Register for our DAC6 email updates

Thursday 12 November, 2020

This year, our DAC6 reporting solution was awarded the runner up prize in the category of IT Product or Service of the Year in the British Legal Tech Awards. The announcement took place during a virtual black-tie ceremony hosted by Netlaw Media and follows hard work from our full-time DAC6 team consisting of developers, subject-matter experts, support technicians and designers. We congratulate Orbital Witness for coming out first-place winners in the category.

What is the award?

The Annual British Legal Technology Awards ceremony acknowledges and rewards excellence in Legal Technology and IT Security within the UK and European Legal Sectors. Hosted by Netlaw Media, the 2020 Awards recognises leadership, innovation and technology as well as individuals, teams and suppliers transforming the future of legal services. The Annual British Legal Technology Awards is an exclusive evening that brings together dignitaries, nominees and guests to celebrate exceptional achievement within the legal sector.

The IT Product or Service of the Year Award recognises innovative new products and solutions which have been launched in the legal sector during the past 12 months. This category, open to start-ups and established vendors, recognises the products and solutions which deliver vision, differentiation, practicality and importance to the sector.

Why is such a solution required for DAC6 reporting?

Aimed at reducing international tax evasion and promoting transparency across EU member states, DAC6 requires the mandatory reporting and exchange of tax information amongst EU member states. It requires lawyers, accountants, tax advisers, bankers and other “intermediaries” to report some aggressive cross-border tax arrangements. The Directive came into force on 1 July 2020 but applies retroactively to all transactions made since June 2018.

Any financial transaction that crosses EU borders and provides a tax benefit could be subject to DAC6. In that event, lawyers, tax advisors or bankers involved in the transaction must report it to the local tax authorities. Those authorities will subsequently share that information across borders, or at least coordinate amongst themselves as to who will report and in which country. A majority of the transactions that are reportable under DAC6 are fully legal and innocuous, but the compliance burden on law firms is likely to be substantial.

The Directive fundamentally shifts legal practice so much that one head of compliance at a top-five global law firm described the Directive as “the most difficult piece of legislation we’ve ever had to grapple with”.

What is our DAC6 reporting solution?

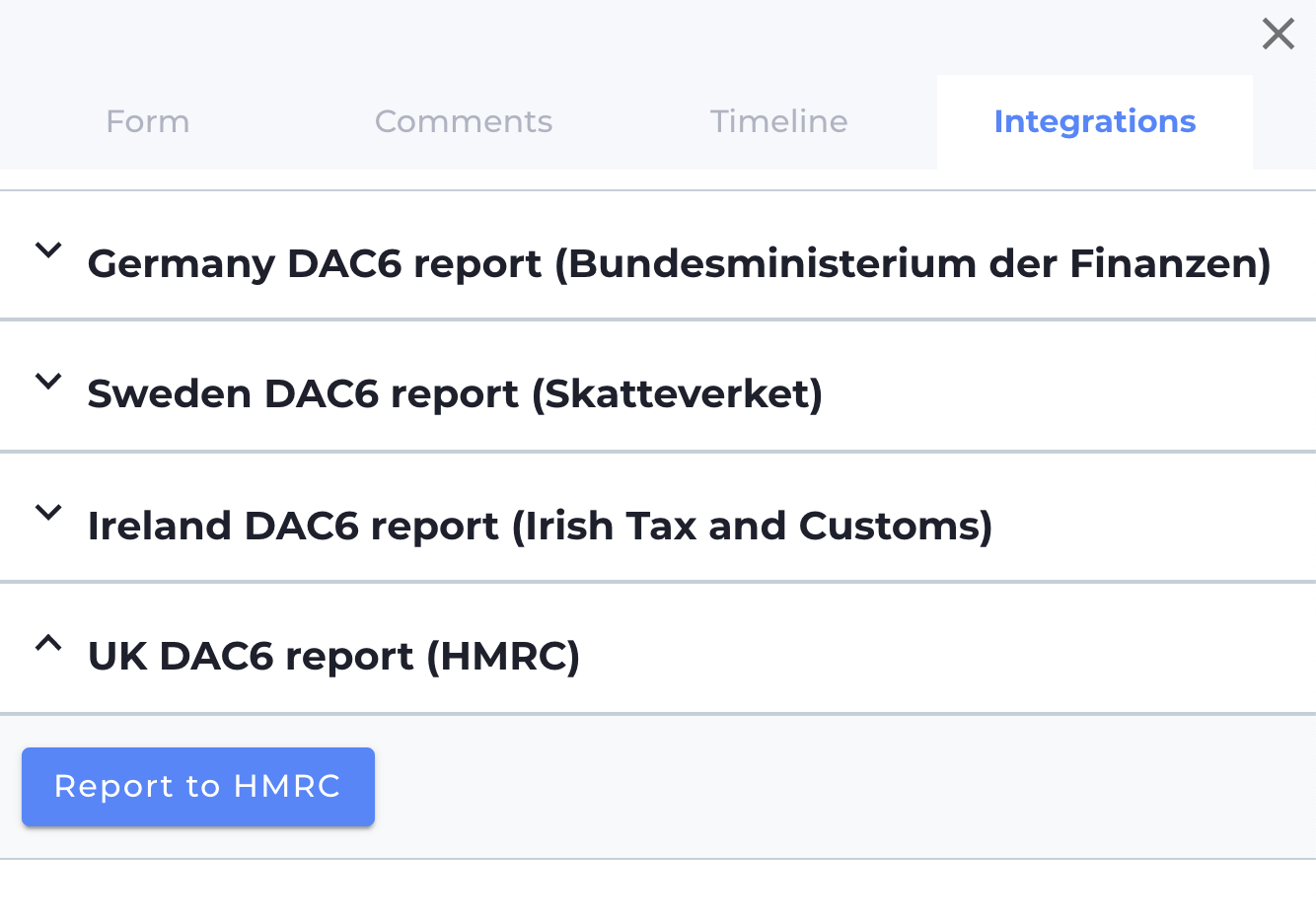

VinciWorks’ DAC6 reporting tool provides law firms, accountancy firms and multinational businesses with the expertise, knowledge and technical infrastructure to comply with the Directive in every EU jurisdiction. Built in consultation with over 100 leading international firms, international tax experts, HMRC and other regulators, our tool features customisable workflows designed and updated for the intricacies of each EU member state’s implementation of DAC6. We offer a number of hosting options to suit any organisation’s needs, including on-premises hosting. Our dynamic tool is already being used by six of the top-10 UK law firms.

Core features

- Built for international firms with different workflows and reporting for every EU country

- Reminders for reporting deadlines and reviewing ongoing transactions

- Customisable dashboard to make it easier for administrators to stay on top of deadlines

- Customisable workflow to easily collect all pertinent data

- Choose from a number of hosting options, including cloud hosting and on-premises hosting