VinciWorks’ updated anti-money laundering courses

The Fourth Money Laundering Directive will be implemented by the end of June 2017. To reflect the changes under The Fourth Directive, VinciWorks has updated all of its courses accordingly. Here are three Anti-Money Laundering courses that have been updated.

Anti-Money Laundering

This course has been designed to teach you anti-money laundering best practices and procedures, as defined by 14 of the world’s leading law firms and in line with the Practice Note that has been drawn up by The Law Society of England and Wales and applicable legislation in the UK and other jurisdictions. Upon completion of the course, participants will be able to understand how to comply with all critical statutory requirements and will be able to play their part in the fight against money laundering. The basic anti-money laundering course is available in three versions: advanced, fundamentals and global.

Anti-Money Laundering: A Practical Overview

This practical overview gives participants the opportunity to refresh their memory of the most significant areas of anti-money laundering best practice. The engaging video includes an overview of what anti-money laundering is, the requirement for client due diligence, how to recognise suspicions and the course of action when you recognise such suspicions, and who to report your suspicions to.

AML 360

This refresher course allows users to be updated on the hot anti-money laundering related topics of today. The course is aimed at lawyers and support staff who have already completed anti-money laundering training.

The customisable course covers the following topics:

- The dangers of virtual currency such as Bitcoin

- How do criminals abuse law firms?

- EU Fourth Directive: What’s new?

- Red flags of money laundering

- CDD: When to do it and what to do

- Is your practice area at risk?

- Source of wealth and source of funds

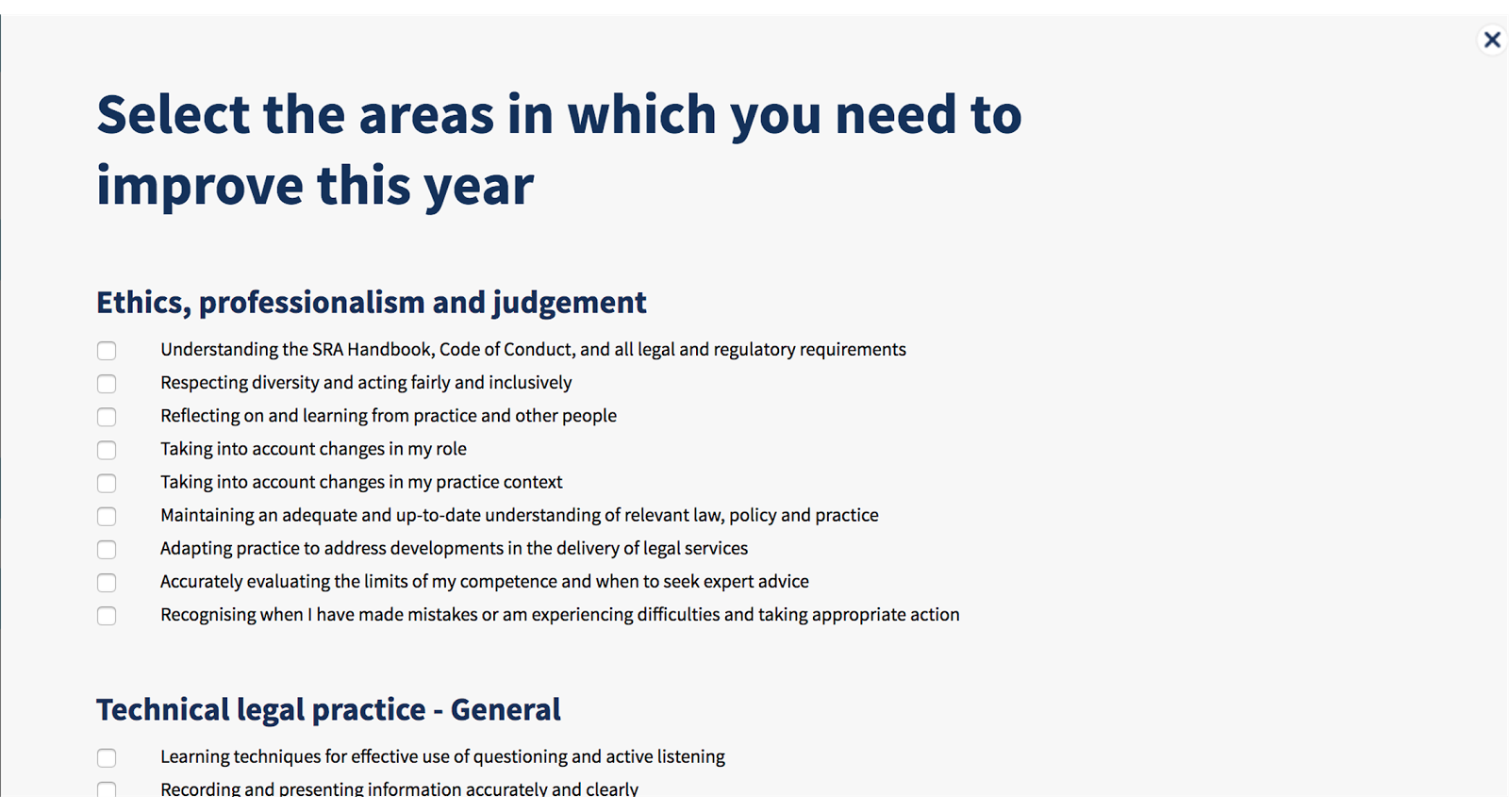

Comply with the Fourth Money Laundering Directive

The implementation of The Fourth Directive means firms will need to ensure staff are familiar with the changes.

Some of key changes under The Fourth Directive:

- Simplified CDD is no longer automatic and any decision to undertake simplified CDD must be backed up with evidence and subject to a risk assessment

- Cash thresholds have been reduced from €15,000 (£12,544) to €10,000 (£8,361)

- The annual turnover limit has been raised to £100,000 across all financial activities

- A central register of beneficial ownership will now be maintained in each EU country and be accessible to government, banks, and anyone with a legitimate interest

You can learn more about the changes under the Fourth Directive here.