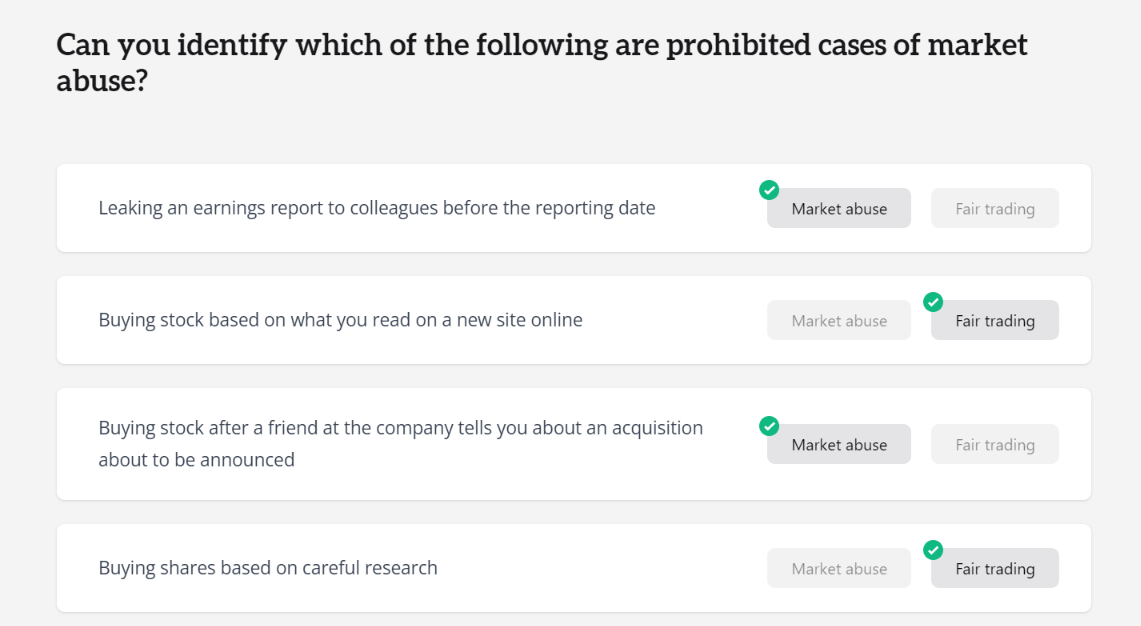

Courses

Financial and Corporate Crime

Health and Safety

Performance and Leadership

InfoSec and Data Privacy

Diversity and Inclusion

Products

Products

-

Training

Deliver and track training with a modern, intuitive LMS.

-

Managing

Edit, customise, and publish courses directly from the Portal.

-

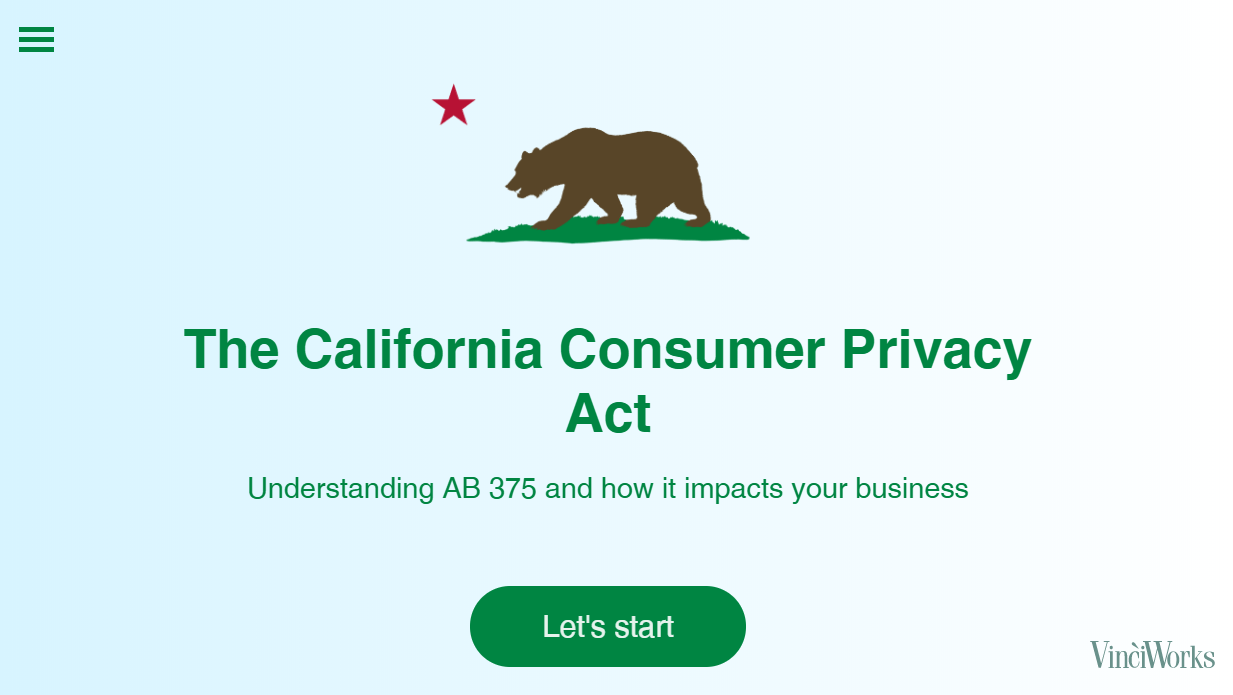

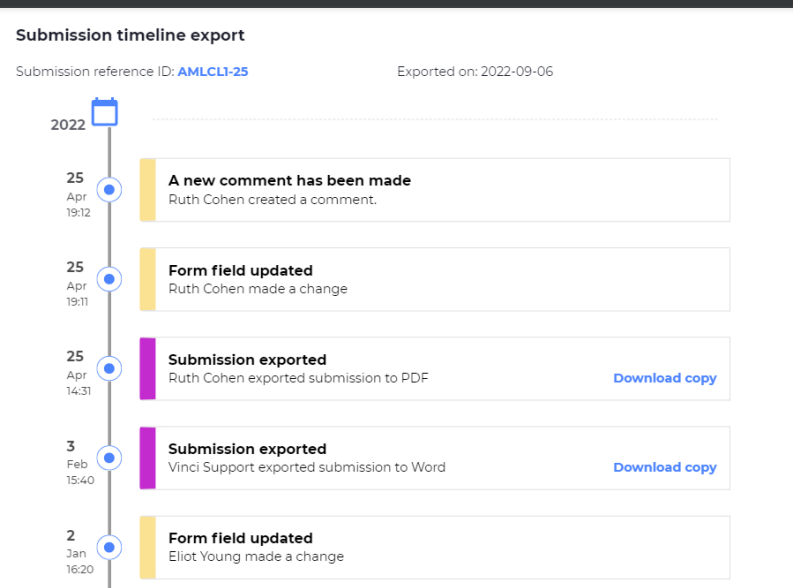

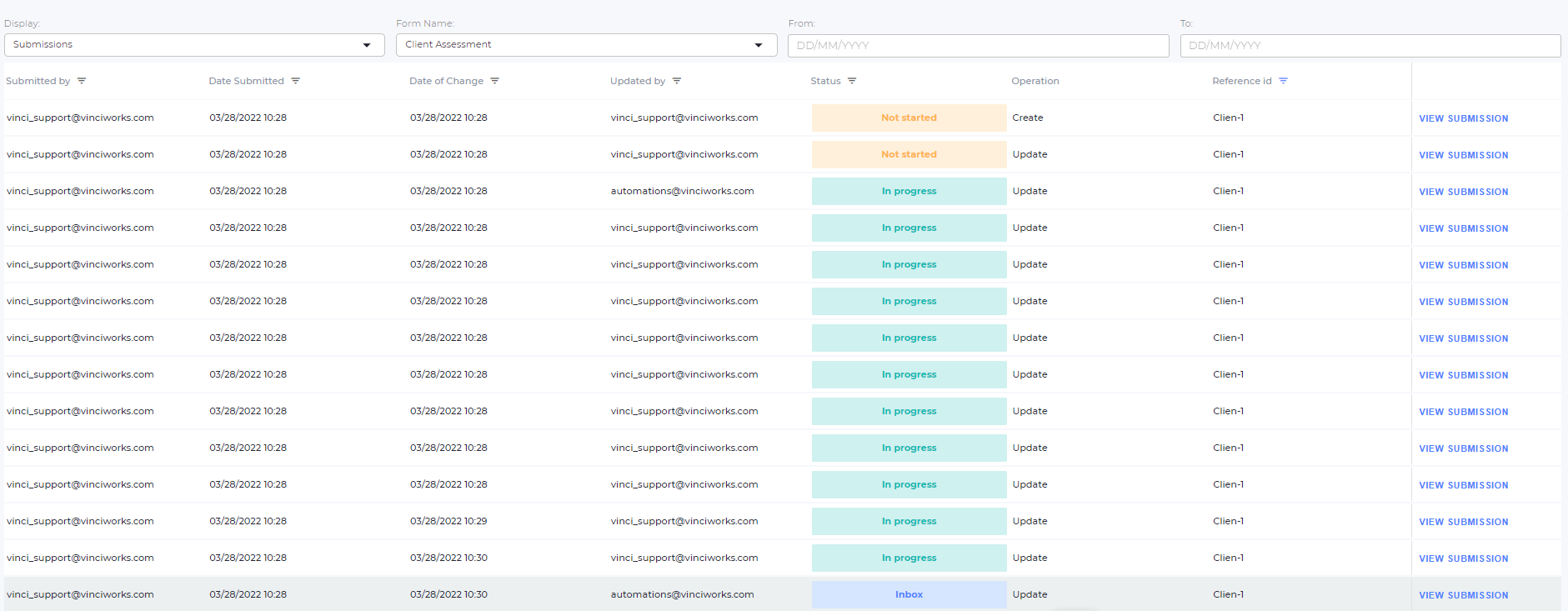

Tracking

Capture disclosures, run workflows, and automate compliance reporting.

-

Consulting

Outsourced compliance support to assess risk, update policies, and meet requirements.