- HMRC has stepped up their Corporate Criminal Offence (CCO) investigations, and DAC6 might be the next target for their audits.

Courses

Financial and Corporate Crime

Health and Safety

Performance and Leadership

InfoSec and Data Privacy

Diversity and Inclusion

Products

Products

-

Training

Deliver and track training with a modern, intuitive LMS.

-

Managing

Edit, customise, and publish courses directly from the Portal.

-

Tracking

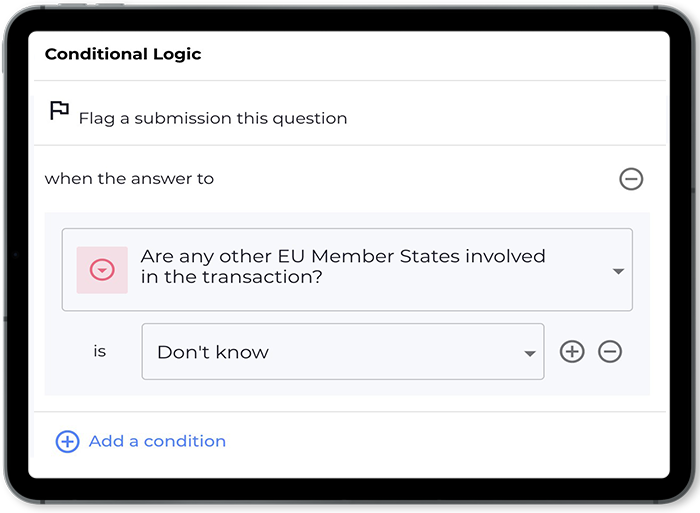

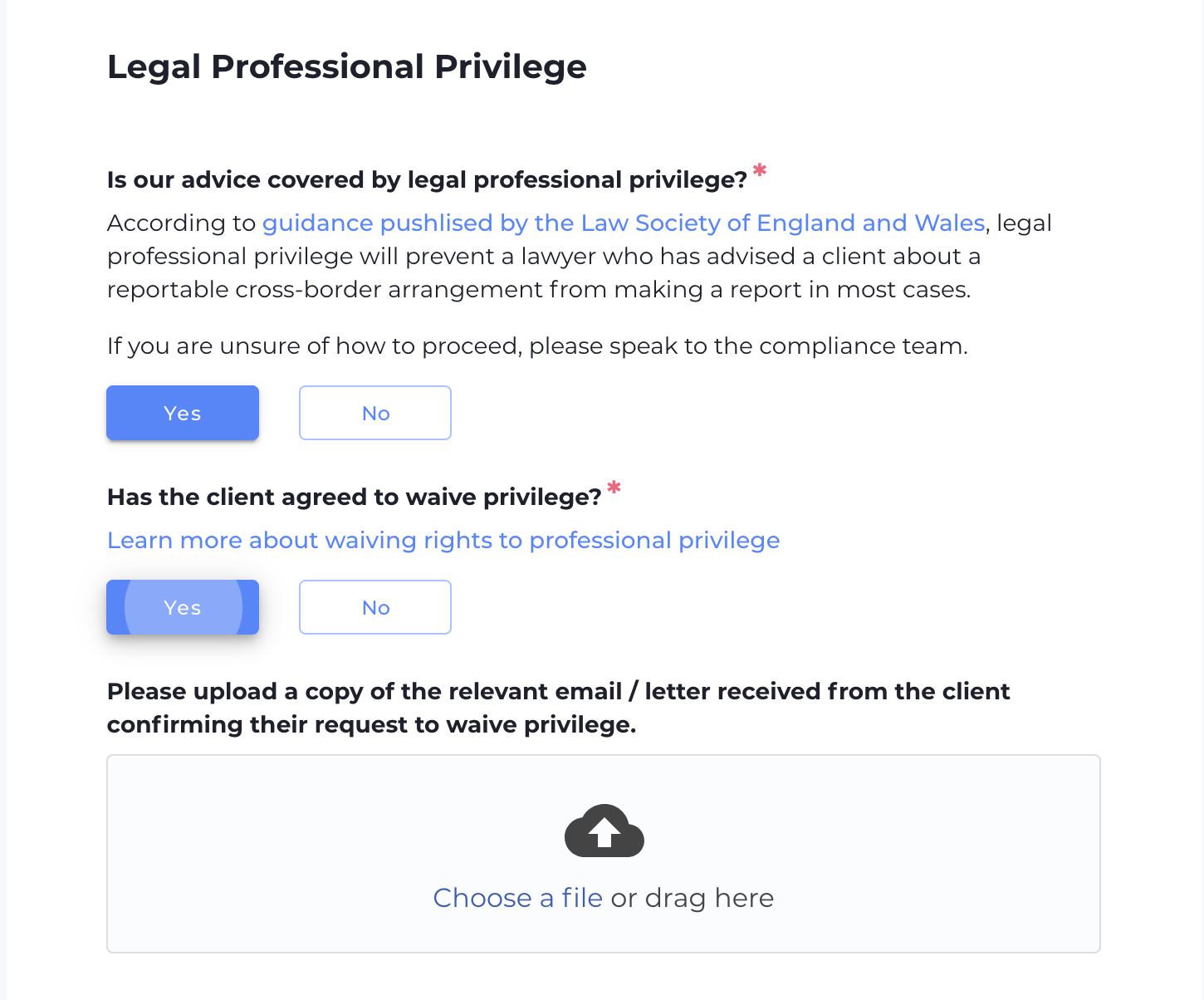

Capture disclosures, run workflows, and automate compliance reporting.

-

Consulting

Outsourced compliance support to assess risk, update policies, and meet requirements.