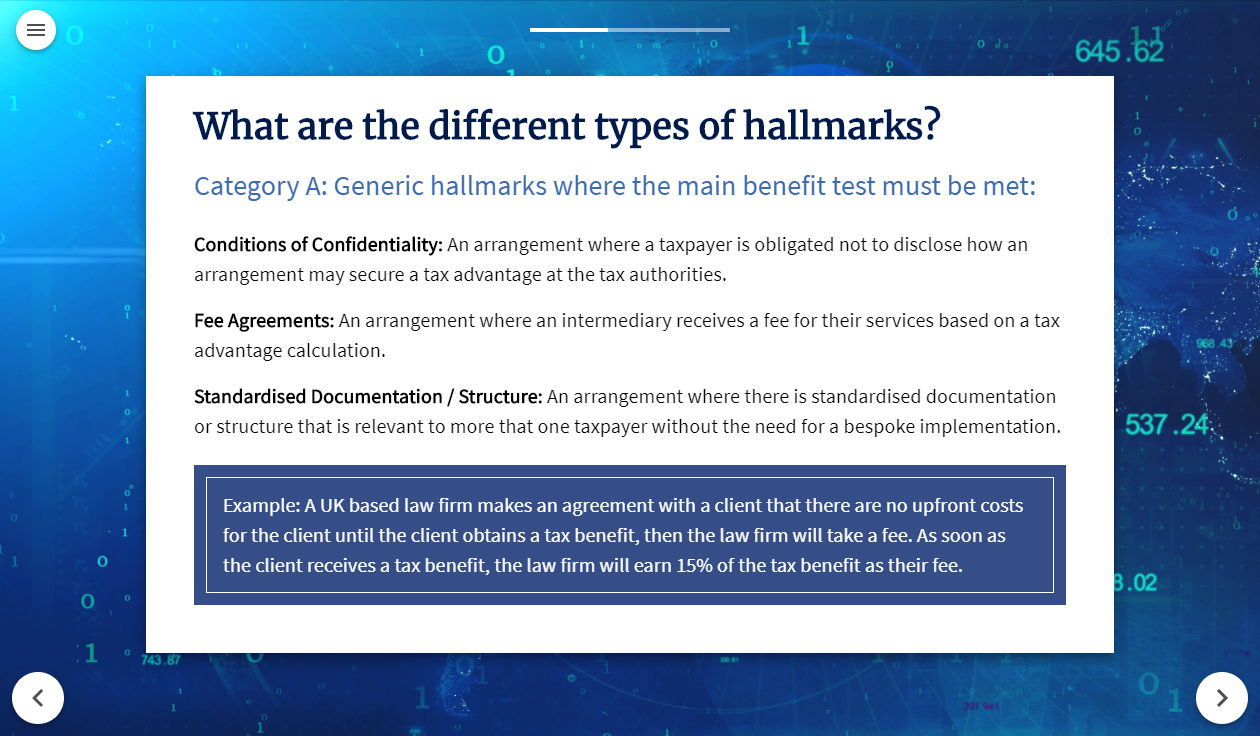

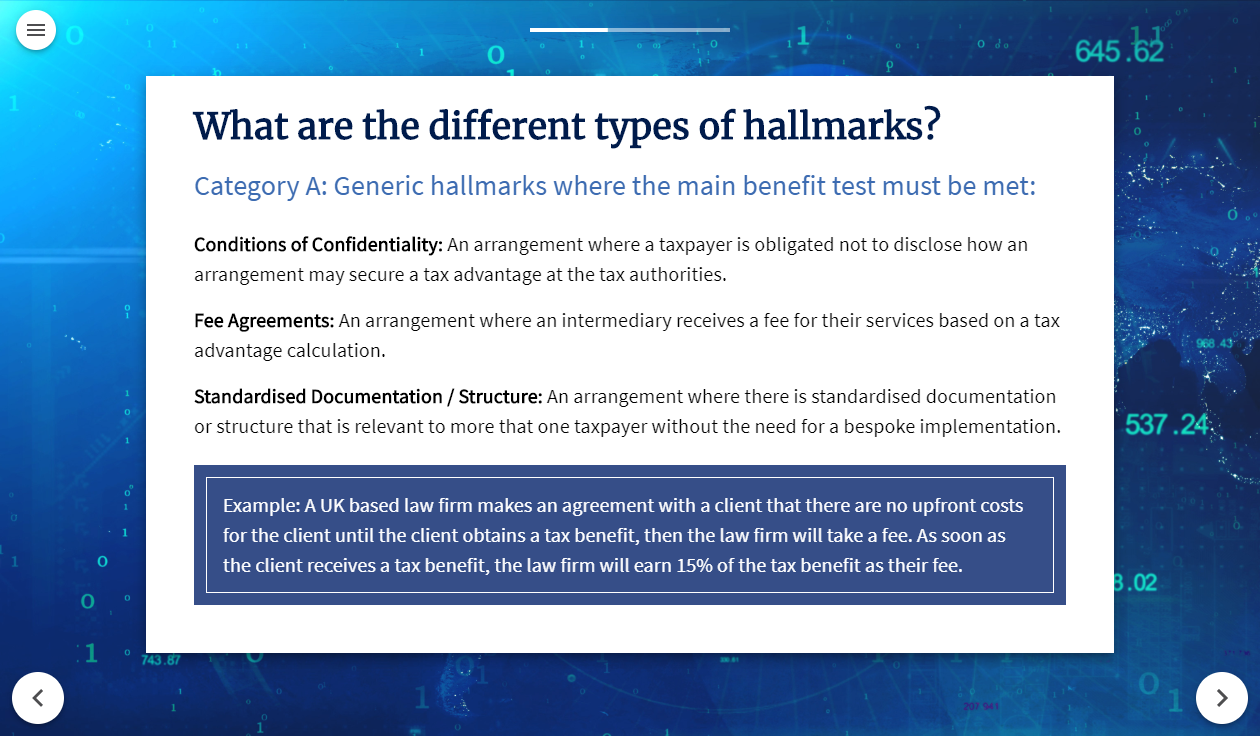

2. Details of the relevant hallmark/s that make the cross-border arrangement reportable.

3. Summary of the content of the reportable cross-border arrangement, including:

a. a reference to the name by which it is commonly known, if any

b. description in abstract terms of the relevant business activities or arrangements (without disclosing commercial, industrial or professional secrets or information which would be contrary to public policy

4. Date on which the first step in implementing the reportable cross-border arrangement has been made or will be made;

5. Details of the national provisions that form the basis of the reportable cross-border arrangement;

6. Value of the reportable cross-border arrangement

7. Identification of the Member State of the relevant taxpayer(s) and any other Member States which are likely to be concerned by the reportable cross-border arrangement.

8. Identification of any other person in a Member State likely to be affected by the reportable cross-border arrangement, indicating to which Member States such person is linked.

Will this information be shared with anyone?

The information reported to HMRC in line with the DAC6 directive requirements will be shared by HMRC with the other EU Member States:

VinciWorks’ DAC6 reporting and training solution

DAC6 requires lawyers, accountants, tax advisers, bankers and other “intermediaries” to report some aggressive cross-border tax arrangements. VinciWorks has developed a reporting and training solution to help organisations effectively track cross-border transactions and train their staff on their responsibilities. Our DAC6 reporting portal collects and records all relevant data in an easily accessible register. The portal can be customised to include questions specific to your industry or organisation. Our online DAC6 training suite provides the information and resources intermediaries need in an accessible format.