DAC6 is a new EU mandatory disclosure regime that imposes mandatory reporting of certain cross-border arrangements. Reporting for some EU member states began back in July 2020. However, the vast majority of member states will begin reporting obligations from January 2021.

Who is affected by DAC6?

Under DAC6, a set of transaction facilitators known as intermediaries will have reporting obligations. An intermediary includes anyone who designs, organises, implements or makes available a transaction.

In reality, this means that banks, trust companies, private equity companies, hedge funds, insurance companies, holding companies, consultants and other financial advisors might be considered intermediaries.

DAC6 best practice tips

DAC6 is complicated, but there are many procedures you can put in place to make it easier for you and your organisation to ensure that the process runs as smoothly as possible. Some things to think about include:

Internal Process: Create a clear internal process to analyse potential DAC6 arrangements.

Training: Provide training to all staff who may need to be aware of DAC6.

Reporting: Check you are able to make a report in all the jurisdictions where you operate.

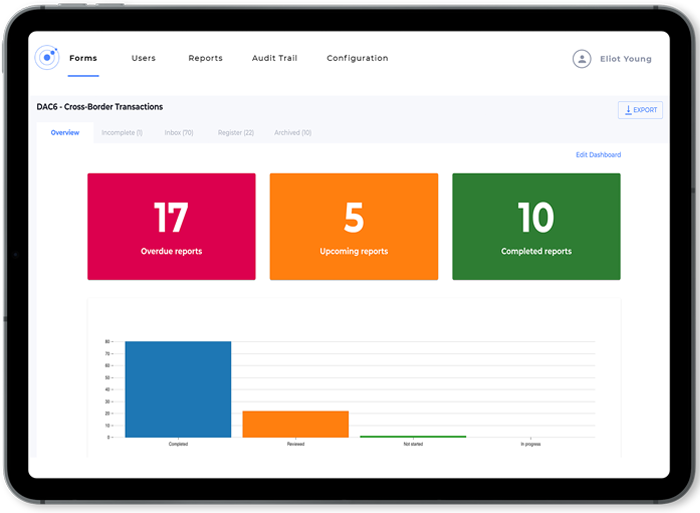

Timeline: Monitor ongoing arrangements and keep track of reporting timelines.

Communication: Put a system in place to provide proof of reporting to other intermediaries or relevant taxpayers.

Audit Trail: Prepare for future tax inspections by maintaining an audit trail of both reportable and non-reportable arrangements should the tax authority request more information.

Implementing a DAC6 reporting tool can help you with all the above steps.

New to DAC6, what now?

If you have just heard about DAC6 and don’t know where to start, don’t worry, VinciWorks has a comprehensive DAC6 solution including training, software and a detailed implementation guide. For more information, contact [email protected].