Register for our DAC6 email updates

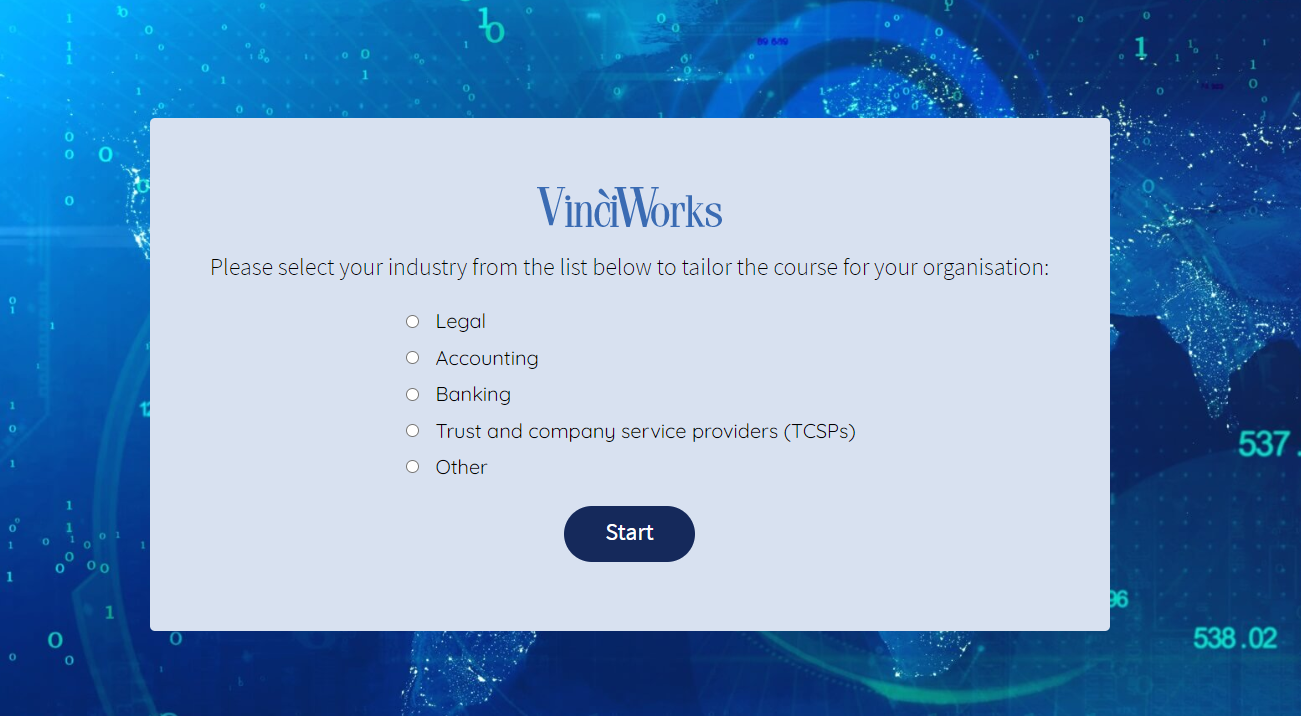

We have just updated our two DAC6 courses to include several versions of each course. The courses begin with a “course builder”, allowing each learner to select their industry and take the relevant course.

Course versions:

- Legal

- Accounting

- Banking

- Trust and company service providers (TCSPs)

- Other

All existing clients that currently license the training have had the courses immediately updated with their industry so their users won’t see the course builder.

What is DAC6?

DAC6 requires lawyers, accountants, tax advisers, bankers and other “intermediaries” to report some aggressive cross-border tax arrangements. Multinational businesses might also be required to report transactions in circumstances where no external intermediary is able to report. These “mandatory disclosure requirements” (MDR) are for tax transactions that cross EU borders, where it seems that the primary purpose of the transaction is a tax advantage.

Due to the COVID-19 pandemic, the EU Commission has given member states the option of deferring DAC6 reporting for six months. Most countries have decided to defer reporting while Germany, Austria and Finland have chosen not to avail themselves of this option.

Why is industry-specific training important?

DAC6 is complicated. When it comes to DAC6 reporting, responsibilities vary depending on each individual’s industry. Training is recommended in order to understand the intricacies of the hallmarks and to determine which transactions must be reported.

Training that does not resonate with the user, that feels like it wasn’t written with a particular industry in mind, does not work. Further, understanding the nature of your responsibilities is challenging when the content and examples are generic and not relevant to the learners’ industry. Our updated DAC6 training includes scenario questions that are relevant to each industry and will resonate with each user.

DAC6 course customisations

In addition to our instant “course builder”, we offer several other customisations:

- Link to internal policies

- Overview of internal procedures

- DAC6 compliance contact details

- Translations – full course text in other languages

- Custom module or additional scenarios

Which DAC6 course should your staff take?

We have created two courses to ensure all your staff, whether DAC6 affects their role directly or not, can train on the complicated new Directive. Here is some guidance on how to choose which course to enrol your staff in:

| DAC6: Advanced | DAC6: Fundamentals | |

| Target Audience | Matter Partners Staff who are responsible for assessing matters for DAC6 | All other staff in your organisation |

| Duration | 30 minutes | 10 minutes |

| Learning outcomes | Deep understanding of which transactions should be reported and when | Awareness of DAC6, its importance and key details |

| Topics covered | ||

| What is DAC6? | ✔️ | ✔️ |

| What needs reporting? | ✔️ | ✔️ |

| Main benefit test | ✔️ | ✔️ |

| Overview of the Hallmarks | ✔️ | |

| Penalties | ✔️ | ✔️ |

| Reporting requirements | ✔️ | some |

| Legal professional privilege | ✔️ | some |

| Relying on other intermediaries | ✔️ | some |

| Detailed explanation of each Hallmark | ✔️ | |

| Examples for each Hallmark | ✔️ | |

| Assessing reporting jurisdiction | ✔️ | |

| Scenario questions | ✔️ | |

| Demo DAC6: Advanced | Demo DAC6: Fundamentals |

If you are still not sure which DAC6 course to enrol your staff in, contact us using the short form below and a member of our team will be in touch.