Risk-taking is key to any company’s success. A recent survey found that companies that understood and embraced the risks of the COVID-19 crisis early on fared much better than those that refused to acknowledge the new reality and continued with their pre-COVID plans. Differences in how they perceived risk had dramatic effects on how they coped with change.

For many companies, taking risks is synonymous with innovating and responding to change. Without embracing some level of risk, companies actually put themselves at greater risk of failure. The challenge is understanding which risks are worth taking, and how to mitigate those which are unavoidable.

This is why it’s so important to have a risk management system in place. Risk management is the process of identifying, assessing and controlling threats to a business. Potential risks facing a company could include, for example, security breaches, internal problems with employees or operating systems, market or regulatory changes, natural disasters, and much more. A good risk management system will consider a wide variety of possible scenarios and prioritise the ones most likely to actually happen. It will also take into account a holistic vision of the company and its goals. Then, it can devise strategies to avoid or minimise the potential risks.

VinciWorks’ new Introduction to Risk Management course explores some of the basic tools that most risk managers use, including designing a risk matrix and composing a risk register. These will help you understand the types of considerations that they use to make decisions and to ensure that a business is prepared for future scenarios.

Topics covered include

- Introduction to risk management

- Guide to developing a risk management system

- Types of risk (operational, financial, security, compliance, and more) and how to mitigate them

- How to evaluate risk

- What a risk register is and how to design one

- Customisable section on “risk at our organisation”

Course features

- Smooth, user friendly scroll design

- Customisable training with the option to include or remove topics for different audiences

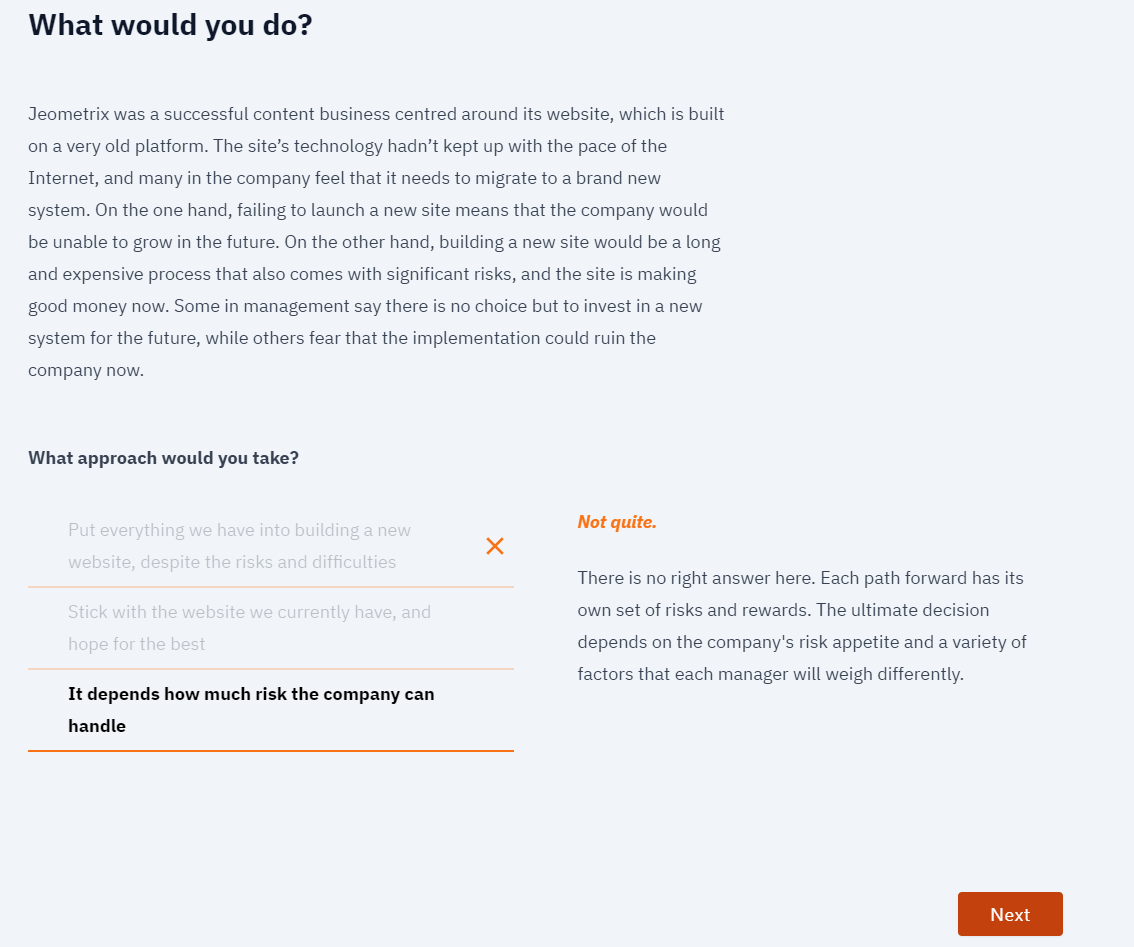

- Interactive learning built in throughout the course, with the ability for the administrators to track responses in order to gain insights into users’ grasp of the topics

- Eye-catching design and an easy to use experience

- Test section