Omnitrack version 2.40.0

User lookup fields A user lookup field allows you to reference your existing user data when filling in a form. If you need to reference a manager or partner on a submission, you can add a User Lookup field and allow people to choose from your up-to-date user list instead of manually entering someone’s details. […]

Why Whistleblowing is Important

World Whistleblowing Day serves as a reminder to raise public awareness about the important role of whistleblowers in combatting corruption and maintaining security. According to the 2021 Global Business Ethics survey report, the global median for reporting misconduct was 81% in 2020, compared with 63% in 2019, so employees are whistleblowing more often. The survey also […]

Regulatory Agenda for June 2021

To help businesses keep track of updates in UK legislation and policies, VinciWorks regularly publishes a regulatory update. Our regulatory agenda for June covers EU developments, back to the office guidance for managers, ongoing acts of parliament, the latest COVID-19 government guidance and more. What’s in the regulatory agenda? What’s new this month? COVID-19 course […]

The mental health benefits of vaccines

Vaccines are helping the world get back to normal. But even as the vast majority of people get vaccinated, there will always be a minority who won’t or can’t. Feelings and opinions around vaccines can be emotive, and workplace vaccination policies must toe a complicated line. There is no legal requirement to be vaccinated, but […]

Why we all have Covid Stress Disorder

The COVID-19 pandemic has caused a near-universal sustained stress-inducing experience in the way other plagues haven’t done in centuries. The COVID-19 pandemic is much more comparable to the experience of a world war than a health scare. The pandemic has impacted everyone’s day-to-day lives and will leave long emotional scars even as life returns to […]

Data Phishing Scams You Need to be Aware of – June 2021

We had hoped that 2021 would bare little resemblance to 2020, the year everything stood still. While this unfortunately hasn’t been the case, there is one group of people who haven’t been on pause – Phishing Scammers. During the 2020/2021 global pandemic, the Federal Bureau of Investigation (FBI) reported that phishing scams increased from 114,702 incidents in […]

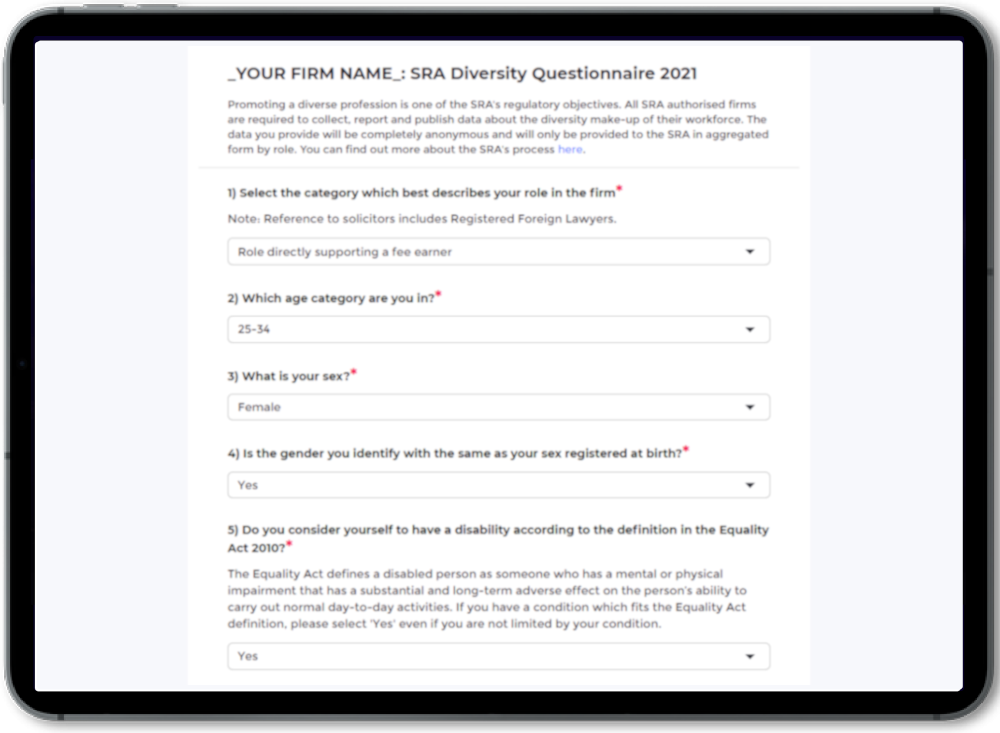

SRA publish diversity reporting deadline dates

All Solicitors Regulation Authority (SRA) regulated firms have an obligation to collect, report and publish data about the diversity make-up of their workforce every two years. The next report is due on 2 August 2021. Firms can report their data to the SRA from 5 July. What information needs to be collected? Employee role Age […]

Omnitrack version 2.39.0

Enhanced automations Automate more steps in your workflow with custom triggers and a robust set of conditions. For example, you can create an automation that will assign Rebecca as the Responsible Admin when the answer to ‘Office Location’ is ‘New York’ but assign the submission to John if the answer is ‘London’. Immediate save of […]

ESG: You’re more prepared than you think

Are you ready for the ESG revolution? Though the thought of undertaking Environmental, Social and Governance (ESG) reporting and becoming compliant might seem overwhelming at first, many companies will find that they are already contributing to many aspects of ESG reporting. Do you train on bribery and tax evasion? If so, that is a key […]