DAC6: Spanish reporting is live

Following the Spanish parliament’s approval of the final legislation implementing the Spanish Mandatory Disclosure Regime, on 13 April 2021, the Spanish Ministry of Taxation approved the reporting format, and reporting in Spain is now live. The Spanish Official Gazette published Order HAC/342/2021 which approves the following three forms: Form 234: For reportable cross-border arrangements by […]

Mental Health – Top Tips to Support Employees

Mental Health issues are not something we ought to treat lightly. Recent research by the ONS revealed that around 1 in 5 (21%) adults experienced some form of depression in early 2021 – an increase since November 2020 (19%) – and more than double that seen before the pandemic (10%). For organisations, it’s crucial mental health is […]

On-demand webinar: ESG — The new era in corporate accountability

From the EU’s upcoming Corporate Due Diligence and Corporate Accountability Directive to the FCA’s Climate-Related Financial Disclosures and the SEC’s new framework for ESG disclosure, corporate accountability is changing. This is on top of existing ESG reporting requirements including the EU Non-Financial Reporting Directive, the French Corporate Duty of Vigilance, and the fact that ESG […]

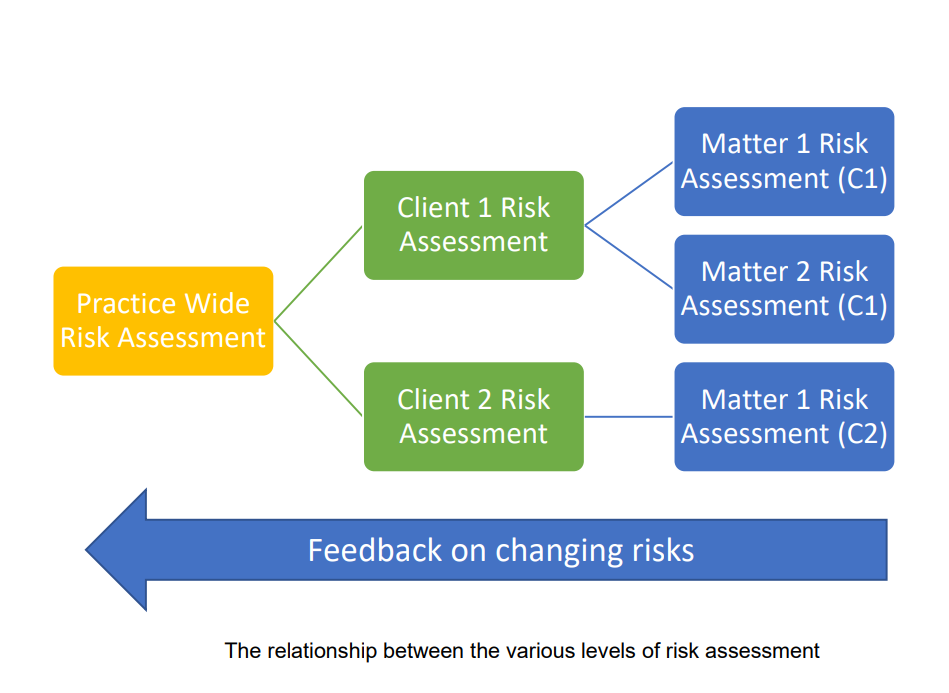

The LSAG AML Guidance – What you need to know

What is the LSAG Guidance? In our last AML blog, we provided an overview of the main UK money laundering offences. We also addressed some of the obligations imposed on individuals and organisations governed by The Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (the ‘Regulations’), as amended. As mentioned in our previous […]

Are passwords becoming a thing of the Pass-t?

A tight password policy has always been key to sound cyber security in any business, and with the landscape changing passwords are going from the protector, to the protected.

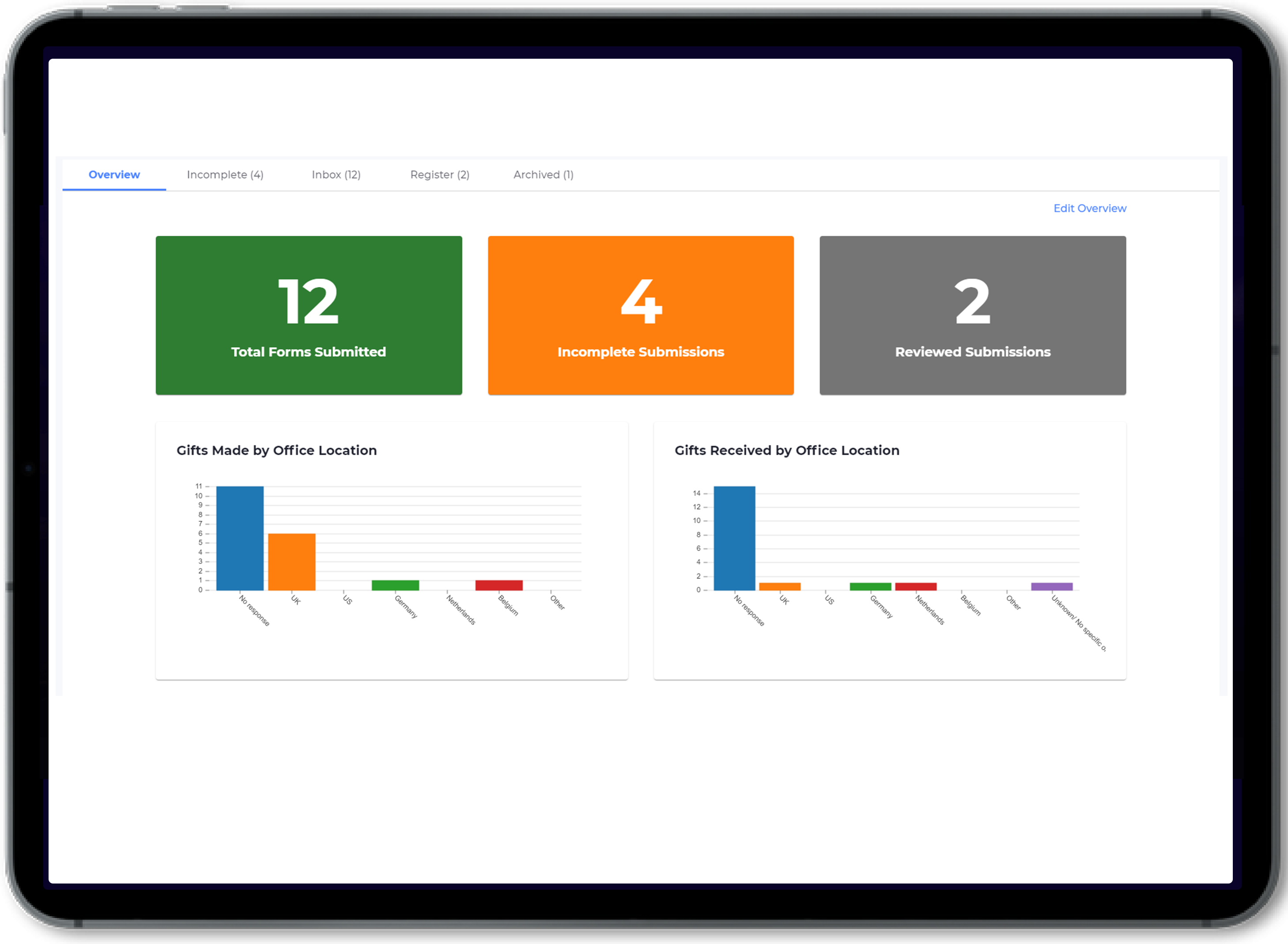

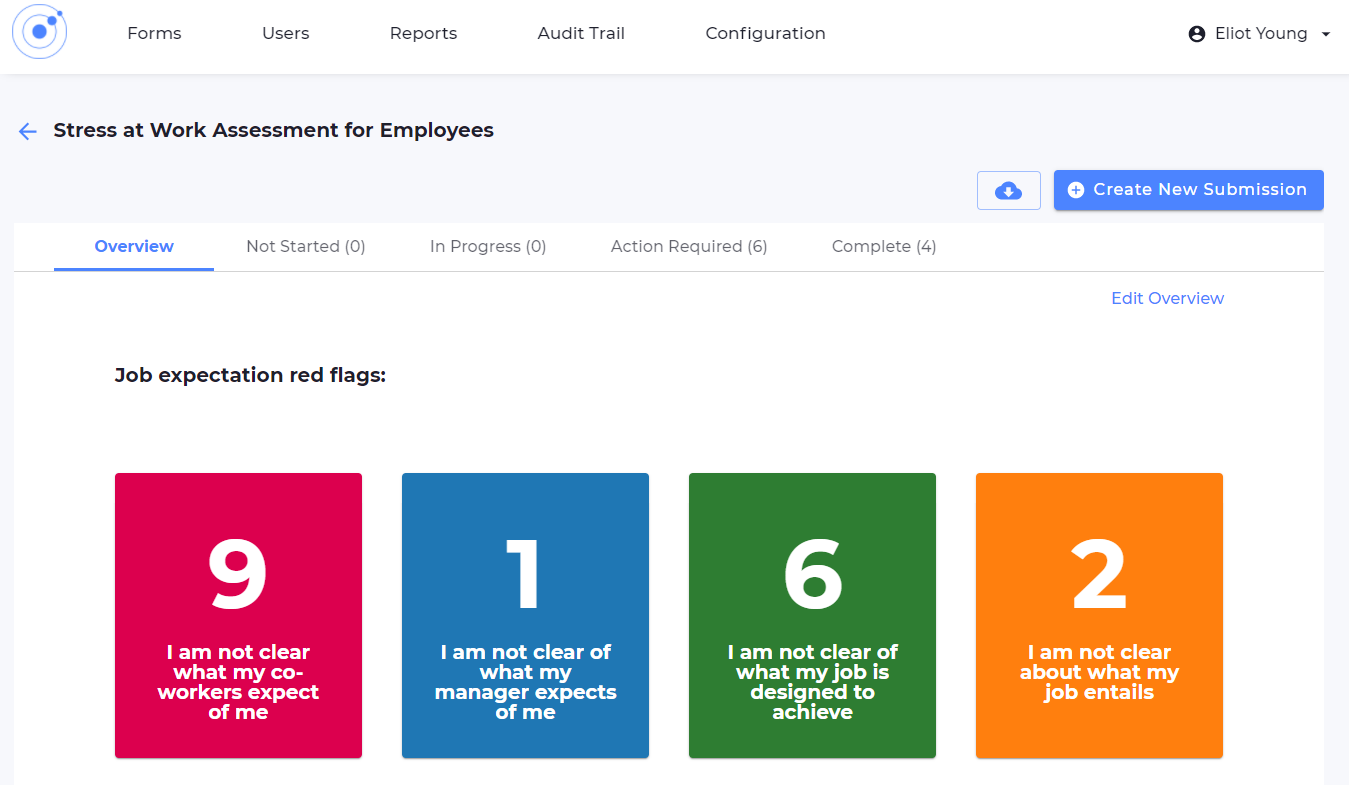

Mental health training now integrated with Omnitrack’s “stress at work” reporting tool

Mental Health: The duty to care and ending the taboo Even before the pandemic hit, employers were beginning to see the importance of addressing mental health issues in their workforce. With the ongoing effects of the pandemic still affecting so many of us, the importance of treating mental health as a priority has only increased. […]

ESG – what is it and why should you care?

Environmental, Social and Governance factors are changing the corporate world What is Environmental, Social, & Governance? ESG Explained ESG – Environmental, Social and Governance – is the hottest acronym in the business world. The term is crowding out the old CSR (Corporate Social Responsibility) approach in favour of a more holistic view that considers the […]

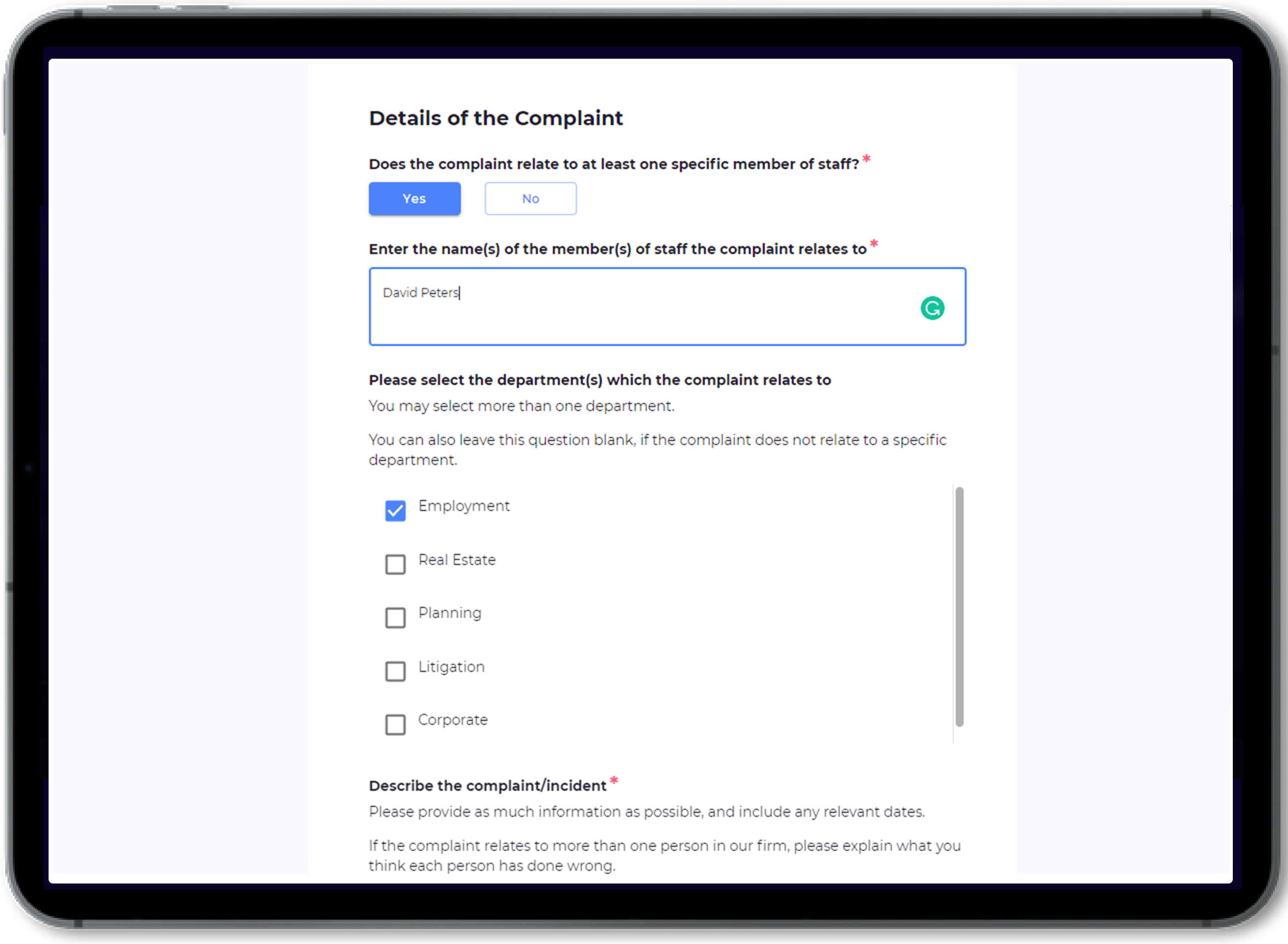

Effective and ineffective complaints reporting: Stories, lessons, and best practice guidelines

Complaints and Incidents Complaints can vary radically in subject matter, intensity, and desired outcomes. For instance, a company can receive a complaint about a seemingly trivial matter, but from a particularly litigious customer. On the other hand, a complaint could relate to an incident of serious misconduct but may be expressed in an understated manner. […]

Jersey Edge Closer to Implementing Mandatory Disclosure Rules

The Taxation (Implementation) (International Tax Compliance) (Mandatory Disclosure Rules for CRS Avoidance Arrangements and Opaque Offshore Structures) (Jersey) Regulations 2020 are expected to come into force in Jersey by the end of 2021. What is included in the Jersey Mandatory Disclosure Rules? The regime is closely aligned with the OECD’s Mandatory Disclosure Rules relating to […]