DAC6 compliance – Why should taxpayers care?

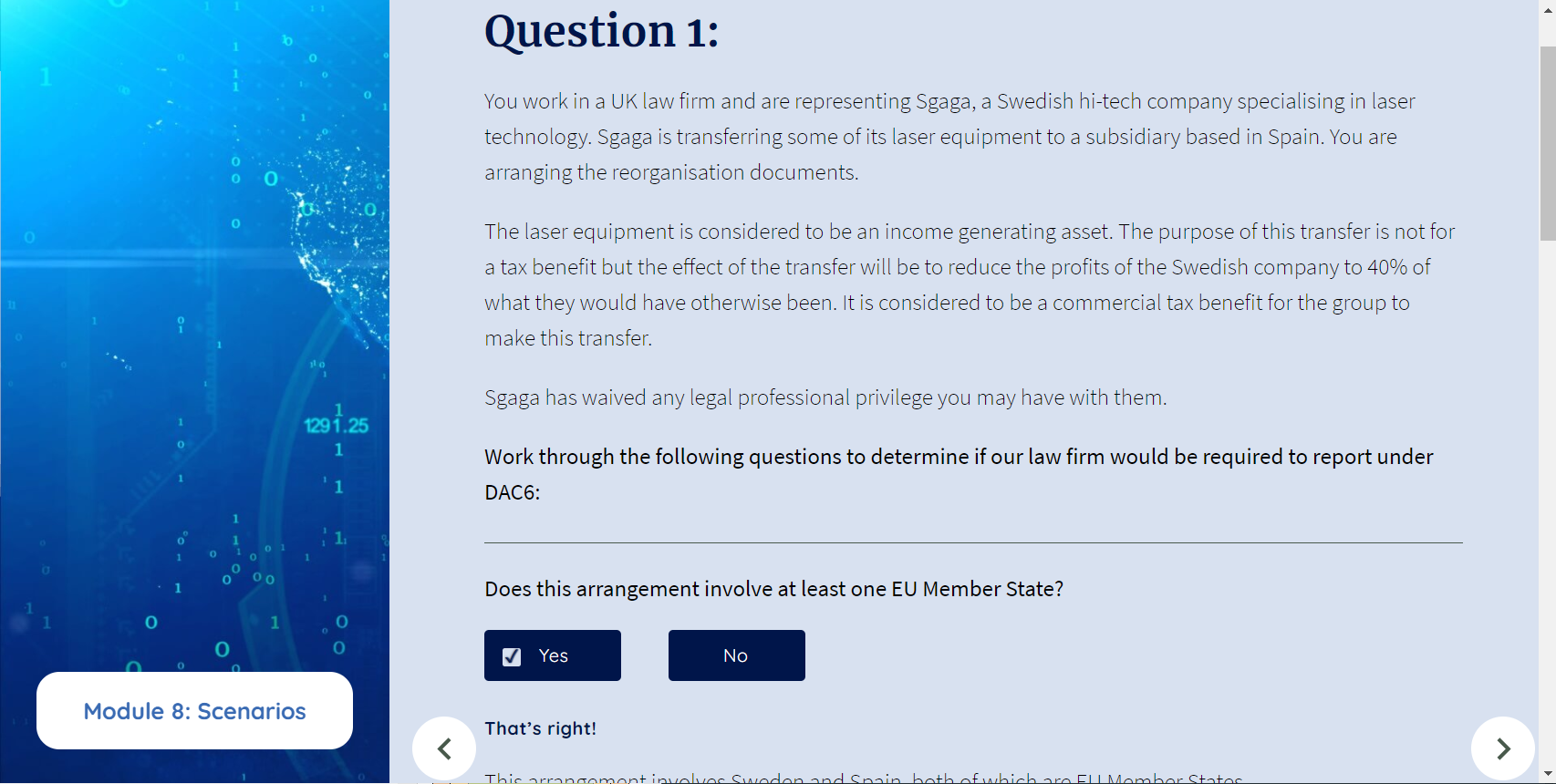

Register for our DAC6 email updates DAC6 is a European Directive aimed at tackling tax avoidance and strengthening tax transparency, as well as improving information sharing between EU member states. The Directive imposes mandatory reporting on lawyers, accountants, tax advisers, bankers, and other so-called “intermediaries”. Are taxpayers required to report DAC6 arrangements in addition to […]

Omnitrack version 2.16.0

Conditional logic for reminders We have created a robust query builder for reminders that will give admins nuanced control over who gets reminded about what; for example, you can now set a reminder that: Checks if a reporting deadline is 5 days away Checks which country the submission was reported from, let’s say Germany Checks […]

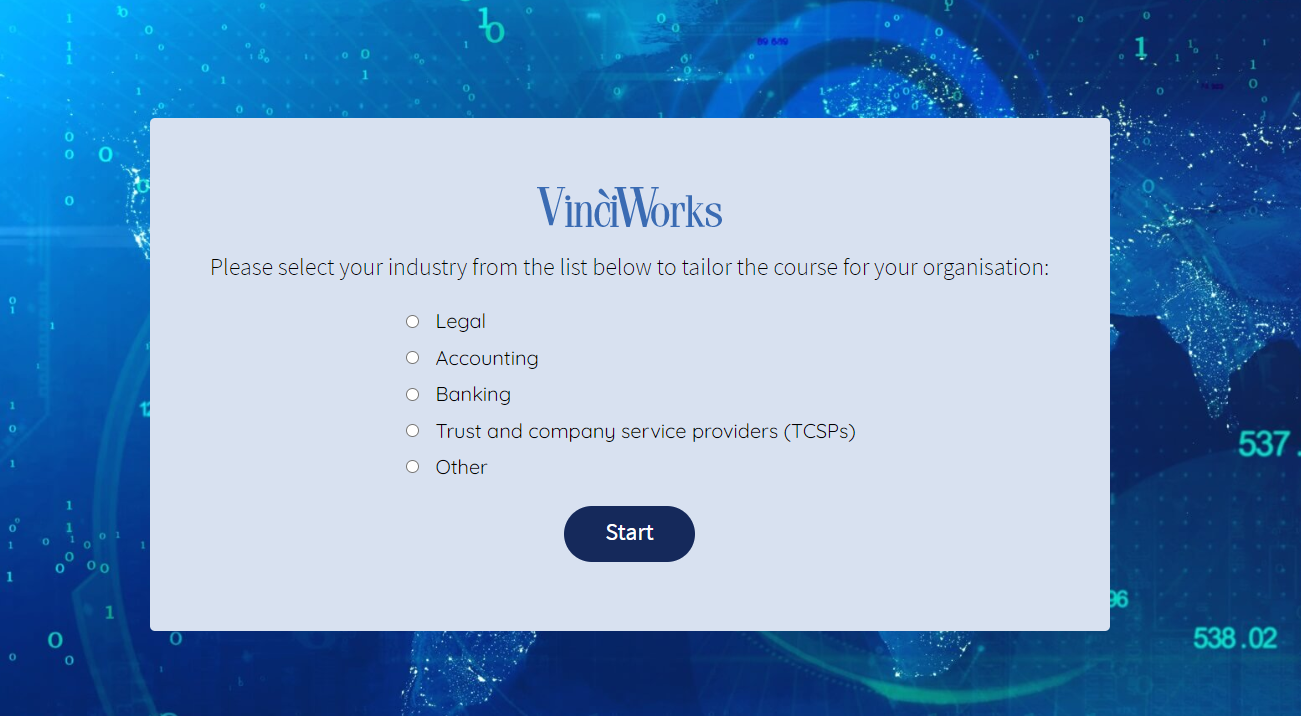

VinciWorks’ DAC6 training now includes versions for multiple industries

Register for our DAC6 email updates

Building Ethical Organisations With Anti-Bribery and Corruption Training

For many organisations, mandatory anti-bribery and corruption training can become a tedious box-ticking exercise. We believe that with the right training program, businesses can deliver compliance training that is flexible, engaging and focused on knowledge retention. We are excited to launch the first of our Compliance Collections for Anti-Bribery and Corruption – an innovative new […]

Germany and Finland do not postpone DAC6 reporting

Register for our DAC6 email updates The deadline for initial reports is 31st July 2020. In June, the European Union Council approved an optional six-month deferral of DAC6 reporting requirements due to COVID-19. 22 member states have availed themselves of that deferral but two, Germany and Finland, have not. On 6 July 2020, Kristina Wogatzki, […]

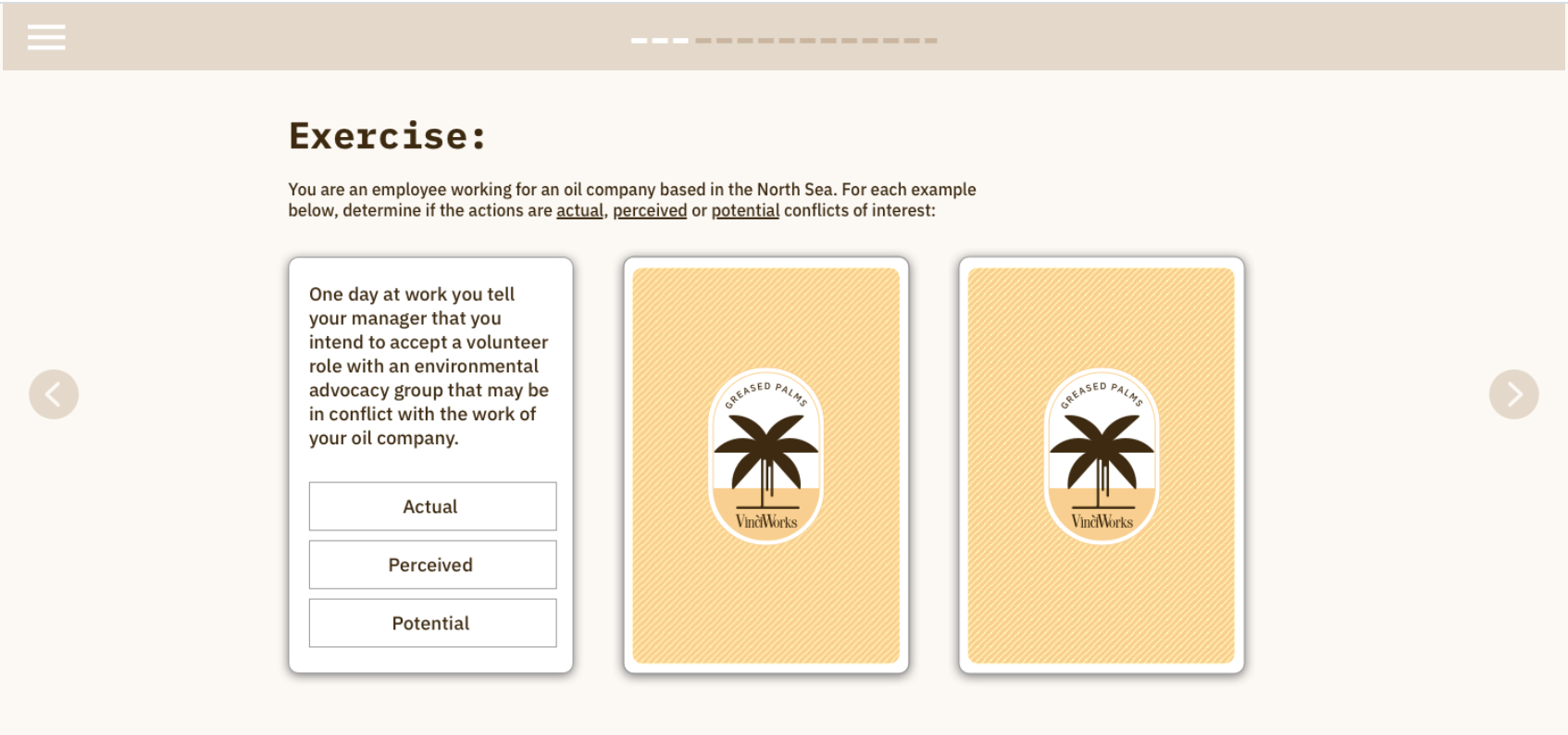

VinciWorks releases new conflicts of interest course

We have now released a new conflicts of interest compliance course. Conflicts of Interest in the Workplace: Understand Your Influences provides learners with a 15-minute overview of conflicts of interest in the workplace. The interactive course explains what a conflict of interest is and covers different situations where an employee might encounter a conflict of […]

EU allows delay of up to six months for DAC6 reporting

Register for our DAC6 email updates Updated 8 July 2020 Important update: Germany, Austria and Finland opt to not postone. On 3 June, 2020, Member State representatives reached an agreement to allow an optional six-month deferral of reporting deadlines for DAC6. On 19 June 2020, the European Parliament voted in favour of the EU Commission’s […]

HMRC publishes guidance on how DAC6 will work

Register for our DAC6 email updates HMRC has published its ‘final guidance’ on how DAC6 will operate in the UK. It includes details on the interpretation of the hallmarks, penalties and reasonable excuses. Click here to download HMRC’s DAC6 guidance This guidance is an update to the draft that HMRC published in March 2020. Although […]

DAC6 training updated to reflect EU Commission’s reporting delay

Register for our DAC6 email updates DAC6 is a European regulation aimed at tackling tax avoidance and tax evasion, strengthening tax transparency and improving information sharing between EU Member States. The Directive requires lawyers, accountants, tax advisers, bankers and other “intermediaries” to report certain aggressive cross-border arrangements. VinciWorks’ DAC6 training is recommended in order to […]