How do you make online training an experience that actually makes a difference in real time? How do you measure what each user is gaining from the training?

All of our compliance courses come complete with an interactive element, be it quizzes, assessments or gamification. This is all very well, but how can administrators and compliance managers utilise these interactions to increase the impact of the training on the entire organisation?

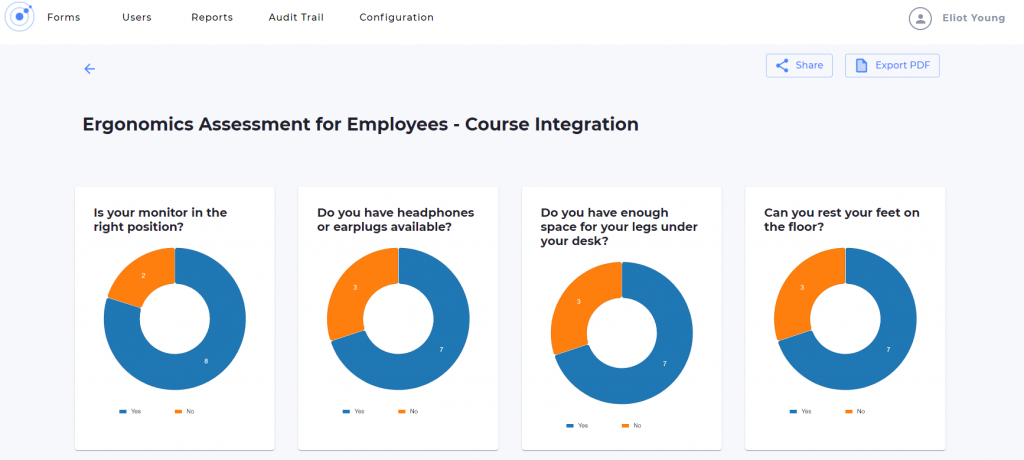

We have just added a new feature to our reporting and tracking solution Omnitrack, allowing administrators and compliance managers to track all necessary data from each course completion. Below are four elements you can integrate and track with Omnitrack.

1. Assessments

Many of our courses include assessments to help establish an organisation’s level of risk. For example, in our health and safety course, which has been adapted for home workers, users undertake a number of assessments related to their workstation setup. These immersive assessments can be integrated. Administrators can then collect rich, actionable data from their users while they complete these assessments. Whether staff are working remotely or from an office, our tool will help businesses ensure all their staff have a comfortable and healthy space to work from home.

Similarly, our mental health course includes a self-assessment on work-related stress. To ensure that businesses can help staff who are struggling with work-related stress or anxiety, or to simply gain an overall understanding of how your staff are affected by stress, the assessment can easily be integrated with Omnitrack. This integration will allow administrators to play an important role in monitoring their staff’s mental wellbeing.

Continue reading