Retail Competition Law

Competition law is a series of rules and regulations which seeks to maintain fair competition in an open market and regulate anti-competitive conduct by companies. One of the key aspects of competition law is price fixing. This is an illegal activity that can result in huge fines, criminal convictions and imprisonment.

What is price fixing?

Price-fixing is agreeing with a competitor what price customers will be charged. It can also include agreements not to sell something below a minimum price or agreeing not to undercut a competitor. Price-fixing leads to inflated prices and customers being overcharged.

4 types of price-fixing:

There are several types of price-fixing:

- Horizontal price-fixing: This type of price-fixing happens when competitors of a particular product agree to set a minimum or maximum price for their products. For example, two or more competing fast-food chains agree to sell hamburgers for the same price.

- Vertical price fixing: This involves an agreement between members up and down the supply chain, for example, an auto manufacturer and its dealers.

- Agreement to raise prices: This involves competitors agreeing to raise the price of a product by a certain amount.

- Agreement to freeze, or lower, prices: This involves participants, such as governments, agreeing to freeze prices in order, for example, to stop inflation and restore consumer’s confidence in the economy. It is generally only used as a last resort when monetary policy, i.e., a central bank’s actions that manage the money supply, fail.

Price fixing doesn’t always have to involve agreements to set the same price. Businesses can also be guilty of price fixing if they:

- Agree to offer or withhold the same discounts or shipping terms

- Agree on a common formula for changing prices

- Set a production quota or capacity

Who is covered by price fixing regulations?

Competition law applies to online markets as well as traditional sellers. It also applies equally to small businesses as well as large ones.

Discussing prices with competitors

You must not discuss the prices you’re going to charge your customers with your competitors.

You’ll be breaking the law if you agree with another business:

- To charge the same prices to your customers

- To offer discounts or increase your prices at the same time

- To charge the same fees to intermediaries, e.g. retailers selling your products

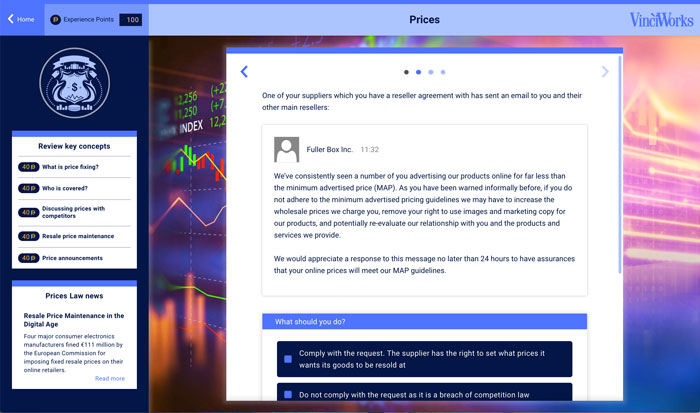

Resale price maintenance

Resale price maintenance (RPM) is where a supplier and a retailer agree that the retailer will not resell the supplier’s products for less than a set price. This does not include recommended resale prices (RRP), as long as the retailer can still resell at a price it wants and there are no threats or incentives.

RPM is often indirect. A supplier may impose restrictions on how far its product can be discounted, impose so-called ‘minimum advertised price policies’ or make threats if a certain price is not maintained. Do not agree with suppliers to fixed or minimum retail prices and do not exert pressure for distributors to adhere to a minimum price.

Price announcements

Unilateral price announcements could amount to a breach of Competition Law where competitor responses to those announcements demonstrate evidence of a strategy for coordinating prices or behaviour. Generic price announcement letters are generally not allowed. This stems from an investigation into the cement industry in 2012 where the Competition Commission (forerunner to the Competition and Markets Authority) found that price announcement letters could serve anti-competitive purposes by signalling the desired direction of prices and softening customer resistance. Instead, price announcement letters must be specific and relevant to the customer receiving it. To avoid falling foul of price announcements:

- Don’t announce future price changes earlier than required or before commercially necessary, generally more than 31 days before the implementation of the new prices

- Avoid announcements of price changes that are not final

- Ensure price increases are fully transparent

- Do not make public statements which refer to competitors or indicate prices are contingent on them

- Set out the last unit price paid and the new unit price

- Be specific in the details of other charges that apply to the customer

Examples of high-profile price fixing scandals

Large businesses are not immune to competition law and over the past six months, millions in fines have been handed out to companies for price fixing. Here are some of the highest-profile price fixing scandals:

- Four electronics manufacturers, including Asus and Phillips, fined a total of EUR 111 million euros for imposing fixed or minimum resale prices on their online retailers

- Bumble Bee Foods CEO Christopher Lischewski charged for his role in the alleged U.S. conspiracy to fix the price of packaged seafood

- CMA publishes a study into pricing algorithms and whether they could be used to support illegal practices

Is price fixing illegal?

In many jurisdictions, including the United States, Canada, and the UK, price fixing is illegal. This would include any agreement among competitors to fix prices, whether the agreement is to lower or raise prices, or keep them at a certain fixed rate. Whenever competitors do any of the above without a legitimate justification, this would be considered illegal.

In the US, the antitrust law that forbids price fixing and other anti-competitive behaviour is the Sherman Act. The scope of the Sherman Law was later expanded in the Clayton Antitrust Act and then in the Robinson–Patman Act. The Sherman Act outlaws “every contract, combination, or conspiracy in restraint of trade,” and any “monopolization, attempted monopolization, or conspiracy or combination to monopolize.” The Sherman Act does not prohibit every restraint of trade, only those that are unreasonable. For instance, an agreement between two individuals to form a partnership restrains trade, but may not do so unreasonably. This will be determined based on whether the restraint on trade is reasonably related to a legitimate purpose.

However, certain acts are considered so harmful to competition that they are almost always illegal. These include plain arrangements among competing individuals or businesses to fix prices, divide markets, or rig bids. These acts are “per se” violations of the Sherman Act; in other words, no defense or justification is allowed.

In the UK, anti-competitive behaviour is prohibited by the Competition Act 1998 and the Enterprise Act 2002. UK businesses are also governed by Articles 101 and 102 of The Treaty on the Functioning of the European Union (TFEU) as it relates to competition in EU markets. After Brexit, Articles 101 and 102 of TFEU will continue to apply to UK businesses as they would to a US company engaging in conduct affecting an EU market. However the European Commission cannot carry out an on-site investigation in a non EU country, nor require the national regulator to do so.

The UK government has no plans to make ‘fundamental changes’ to the competition law framework. Existing EU rules will be transposed into UK law with EU Withdrawal legislation.

Why is price fixing harmful?

Price fixing upsets the normal laws of supply and demand: it is anti-competitive and ultimately hurts consumers and businesses. It is harmful to customers because it often means higher prices, and it is harmful to businesses as it gives monopolies an advantage over competitors. Smaller companies can be squeezed out of the market and it is difficult for new companies to enter.

VinciWorks’ competition law course includes price fixing module

VinciWorks’ latest competition law course, Competition Law: Know Your Market, includes a full module on price fixing, presenting interactive scenarios whereby users will need to assess whether or not price fixing may be occurring.