An introduction to intersectionality

This course shows how an intersectional lens can be used to tackle discrimination and exclusion, and improve inclusion at work.

February is LGBT+ History Month: how can your organisation participate?

February is LGBT+ history month, the annual month-long celebration that recognises the history and contributions of the lesbian, gay, bisexual, trans and nonbinary (LGBT+) community. It’s also an opportunity to raise awareness of the issues LGBT+ people face and reflect on the history of LGBT+ rights. This year’s theme for the month is ‘Behind the […]

A new ‘failure to prevent’ fraud offence will shake up corporate compliance

The ‘failure to prevent’ concept is being expanded to fraud, false accounting and money laundering The UK government have announced they are pushing ahead with a game-changing new regulation to expand the ‘failure to prevent’ family of offences to failure to prevent fraud. The announcement came during Parliamentary debate over the Economic Crime and Corporate […]

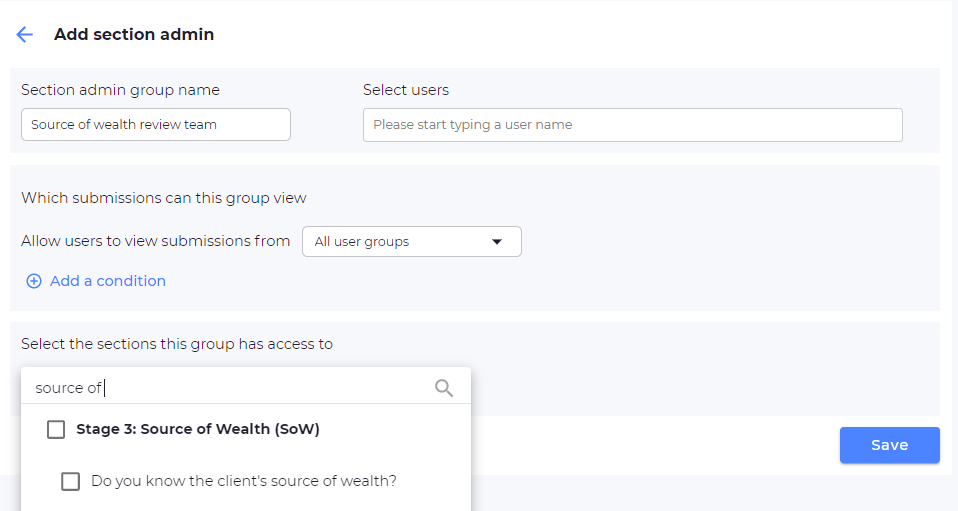

Omnitrack version 2.77.1

Ability to give form admins section-specific access We are excited to announce a new feature that will enhance the experience of managing your forms. The new feature allows you to set up admins who are responsible for specific sections of the form. Admins will be restricted to viewing only the sections they are assigned to, […]

Why should businesses have ESG policies?

Companies around the world are beginning to recognise the importance of having Environmental, Social, and Governance (ESG) policies in place. These policies not only benefit society and the planet but can also lead to financial benefits for companies. From reducing carbon emissions to promoting diversity and inclusion, ESG policies are becoming a key part of […]

Health and safety and the supply chain

Making sure third parties comply with H&S A well-functioning supply chain is critical to keeping business operations running successfully, from the products they sell to the services they offer consumers. This involves not only having a supply chain that is productive operationally, but also carries out its activities legally and ethically This guide will discuss […]

On-demand webinar: Health, safety and the supply chain in a changing world

In a rapidly changing economy, companies are ever more reliant on a well-functioning supply chain to get things done. From outsourcing payroll to launching a new product, supply chain management has never been more crucial. Examining the risks posed by new suppliers is equally vital. A worrying incident can have a knock-on effect on your […]

UK MDR: What’s Changed? New micro course

The UK has published the final version of the updated regulations for UK Mandatory Disclosure Rules (MDR). These regulations will come into force on 28 March 2023, and any arrangements entered into on or after this date will need to be reported to HMRC under these rules. The new MDR rules will replace the existing […]

Members’ Update 14th December 2022

Summary of 2022 online course releases: neurodiversity, allyship, domestic abuse, how to challenge