DAC6 is an EU directive that requires lawyers (and other intermediaries) to report certain cross border tax arrangements to local tax authorities.

There is a provision within DAC6 that exempts lawyers from reporting, where a report would breach legal professional privilege. In such a case, the lawyer is expected to notify the taxpayer (and in some cases other intermediaries) of their disclosure obligations under the rules, provided that doing so does not itself breach legal professional privilege.

The Law Society of England and Wales has just published its guidance on LPP.

The main points from the Law Society are as follows:

- Before making a DAC6 report to HMRC, lawyers should ask themselves whether any information in the report would reveal the substance or subject matter of confidential communications that have passed between them and their clients in the context of providing legal advice

- In most cases, the Law Society expects that LPP will prevent a lawyer who has advised a client about a reportable cross-border arrangement from making a report under DAC6

- If LPP applies, the lawyer must inform the client about their obligation to report under DAC6

- If a lawyer makes a report to HMRC under DAC6, HMRC should send them an arrangement reference number. Although it probably does not breach LPP, lawyers should assess LPP before sharing the arrangement number with other intermediaries

- Clients can waive LPP, but lawyers cannot

- Privilege can be waived at any time, but it should be waived unambiguously and in writing

How firms view legal professional privilege

In a survey conducted by VinciWorks in January about the impact of legal professional privilege, a majority of the over 100 firms polled felt that at least 20% of transactions would be subject to LPP. In addition, the survey found that a majority of firms believed that over 20% of reports would be made by other intermediaries.

However those same firms acknowledged that in some cases LPP would be waived.

Impact on law firms

Even in cases where LPP applies, law firms will still need to:

- Determine if an arrangement is reportable under DAC6

- Notify other intermediaries or taxpayers that the transaction is reportable (when possible without breaching LPP)

- Keep track of arrangement reference numbers when other intermediaries report

- Keep track of why LPP was invoked or evidence of it being waived

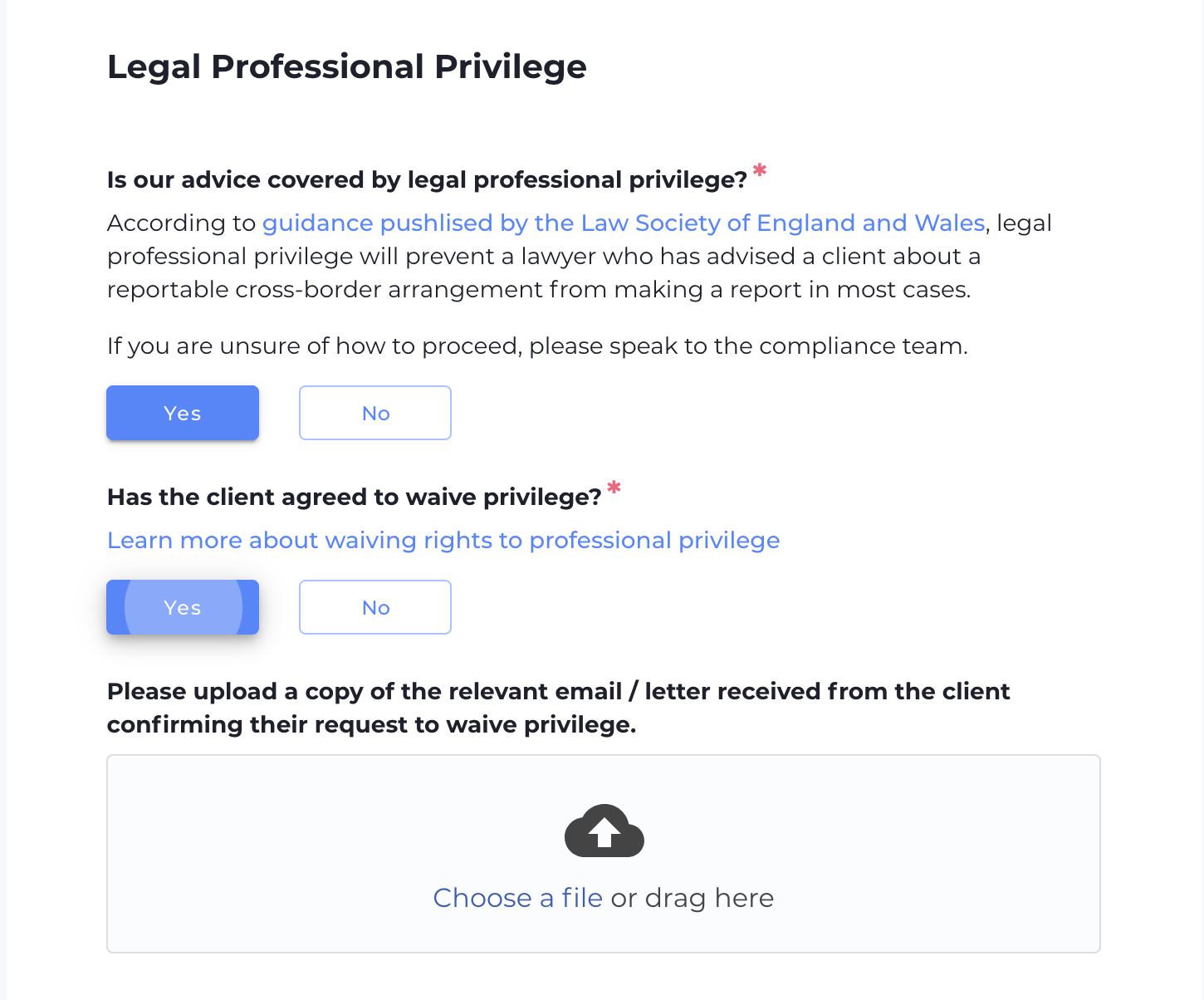

Legal professional privilege in the DAC6 Reporting Tool

VinciWorks’ DAC6 reporting tool helps law firms manage their reporting obligations with LPP. It includes detailed guidance on when LPP applies and it enables lawyers to:

- Upload evidence that LPP was waived

- Record details of other reporting intermediaries

- Record details of the arrangement reference number

Click here to learn more about VinciWorks’s DAC6 Reporting Tool