Register for our DAC6 email updates

DAC6 has now been in force for over three months, with intermediaries and businesses in Germany already having to report historical transactions.

Over the past 18 months, VinciWorks has consulted with international law firms, accounting firms, corporate compliance teams and tax authorities to help them grapple with the Directive and develop best-practice for DAC6. Our webinars, core group meetings and face-to-face interactions have drawn questions covering main benefit tests, reporting in Germany, understanding hallmarks, how DAC6 affects non-legal sectors and several other aspects of the Directive.

During this webinar, we gave attendees the opportunity to have their questions answered by our Legal and Research Executive Ruth Mittelmann Cohen and Director of Best Practice Gary Yantin.

DAC6 Q&A – key topics covered

- What does the DAC6 reporting delay mean?

- How specific countries, such as Germany, Poland and the UK, are implementing DAC6

- Updating reports after they have been submitting

- Instances when reporting is the obligation of the taxpayer rather than the intermediary

- Best practice for reporting in multiple jurisdictions

About the experts

Legal and Research Executive Ruth Mittelmann Cohen holds an LLB specialising in International Commercial Law. Ruth has experience in both the public and private sectors, having consulted for many Fortune 500 companies. She has expert-level knowledge across a wide range of areas including DAC6, GDPR, harassment, information security, commercial law and regulatory compliance.

As Director of Best Practice at VinciWorks, Gary Yantin works with professional service firms of all sizes to provide the best compliance learning experience for their staff. He was previously an in house lawyer and a solicitor in private practice. Gary has hosted many webinars and workshops for VinciWorks on a wide range of risk and compliance topics including GDPR and the SRA’s new approach to ongoing learning.

About VinciWorks’ DAC6 reporting solution

Our DAC6 reporting solution allows intermediaries and multinational businesses to record all cross-border transactions while guiding them on which transactions require reporting.

Key features

- Built for international firms with different workflows and reporting for every EU country

- Record all cross-border tax transactions that may require reporting

- Fully integrated with Intapp API to provide an end-to-end solution.

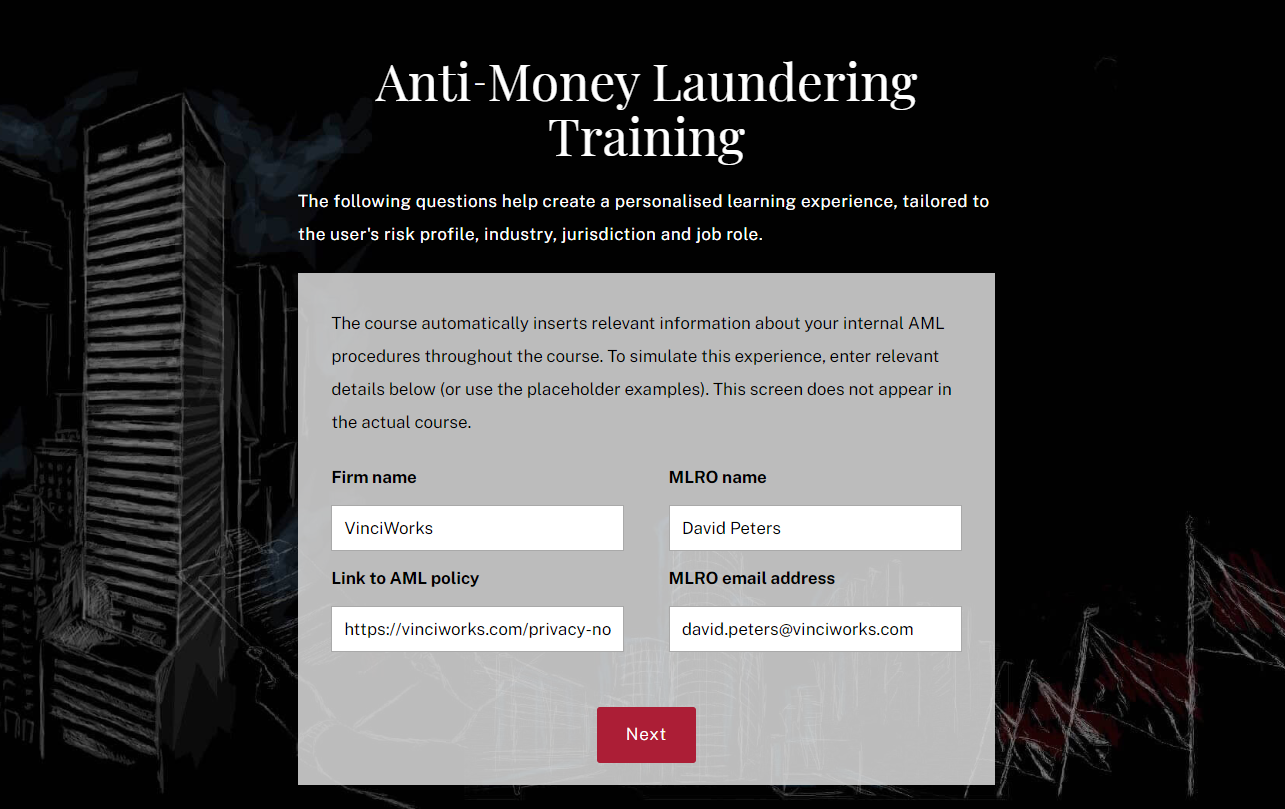

- Links to DAC6 training to review specific hallmarks and reporting requirements

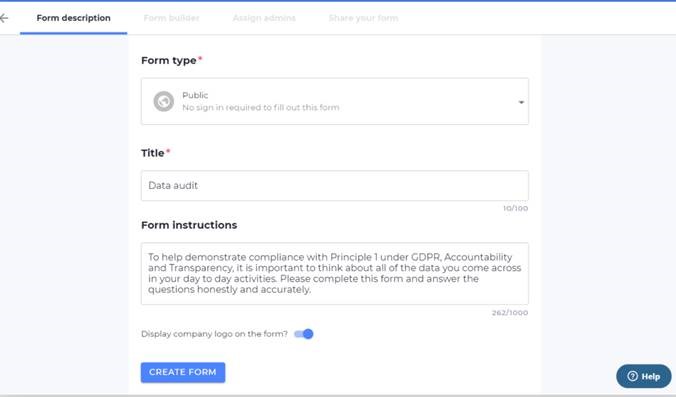

- Customisable ready-to-go form template library