How employers can create an inclusive work environment

Diverse workforces offer a mixture of skill sets, experiences and ways of thinking that benefit individuals and the organisations they work for. Diversity can increase creativity, innovation, productivity and wellbeing, helping to create a working environment where everyone can reach their full potential. However, these benefits don’t just come from hiring a diverse range of […]

What is the Posted Workers Directive (PWD)? Download our guide

The Posted Workers Directive, an EU Directive introduced on 30 July 2020, aims to ensure fair wages and a level playing field between posting and local companies in the host country whilst maintaining the principle of free movement of services. The Directive defines a set of mandatory rules regarding the terms and conditions of employment […]

Does the Sixth Money Laundering Directive apply in the UK?

6th money laundering directive UK The Sixth Anti-Money Laundering Directive (6AMLD) is an EU directive that aims to enhance the existing anti-money laundering (AML) and counter-terrorism financing (CTF) regulations within the European Union. The United Kingdom has implemented the provisions of 6AMLD into its domestic legislation. Some key points the UK was able to implement […]

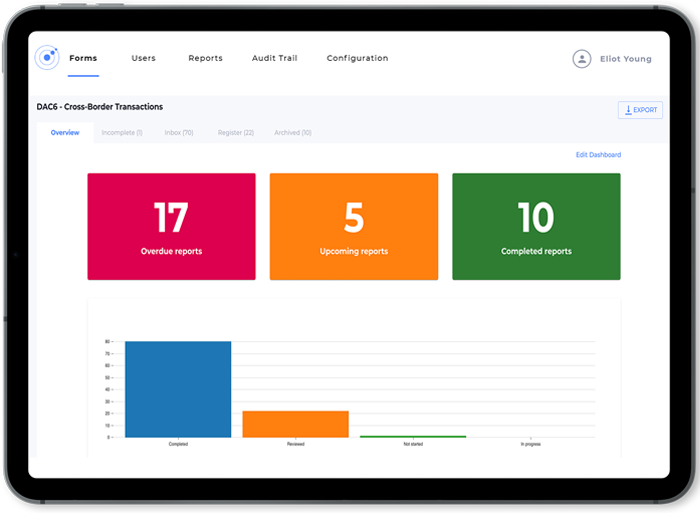

DAC6 is coming: What now?

DAC6 is a new EU mandatory disclosure regime that imposes mandatory reporting of certain cross-border arrangements. Reporting for some EU member states began back in July 2020. However, the vast majority of member states will begin reporting obligations from January 2021. Who is affected by DAC6? Under DAC6, a set of transaction facilitators known as […]

DAC6 in Ireland: Finance Bill 2020 proposes changes to legislation

Register for our DAC6 email updates Proposed changes to Ireland’s implementation of DAC6 were announced in the Finance Bill 2020. Some of the relevant changes include: Additional DAC6 exemptions: DAC6 will no longer apply to fees, such as for certificates and other documents issued by public authorities; and dues of a contractual nature, such as […]

DAC6 in Germany: Partial reporting allowed… again

Register for our DAC6 email updates The German tax authority has confirmed in their latest edition of the DAC6 Communication Manual released on 4 December 2020 that they have backtracked on their decision not to accept partial reports in certain cases where legal professional privilege applied to an arrangement. The latest update makes it clear […]

Omnitrack version 2.27.0

Features & improvements Single submission exports Users can now export submissions to Word which allows them to tailor the content of reports before passing them along to clients or internal stakeholders. In addition, PDF exports now include page numbers and dates. End user dashboard The end-user dashboard will save an individual user’s layout automatically. Users […]

Found in Translation: Translate any VinciWorks course

Almost all UK legislation, such as GDPR, the Criminal Finances Act 2017, the Money Laundering Regulations 2017 and the Bribery Act 2010, has extra-territorial reach. It is therefore critical to an international business’ global compliance plan that all staff are made aware of the laws, wherever they are and whatever language they speak. Failure to show that […]

DAC6 – Country-by-country guide updated in light of latest guidance

Register for our DAC6 email updates The DAC6 compliance requirements of global businesses vary from country to country. Despite the approaching 1 January deadline, not all EU member states have yet finalised their guidance and additional details, such as legal professional privilege and penalties vary between each state. To help firms save time and money […]