Register for our DAC6 email updates

DAC6 is a European regulation aimed at tackling tax avoidance and tax evasion, strengthening tax transparency and improving information sharing between EU Member States. The Directive requires lawyers, accountants, tax advisers, bankers and other “intermediaries” to report certain aggressive cross-border arrangements.

VinciWorks’ DAC6 training is recommended in order to understand the intricacies of these hallmarks and to determine which transactions must be reported.

Due to the Covid-19 pandemic, the European Commission has confirmed an optional deferral of the implementation of DAC6 by six months. Each member state will now decide whether they will avail themselves of the optional deferral. Most countries are set to defer reporting, with several, including the UK, Ireland and France already having announced their intentions to defer reporting. We will continue to update this blog as more countries decide on whether and how to implement the new timeline.

We have just updated our Advanced and Fundamentals courses to reflect the changes. This will allow users to gain a full understanding of the EU’s reporting timeline.

About our DAC6 training

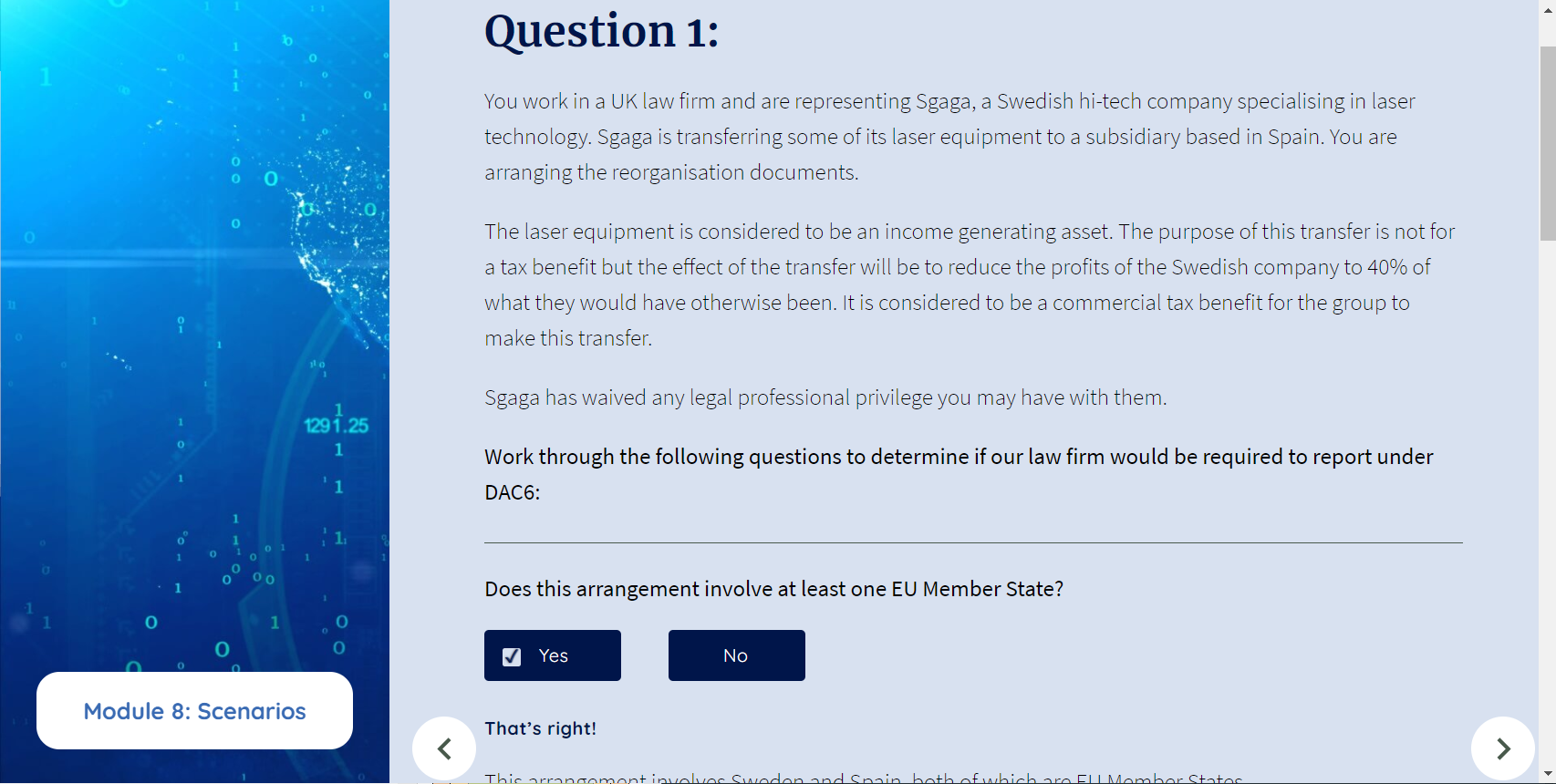

Our training includes both an advanced course that explains each hallmark in depth along with practical examples and scenarios to test the learner’s understanding and a 10-minute overview of DAC6 legislation, what it is and why you should care.

Course features

- Detailed examples of each hallmark

- Interactive scenario questions to ensure understanding of the DAC6 reporting process

- Can be translated into any language so employees across the EU can complete the training

- Interactive test sections at the end of each module to help users understand their reporting requirements

- Fully customisable — additional scenarios can be included in the training to relate to the organisation’s industry and policies

Which DAC6 course should your staff take?

We have created two courses to ensure all your staff, whether DAC6 affects their role directly or not, can train on the complicated new Directive. Here is some guidance on how to choose which course to enrol your staff in:

| DAC6: Advanced | DAC6: Fundamentals | |

| Target Audience | Matter Partners Staff who are responsible for assessing matters for DAC6 | All other staff in your organisation |

| Duration | 30 minutes | 10 minutes |

| Learning outcomes | Deep understanding of which transactions should be reported and when | Awareness of DAC6, its importance and key details |

| Topics covered | ||

| What is DAC6? | ✔️ | ✔️ |

| What needs reporting? | ✔️ | ✔️ |

| Main benefit test | ✔️ | ✔️ |

| Overview of the Hallmarks | ✔️ | |

| Penalties | ✔️ | ✔️ |

| Reporting requirements | ✔️ | some |

| Legal professional privilege | ✔️ | some |

| Relying on other intermediaries | ✔️ | some |

| Detailed explanation of each Hallmark | ✔️ | |

| Examples for each Hallmark | ✔️ | |

| Assessing reporting jurisdiction | ✔️ | |

| Scenario questions | ✔️ | |

| Demo DAC6: Advanced | Demo DAC6: Fundamentals |

If you are still not sure which DAC6 course to enrol your staff in, contact us using the short form below and a member of our team will be in touch.