On 25 May 2018, the Economic and Financial Affairs Council of the European Union (ECOFIN) adopted the 6th Directive on Administrative Cooperation (the “DAC6”), requiring so-called tax intermediaries to report certain cross-border arrangements that contain at least one of the hallmarks as defined in DAC6.

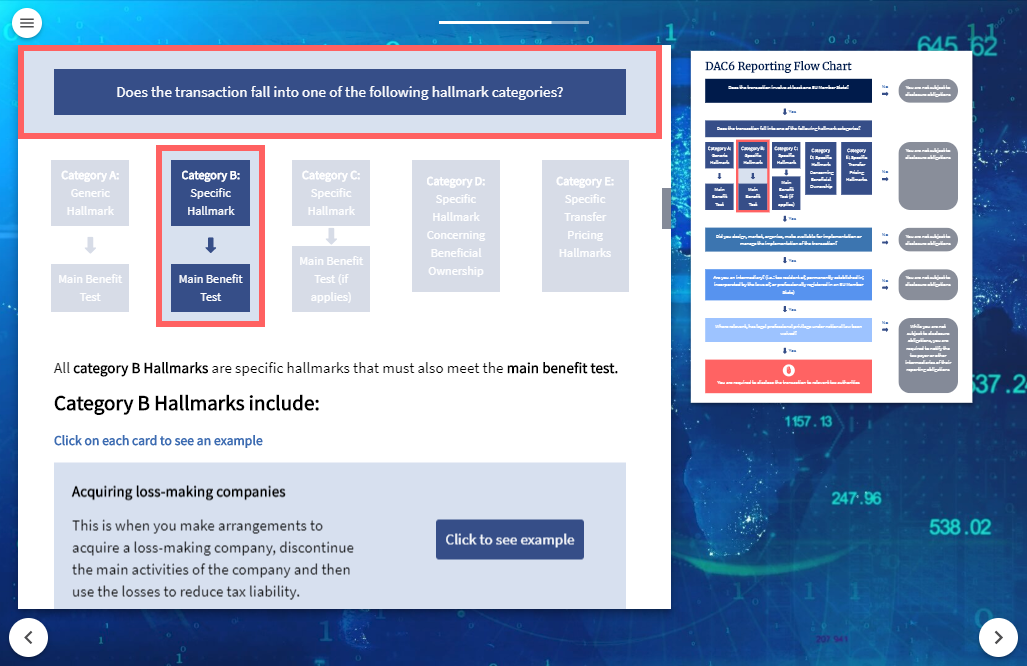

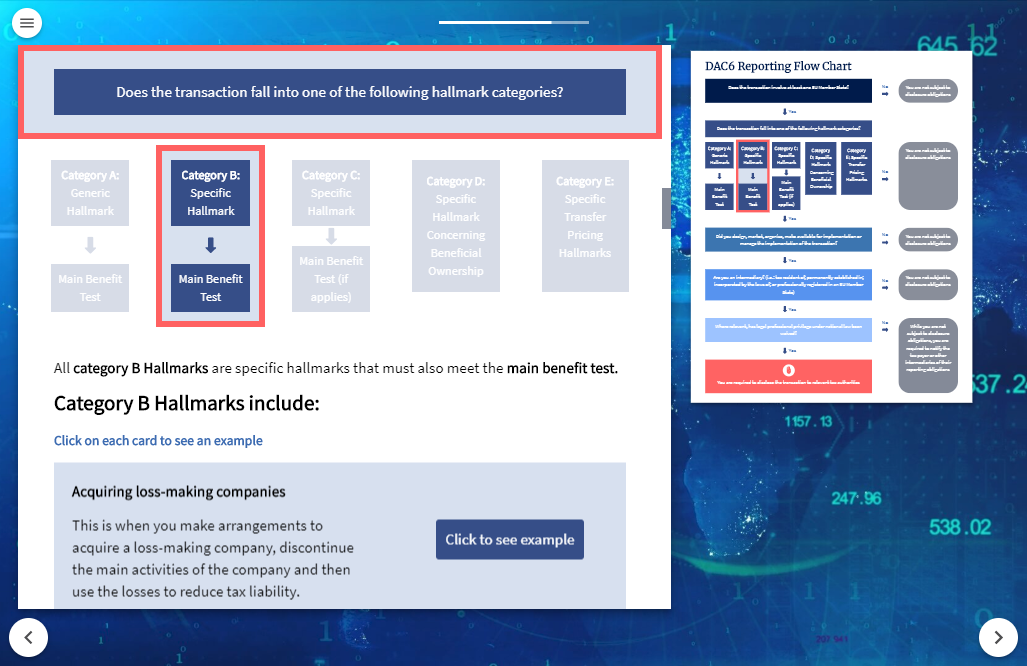

Within DAC6, there are five different hallmark categories that represent an indication that a transaction may have a potential risk of tax avoidance.

This blog will focus on the category A hallmarks which are classified as generic hallmarks. These may include one of the following:

- Conditions of confidentiality: An arrangement where a taxpayer or participant is obligated not to disclose how an arrangement can secure a tax advantage vis-a-vis another intermediary or the tax authorities.

- Fee agreements: An arrangement where an intermediary receives a fee for their services based on the tax advantage calculation.

- Standardised documentation/structure: An arrangement where there is standardised documentation or structure and it is relevant to more than one taxpayer without the need for a customised implementation.

DAC6 – The main benefit test

It is important to note that each category A hallmark also requires that the main benefit test is met – this is a condition where the main benefit of a transaction is a tax advantage.

An example of a category A hallmark would be if a UK based law firm makes an agreement with a client that there are no upfront costs for the client until the client obtains a tax benefit, then the law firm will take a fee. As soon as the client receives a tax benefit, the law firm will earn 15% of the tax benefit as their fee.

Failure to report a cross border transaction under DAC6 will result in effective, proportionate and dissuasive penalties. DAC6 should therefore not be taken lightly.

DAC6 reporting and training solution

If you think you or your organisation may be required to report under DAC6, then VinciWorks has a DAC6 reporting and training solution to help businesses understand their reporting obligations under DAC6 and keep track of their cross-border transactions. The customisable solution includes:

- DAC6 reporting portal – a secure, enterprise-wide data management tool for recording cross-border tax arrangements that may need to be reported under DAC6

- DAC6: Advanced – an interactive course that follows a flow-chart navigation and includes example scenarios to help users understand DAC6

- DAC6: Fundamentals – a short course providing a fundamental understanding of DAC6 suitable for everyone in a business