Ransomware attacks computers in 150 countries

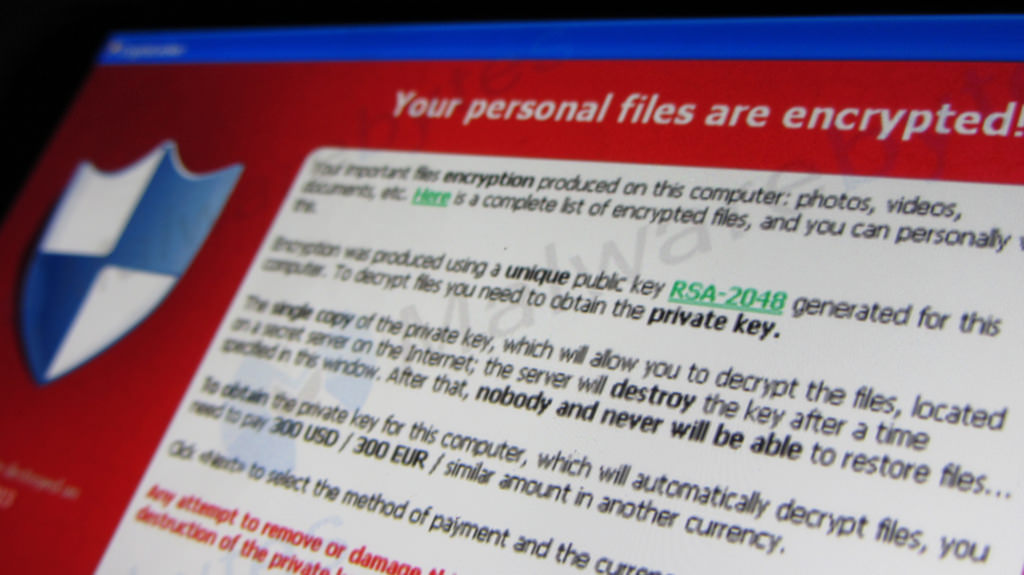

On Friday hundreds of thousands of computers were held to digital ransom as a cyber security attack spread around the world. The cyber weapon, allegedly stolen from the US National Security Agency (NSA), even locked NHS staff out of their systems, forcing hundreds of critical operations to be cancelled and staff having to turn away sick patients at the door. The attack spread quickly and installed malware onto over 200,000 computers, demanding payments of up to $600 in return for the data. With cyber security experts expecting more attacks imminently, this latest attack shows everyone needs to understand cyber security and make it a top priority.

The cyber attack that began with spam emails

The attack began with targeted phishing emails appearing to contain job offers, security warnings and invoices, as well as people’s own personal files. Once the files were unassumingly downloaded, the ransomware was able to spread across large networks. This makes understanding how to protect against cyber attacks more important than ever, with the opening of phishing emails often having the ability to affect computers across a whole network.

Continue reading

“These crimes must be stopped and the victims of modern slavery must go free. This is the great human rights issue of our time, and as Prime Minister I am determined that we will make it a national and international mission to rid our world of this barbaric evil.”

“These crimes must be stopped and the victims of modern slavery must go free. This is the great human rights issue of our time, and as Prime Minister I am determined that we will make it a national and international mission to rid our world of this barbaric evil.”

The UK’s Modern Slavery Act is changing the landscape of how companies deal with the risk of modern slavery in their supply chains. While the requirement to issue a modern slavery and human trafficking report only applies to companies with a global turnover greater than £36m, businesses of all sizes are getting ahead of the curve and introducing comprehensive anti-slavery and anti-trafficking policies across their supply chain.

The UK’s Modern Slavery Act is changing the landscape of how companies deal with the risk of modern slavery in their supply chains. While the requirement to issue a modern slavery and human trafficking report only applies to companies with a global turnover greater than £36m, businesses of all sizes are getting ahead of the curve and introducing comprehensive anti-slavery and anti-trafficking policies across their supply chain.