- Failure to prevent fraud is a new regulation impacting all UK businesses. How will the offences work in practice? Download our free guide.

Courses

Financial and Corporate Crime

Health and Safety

Performance and Leadership

InfoSec and Data Privacy

Diversity and Inclusion

Products

Products

-

Training

Deliver and track training with a modern, intuitive LMS.

-

Managing

Edit, customise, and publish courses directly from the Portal.

-

Tracking

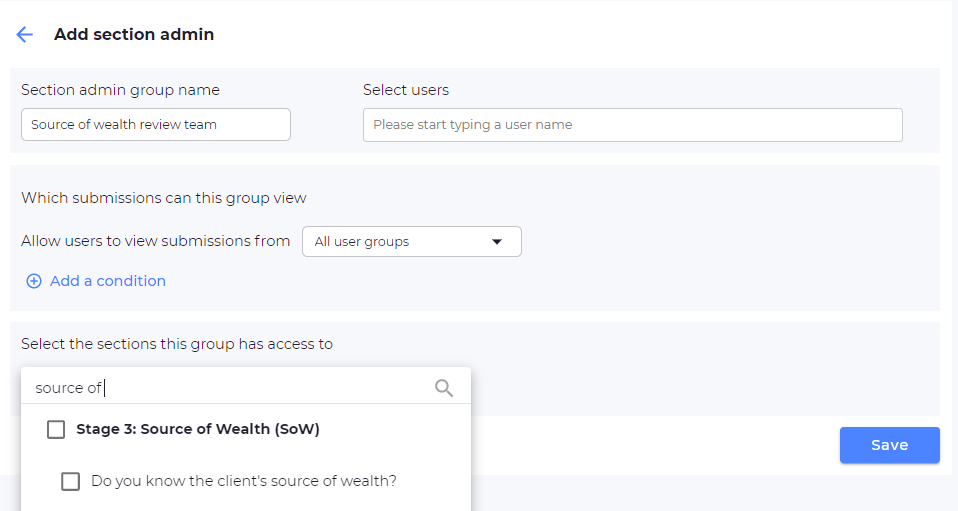

Capture disclosures, run workflows, and automate compliance reporting.

-

Consulting

Outsourced compliance support to assess risk, update policies, and meet requirements.