We have just released the first episode of our new podcast, Compliance 101, hosted by our Director of Learning and Content Nick Henderson.

Compliance is a big word. From bribery to money laundering, data protection to diversity, there’s no end to the number of topics to discuss, and what can seem like an overwhelming amount of information out there.

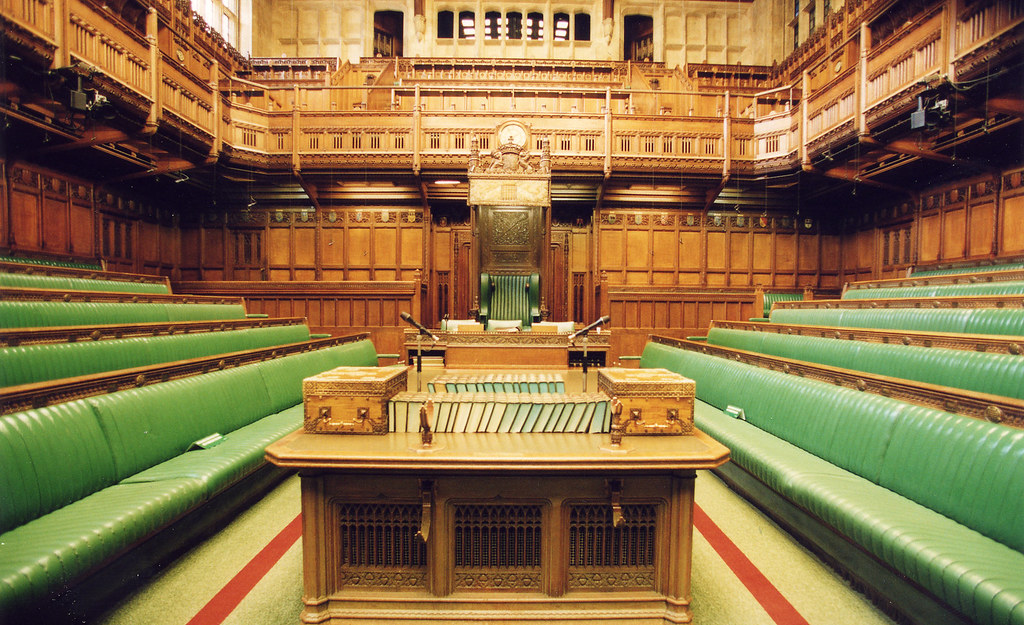

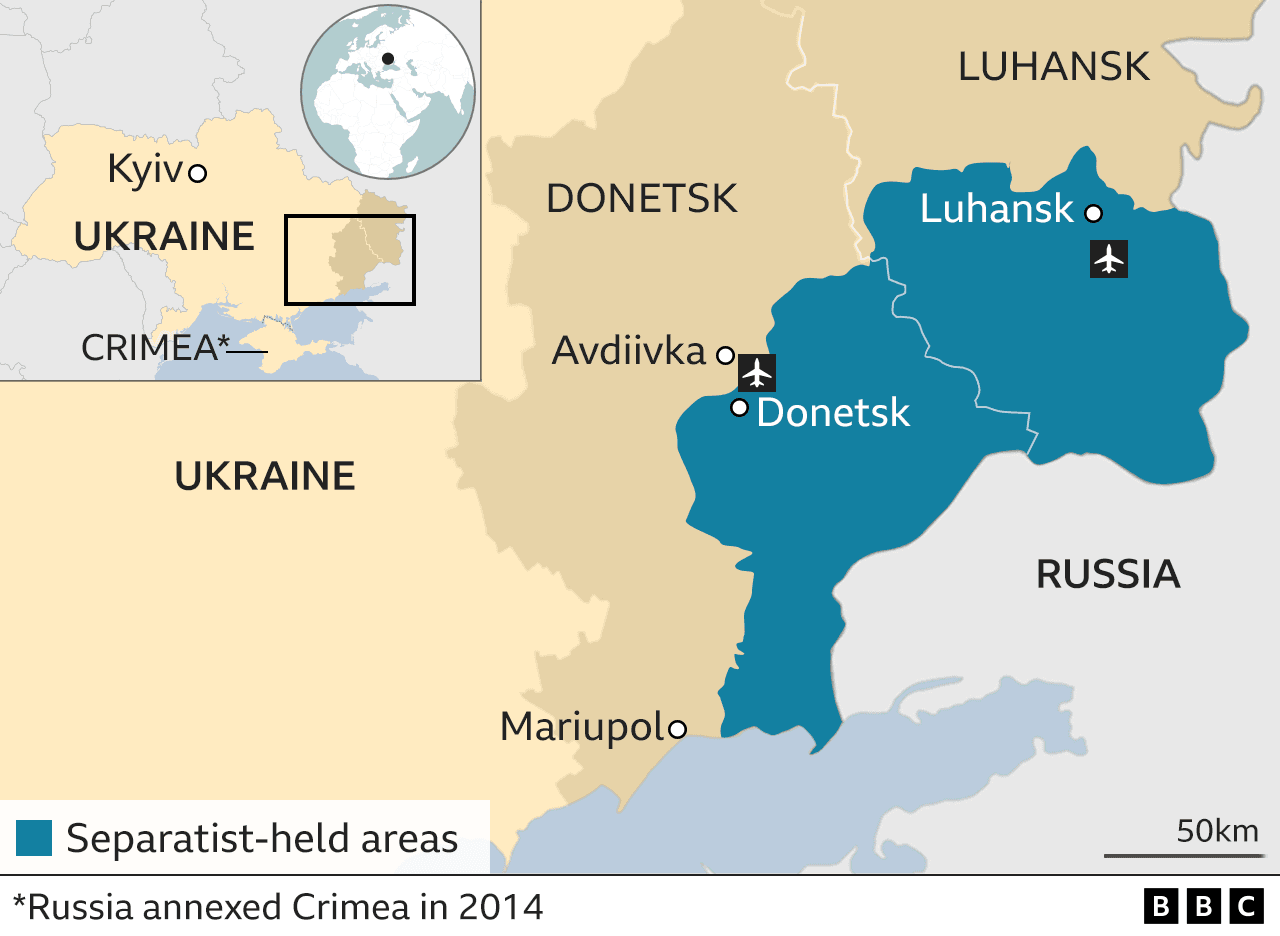

VinciWorks has always been about keeping compliance simple, and we’re going to do the same with this podcast. Because we have been providing compliance training to the world’s leading law firms based out of London, we are well versed in UK regulations. But this podcast is going to take a global view of compliance. We will bring in international viewpoints, discuss developments in key jurisdictions like the EU, the US and UK, and aim to provide perspectives beyond one jurisdiction or one industry.

In our first episode, Nick will be speaking to Director of Best Practice Gary Yantin to delve into what is considered bribery and share some insight on the warning signs and red flags to look out for. Nick and Gary will also consider the need to go beyond tick-box compliance when it comes to bribery.

Listen to Episode 1: What is bribery and corruption?

You can listen to the first episode here. Don’t forget to follow us on Spotify, Stitcher, Apple Podcasts and other popular podcast providers to get updated on future episodes.