Complying with the Posted Workers Directive (PWD)

What is a posted worker? A ‘posted worker’ is an employee or agency worker who is temporarily sent by an employer from one European Economic Area (EEA) country (and Switzerland) to another. What is the Posted Workers Directive? The Posted Workers Directive was originally passed by the European Union in 1996, with a major revision […]

VinciWorks’ DAC6 reporting solution awarded runner up prize in the British Legal Technology Awards

Register for our DAC6 email updates Thursday 12 November, 2020 This year, our DAC6 reporting solution was awarded the runner up prize in the category of IT Product or Service of the Year in the British Legal Tech Awards. The announcement took place during a virtual black-tie ceremony hosted by Netlaw Media and follows hard […]

Criminal Finances Act – reasonable procedures checklist

Are your staff aware of the reasonable procedures under the Criminal Finances Act? The Criminal Finances Act, which came into force in September 2017, introduced the requirement for businesses to have reasonable procedures to prevent the facilitation of tax evasion. If you do not feel that your organisation complies with the Criminal Finances Act, it is important […]

Now Available – New Data Protection Collection

Check out our brand-new Data Protection Collection – the third Compliance Collection we launched this year. An innovative new approach for keeping awareness training programmes fresh, year on year. Mitigating the Risks of Data Breaches Last month, British Airways was fined £20M over a data breach that took place in 2018. While Marriott Hotels was fined for £18.4M for […]

DAC6 in Germany: Partial reporting just got even more complicated

The German tax authority has confirmed to VinciWorks in line with their latest edition of the DAC6 Communication Manual that they will no longer be accepting partial reports in certain cases where legal professional privilege applies. Instead, the taxpayer will be expected to make a complete report. Reports for non-marketable arrangements will (contra legem) no […]

Year Four of the Criminal Finances Act – what now?

What you need to do now to prevent facilitation of tax evasion We’re coming up to Year Four of the Criminal Finances Act. And while we haven’t seen a rush of prosecutions that many feared, the British authorities have been ramping up enforcement in recent months with 13 live investigations of the failure to prevent […]

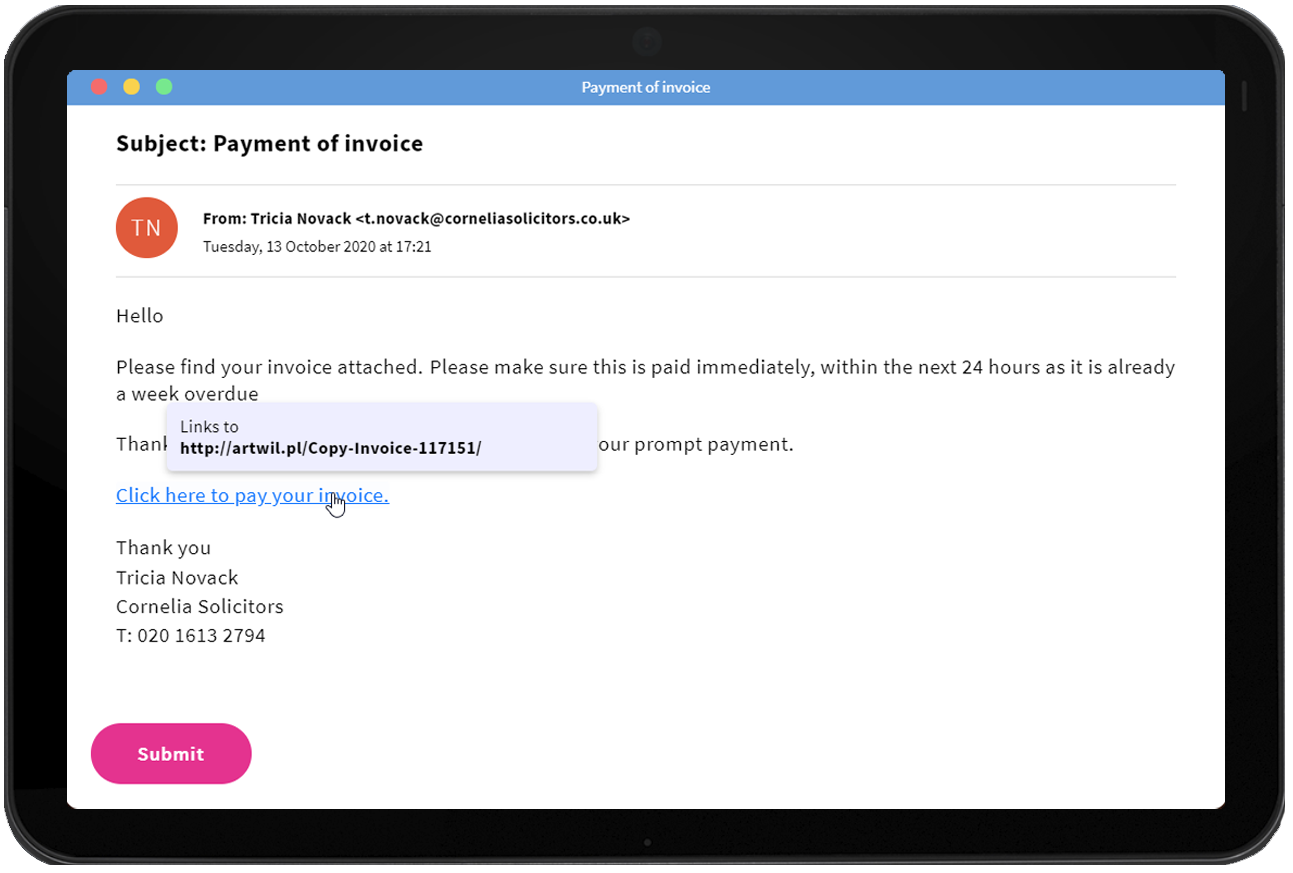

New course release: Phishing Challenge 4.0

Research shows that even with all of the right IT protections in place, a majority of staff are at medium to high risk of falling prey to phishing attacks. These types of attacks are especially dangerous because, in contrast to other types of scams that may be easier to detect, phishing attacks use psychological gimmicks […]

A Dozen Investigations of the Corporate Offence of Failing to Prevent Facilitation of Tax Evasion

The Criminal Finances Act has been in force since 2017. While there have been no prosecutions as yet, HMRC are currently investigating thirteen potential violations of the Corporate Criminal Offence of failing to prevent the facilitation of tax evasion. The Act places responsibility on businesses to make sure none of their employees are involved in helping someone […]

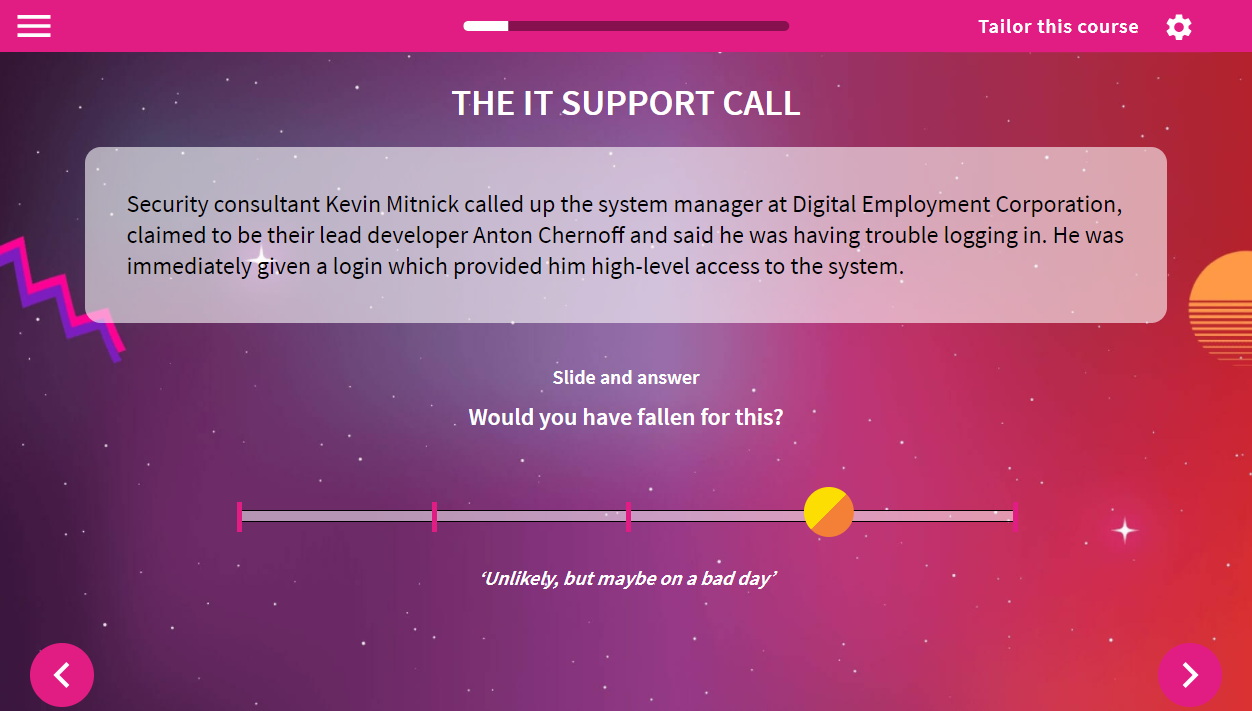

Social engineering: Don’t bite the bait

What is social engineering? We’ve all heard of headline-making cyber attacks and the havoc they have all too often managed to wreak. This includes the 2019 ransomware attack in Texas that held 22 cities hostage for millions of dollars and lasted for several days before being resolved. These news-worthy attacks, which are usually technical in […]