Since Russia launched its invasion of Ukraine at the end of February, the west has imposed significant sanctions on Russia, Belarus, and Vladimir Putin’s oligarchs who fund his war. The rapidly evolving nature of the situation has made sanctions compliance an increasing challenge for businesses, but also one that is vital to understand. In this special episode, we look at sanctions compliance in the wake of the ongoing Russian invasion of Ukraine.

Continue reading

Keeping track of sanctions on Russia

Since Russia launched its invasion of Ukraine at the end of February, the West has imposed significant sanctions on Russia, Belarus, and Vladimir Putin’s oligarchs who fund his war. The conflict has also marked unprecedented international cooperation between Western allies unseen since the days of the Cold War.

The rapidly evolving nature of the situation has made sanctions compliance an increasing challenge for businesses, but also one that is vital to understand. New laws such as the Economic Crime Act in the UK have ramped up sanctions compliance and increased penalties on businesses – any businesses – who get things wrong.

Continue reading

What the UK Economic Crime Act and UAE grey listing means for business

There’s been a number of important changes to money laundering in recent weeks which will affect all businesses, but in particular regulated entities. Those are businesses such as law firms and estate agents which are required to adhere to money laundering rules and conduct actions such as due diligence on their customers.

UK Economic Crime Act becomes law

Continue reading

The field of economic sanctions has been growing increasingly complicated in recent years and was thrust into the spotlight when Western nations launched an unprecedented line of sanctions against Russia in February 2022 following its invasion of Ukraine. Many businesses were caught off guard by the sudden changes.

While countries use sanctions as a diplomatic tool to apply economic pressure on threatening regimes, their implementation is often not well understood by the workers in charge of applying them.

VinciWorks’ new, updated suite of sanctions courses provides your staff with the tools to understand and comply with sanctions requirements during volatile times. The suite of courses teaches users how sanctions are applied and how to comply with sanctions requirements. There are two versions of the course: An short, introductory overview for general staff (five minute course), and an in-depth detailed course that provides an in-depth explanation of how to conduct sanctions compliance in the UK, US, EU and UN countries (20 minute course).

Continue readingFollowing Russia’s invasion of Ukraine in February 2022, the US, UK and EU have imposed an unprecedented level of financial sanctions against Russia. The new sanctions block dealings with many Russian banks and restrict many types of business interactions. Now, more than ever, it is important for businesses to keep track of sanctions and ensure their sanctions policy is up to date.

VinciWorks has created a free sanctions policy template that can easily be edited to suit your organisation, industry and staff, as well as remain relevant with all the current sanctions in place.

You can download the sanctions policy template for free by clicking on the button below.

Actions against Russia will impact UK businesses and compliance

As a result of the Russian invasion of Ukraine, the UK government has brought forward the Economic Crime (Transparency and Enforcement) Bill which includes a new register of foreign owners of UK property. Entities who do not declare their beneficial owner will face restrictions in selling their property or face prison. Unexplained Wealth Orders (UWOs) are also being strengthened, with those who hold property in the UK in a trust will be considered an asset’s holder. Law enforcement will have more time to implement UWOs and be protected from litigation costs if the order is successfully challenged.

Continue reading

What businesses need to know about new sanctions on Ukraine and Russia

Following the invasion of Ukraine by Russia, a series of new sanctions have been announced by the US, UK and EU, alongside other nations. This is a rapidly evolving situation with facts changing on an hourly basis. Sanctions compliance is vital for any business. From client due diligence to payment processing, sanctioned individuals will be working harder to move their money out of sanctioned jurisdictions. Businesses must be alert to this.

Payoneer fined for sanctions violation

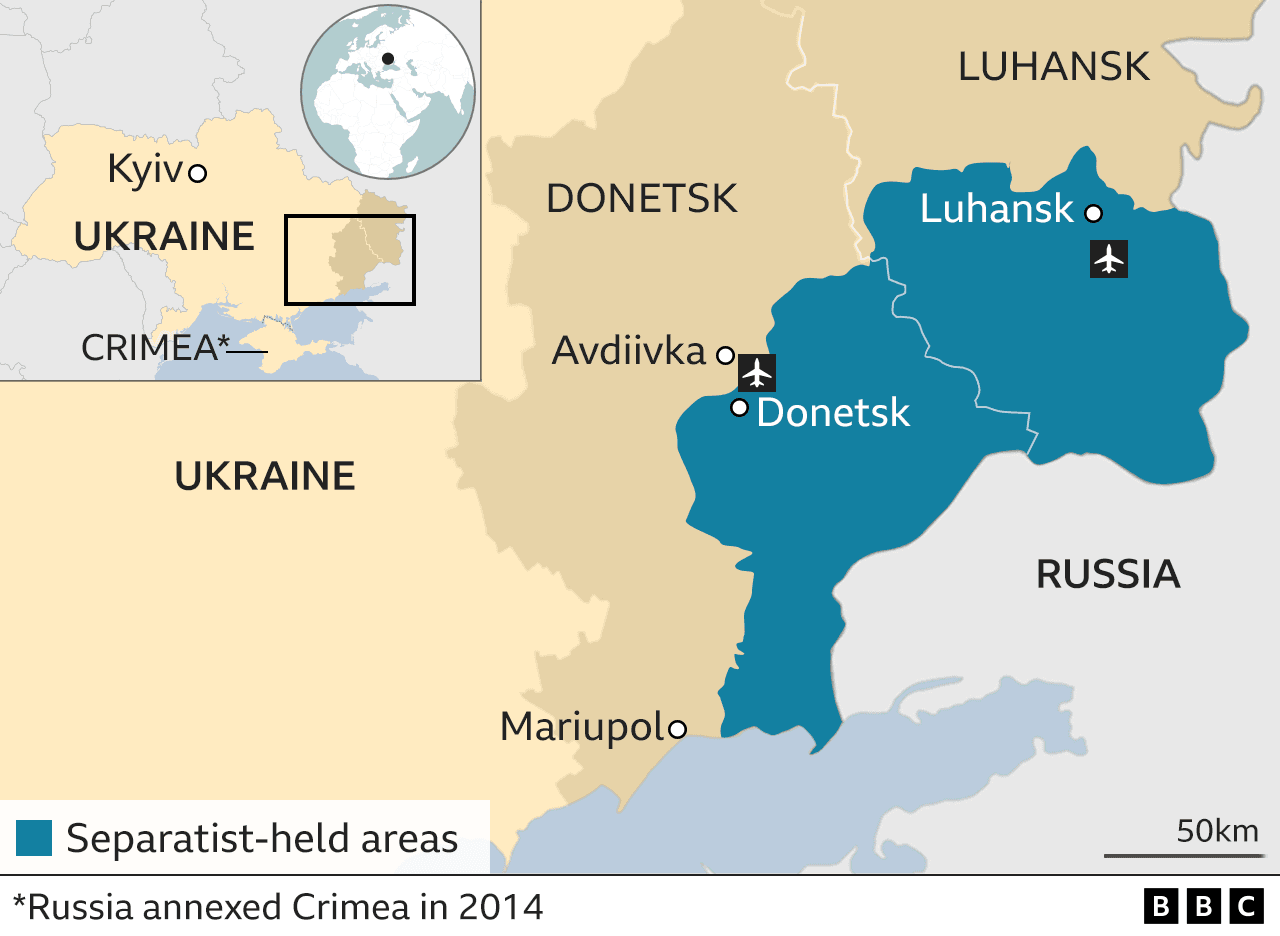

In July 2021, Payoneer was fined $1.4 million by the US sanctions authority, the Office of Foreign Assets Control (OFAC) for over 2,200 violations of multiple sanctions regimes.

In the settlement agreed to by Payoneer, they admitted to processing payments for parties located in Crimea, Iran, Sudan and Syria, all countries subject to US sanctions. They also processed 19 payments on behalf of individuals sanctioned by the US.

This meant sanctioned individuals were able to engage in over $800,000 worth of transactions. The fine comes at a tricky time for Payoneer, who began trading on the Nasdaq exchange the month before, with a valuation of $3.3 billion.

Continue readingCorruption remains the most prevalent financial crime in Latin America and the Caribbean. This means that corruption, often committed by public officials, is also the largest source of illicit funds that have to be laundered, even more than cash generated by drug trafficking and people smuggling.

Continue readingOn 10 January 2022, the European Commission published an amendment to the delegated regulation of high-risk jurisdictions for anti-money laundering and counter terrorist financing.

The EU’s prescriptive list contains details of third-country jurisdictions which have strategic deficiencies in their Anti-Money Laundering / Counter Terrorist Financing (AML/CFT) regimes that pose significant threats to the financial system of the European Union must be identified in order to protect the proper functioning of the internal market.

The EU commission see the following countries as having strategic deficiencies in their AML/CFT regime:

Continue readingFor global companies, particularly in the financial services sector, sanctions compliance is becoming ever more fraught. Payments and money transfers are becoming ever more globalised, and new businesses are popping up to take advantage of a booming market. But when it comes to sanctions compliance, the costs of getting it wrong are rising.

Payoneer is a firm specialising in business-to-business cross-border payments. It is used by global leaders like Airbnb, Amazon, Google and Upwork to facilitate cross-border wire transfers, online payments, and debit card services. The company also offers facilities for small and medium-sized businesses to send payments anywhere in the world, quickly and cheaply.

Continue reading