Register for our DAC6 email updates

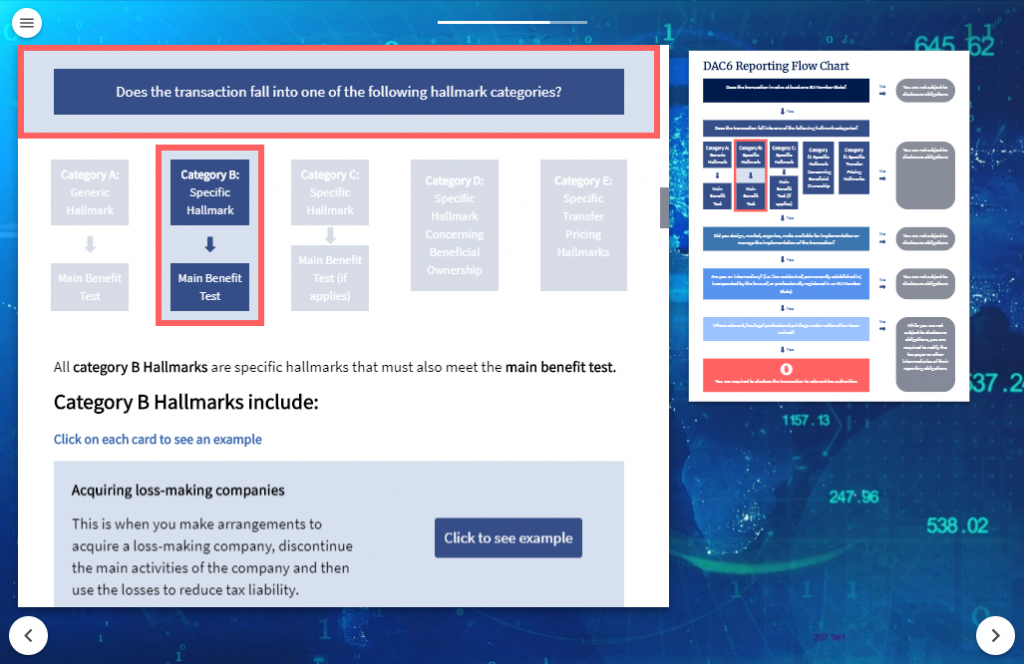

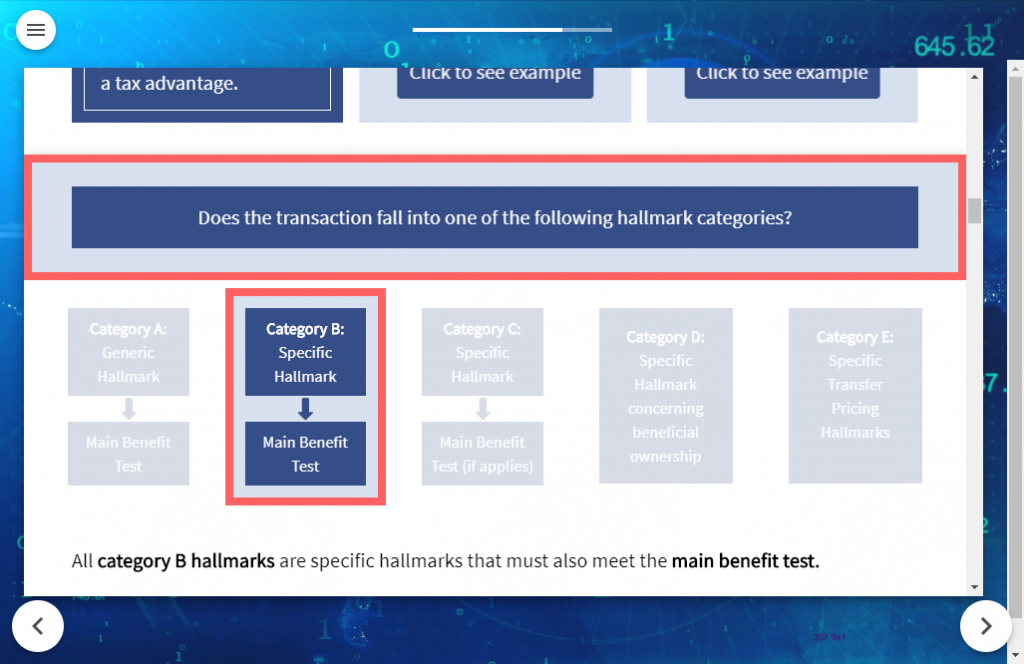

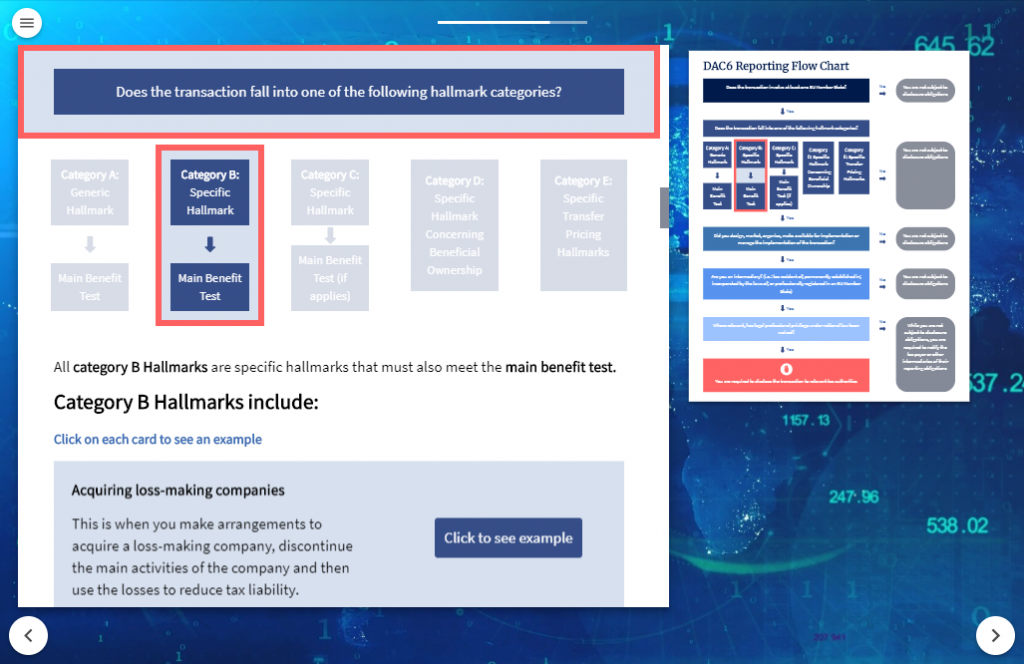

On 25 May 2018, the Economic and Financial Affairs Council of the European Union (ECOFIN) adopted Council Directive (EU) 2018/822, also known as the 6th Directive on Administrative Cooperation (DAC6), requiring tax intermediaries to report certain cross-border arrangements that contain at least one of the hallmarks defined in the Directive. The aims of DAC6 is to tackle tax evasion and avoidance, strengthen tax transparency and improve information sharing between EU Member States.

Count how many times you said the word “tax” this week. Easy? How about every time this month. Harder? All right, what about every time you said the word “tax” to a client in the last 18 months? Still confident about the number?

Now, think about every time that could have been construed as advice. What about doing transactions with other countries or thinking about tax planning measures? All of these instances might need to not only be remembered, but also recorded and reported to the national tax authority.

Continue reading