Following the Spanish parliament’s approval of the final legislation implementing the Spanish Mandatory Disclosure Regime, on 13 April 2021, the Spanish Ministry of Taxation approved the reporting format, and reporting in Spain is now live.

The Spanish Official Gazette published Order HAC/342/2021 which approves the following three forms:

Form 234: For reportable cross-border arrangements by intermediaries or taxpayers.

Form 235: For quarterly reporting obligation of marketable arrangements by intermediaries.

Form 236: For the taxpayers’ annual reporting of cross-border arrangements which are applied in the tax year.

The initial reporting deadline for historic arrangements is May 14, 2021. These include arrangements that are reportable in Spain for the following periods:

- If the first step of implementation of an arrangement was carried out between 25 June 2018, and 30 June 2020.

- If the first step in implementation of an arrangement arose between 1 July 2020 and 14 April 2021.

On an ongoing basis reportable DAC6 arrangements will need to be filed within 30 days of triggering events.

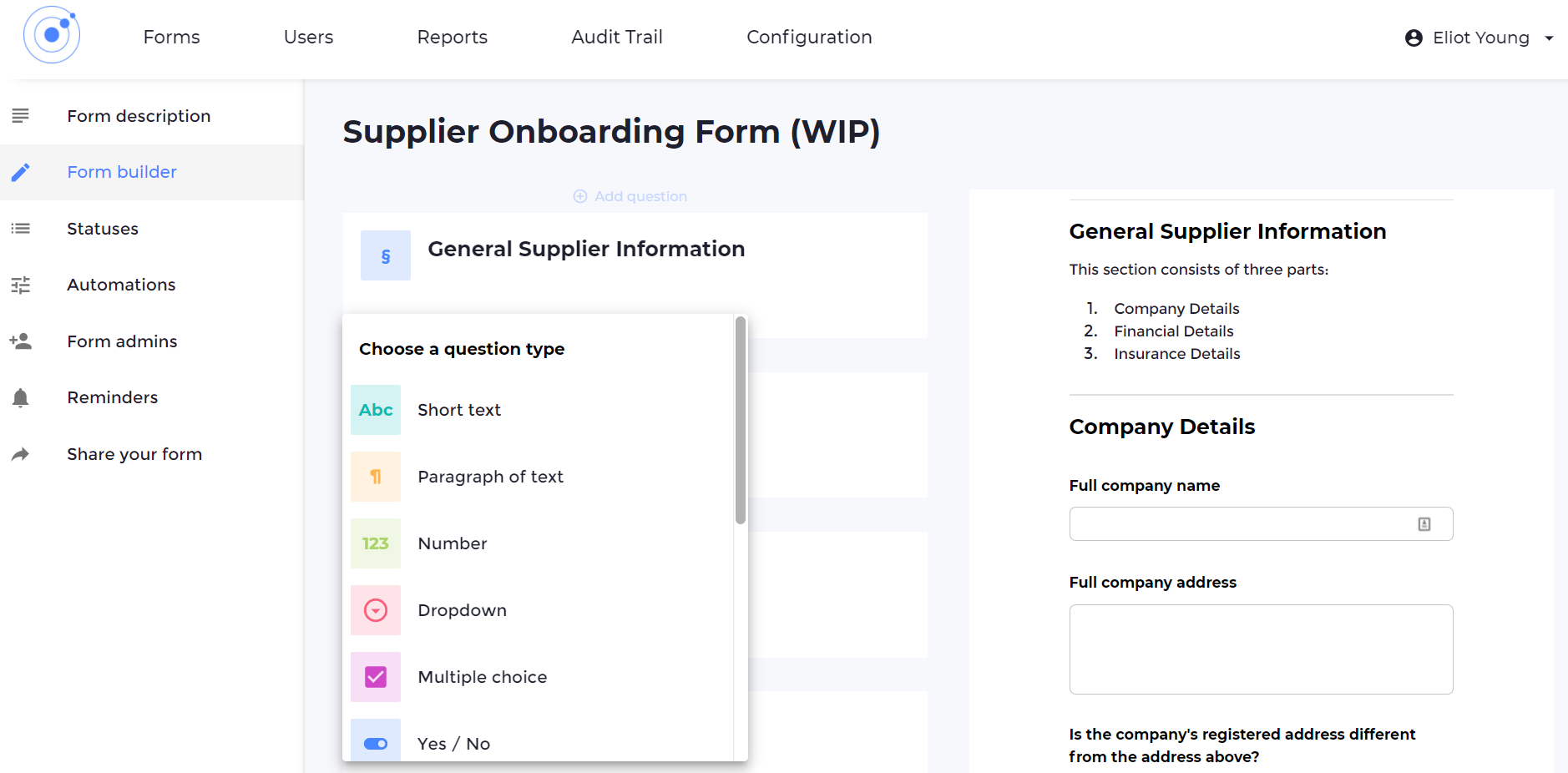

VinciWorks’ DAC6 Solution offers reporting solutions for international firms for MDR regulations in many jurisdictions including Spain.

Get in touch with us to see how Omnitrack can help ensure you are completing your reporting requirements.