UK estate agents were hit last week with surprise HMRC inspections as part of a week-long crackdown on money laundering in the property industry.

HMRC paid surprise visits to estate agents after they were suspected of trading without being registered as required under money laundering regulations. In all, agents in London (35), Leicester (5), South Bucks and Berkshire (4), Greater Manchester (3), Watford (1), Wakefield (1) and Wolverhampton (1) were raided in order to determine their compliance with money laundering regulations of 2017.

The unannounced visits were followed by a list published online

Over the past 3 years, HMRC has carried out over 5,000 interventions on supervised businesses, with 655 penalties worth £2.3 million issued in 2017 to 2018.

If HMRC comes knocking on your door early one morning, can you demonstrate that you’re properly keeping records and training staff on the Money Laundering Regulations 2017? Compliance means protecting your business and reputation.

Helpful anti-money laundering compliance resources

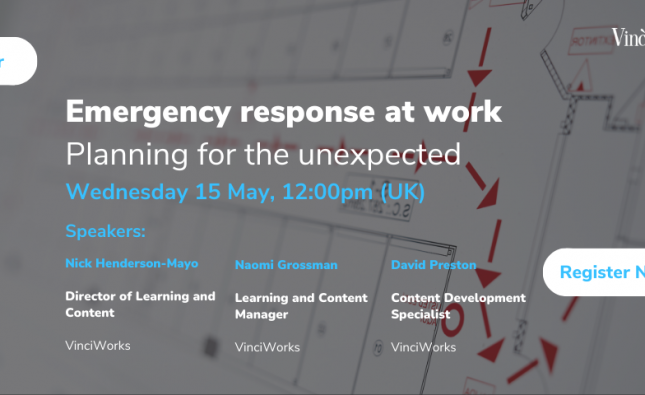

You can find educational resources for estate agents on the Money Laundering Regulations 2017 on the government website. You can also try VinciWorks’ training and download compliance resources such as policy templates, on-demand webinars