Register for our DAC6 email updates

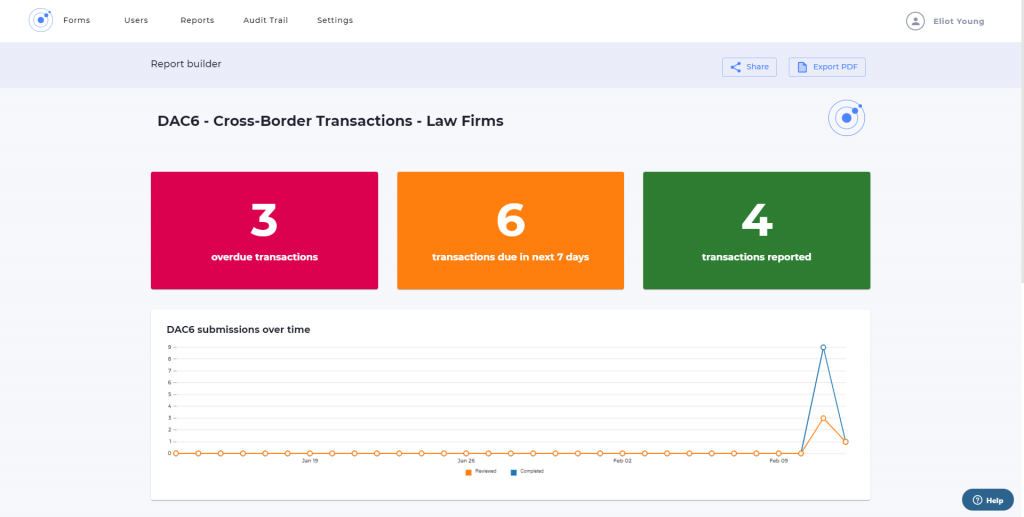

One of the most important aspects of DAC6 compliance is making sure intermediaries report transactions within the reporting deadline. Having consulted with over 50 leading international firms and HMRC, we have updated the DAC6 portal dashboard to make it easier for administrators to stay on top of deadlines. Our customisable dashboard will allow firms to easily track when a deadline is approaching, see what’s overdue and review what has been reported.

What are the key features of the new DAC6 portal dashboard?

1. Clear overview of the status of reports

Failure to submit a report can result in a fine from HMRC. The dashboard gives a clear, customisable visual overview of the upcoming deadlines and overdue reportable transactions.

Continue reading