Register for our DAC6 email updates

On 13 January 2020, HMRC laid the UK’s DAC6 legislation before the House of Commons in the form of the International Tax Enforcement (Disclosable Arrangements) Regulations 2020, Statutory Instrument 2020 No. 25. The legislation will come into force on 1 July 2020. Reporting will be required for transactions in which the first step of implementation was carried out on or after 25 June 2018.

Since DAC6 was adopted by ECOFIN on 25 May 2018, VinciWorks has been in close consultation with HMRC and over 50 leading international firms to establish the implications of the EU Directive and build a reporting solution to help firms comply.

In this webinar, we covered the core features of our software and gave guidance on how intermediaries can use it to report transactions.

You can request a recording of the webinar by clicking the button below.

VinciWorks has hosted several webinars on topics such as GDPR, health and safety, whistleblowing and more. You can view all of our webinars on-demand and sign-up for upcoming webinars here.

What is VinciWorks’ DAC6 reporting solution?

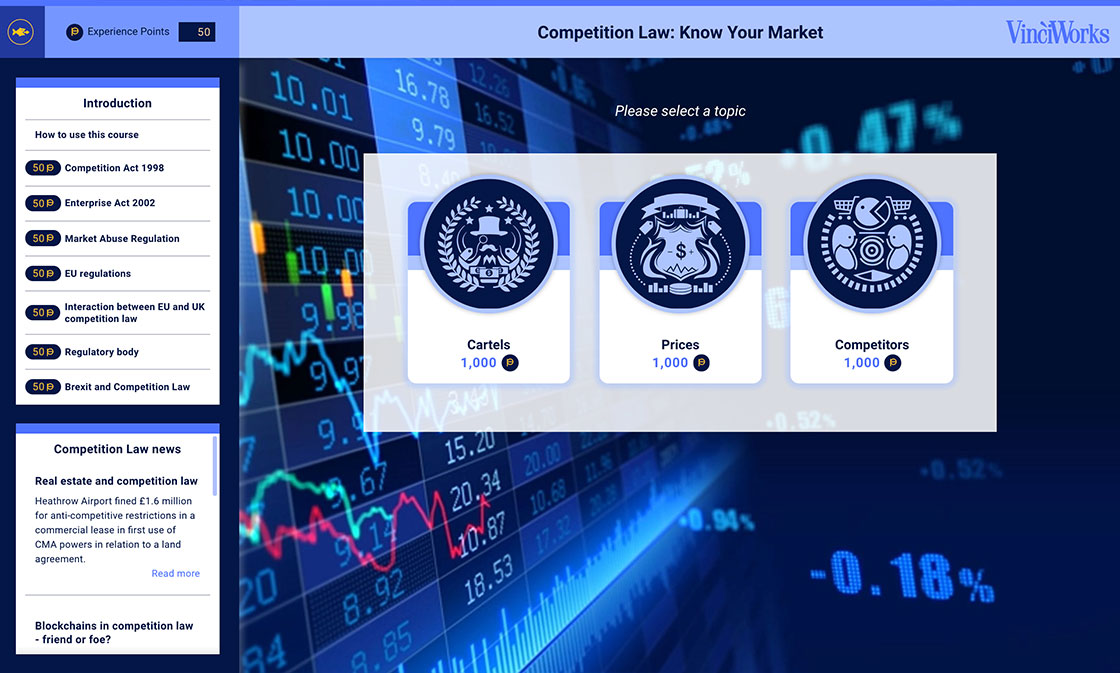

Our DAC6 reporting solution allows intermediaries to record all cross-border transactions while guiding them on which transactions require reporting. It is recommended that intermediaries complete DAC6 training to gain a clear understanding of their reporting obligations under DAC6.

Key features

- Record all cross-border tax transactions that may require reporting

- Fully integrated with Intapp API to provide an end-to-end solution.

- Links to DAC6 training to review specific hallmarks and reporting requirements

- Customisable ready-to-go form template library