International Standard on Quality Management (ISQM) 1: What you need to know

In September 2020, the International Standards on Quality Management approved the ISQM 1, ISQM 2 and the International Standard on Auditing (ISA 220 Revised). The three Quality Management Standards are the culmination of the response of the International Auditing and Assurance Standards Board (IAASB) to a series of high-profile audit failures. The new standards are […]

Omnitrack version 2.45.0

Enhancements to visibility logic You can now build logic based on whether another field is blank and based on whether a date field is in the past or the future. Example of date field logic using past or future – Show a question ‘Why didn’t you request approval for this gift before it was received?’ […]

On-demand webinar: Data Protection — What the UK wants to change

The UK government’s consultation on reforming data protection, launched on 9 September, sets out a radically different framework for data protection than GDPR. From re-orientating the Information Commissioner’s Office to new ways for businesses to process data, these far-reaching reforms are set to have a significant impact on business. Although the plans have been announced in consultation […]

10 Healthy Eating Tips to Improve Wellbeing

Having a healthy, balanced diet plays a really important role in your overall health and wellbeing. In fact, you may have noticed for yourself that eating certain types of food helps to lift your mood, increase your energy levels, and makes you feel more positive and motivated. Conversely, other types of food can have quite […]

Significant changes planned for UK data protection law

Here’s what you need to know about the UK’s plans to radically alter GDPR The UK government’s consultation on reforming data protection, launched on 9 September, sets out a radically different framework for data protection than GDPR. From re-orientating the Information Commissioner’s Office to new ways for businesses to process data, these far-reaching reforms are […]

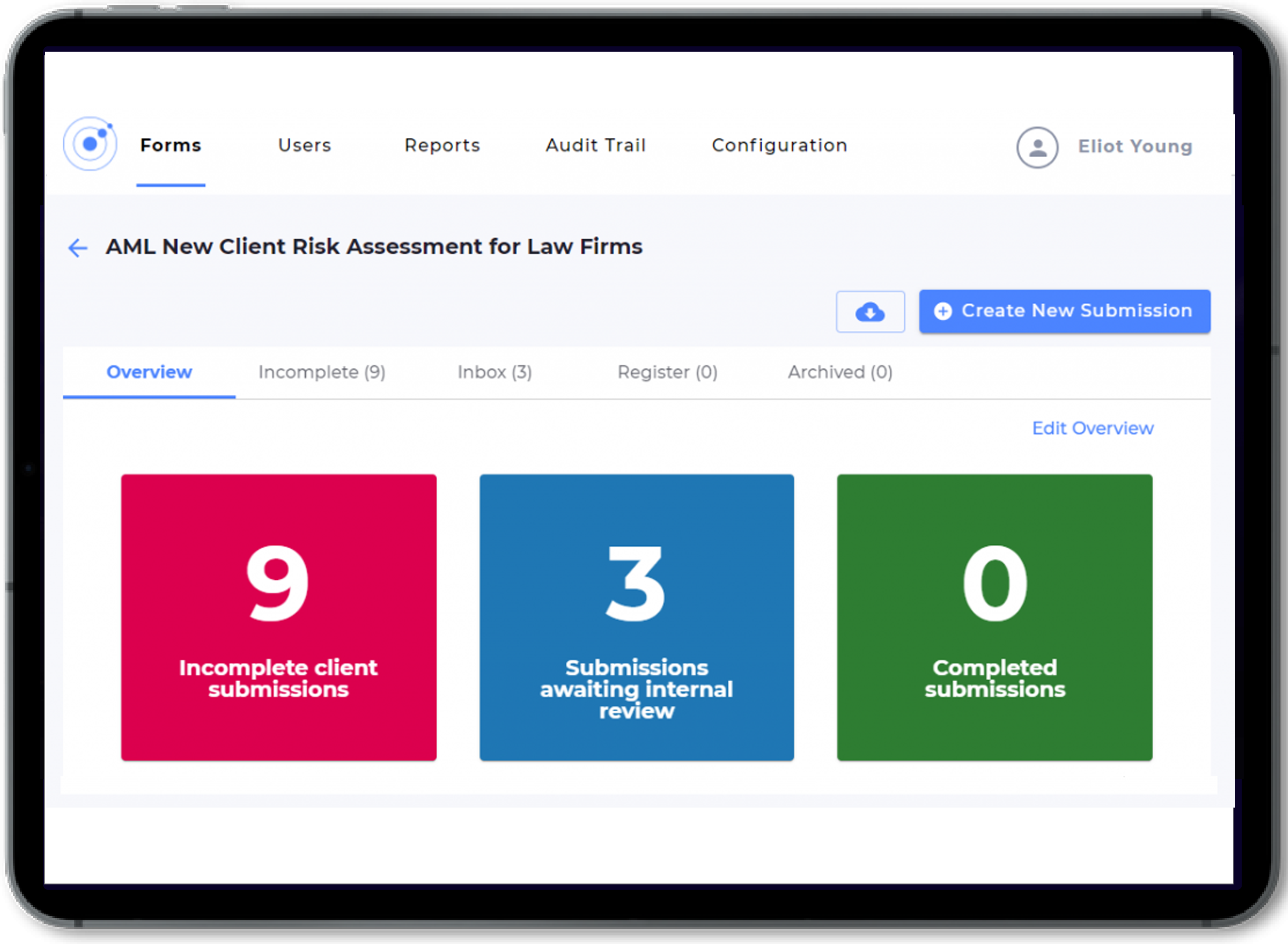

LSAG AML guidance – Practical tips for compliance

This is the sixth blog in series to help law firms grapple with the latest Legal Sector Affinity Group (LSAG) guidance on the Money Laundering Regulations. In this series, we looked at some key points from the LSAG Guidance on the Money Laundering Regulations 2017. This included the different types of risk assessment which firms […]

Diversity and inclusion – Be the solution: Why bystander training works

What is bystander intervention training? Bystander intervention training is an educational program designed to equip individuals with the knowledge and skills to safely and effectively intervene in situations where harm, harassment, or violence may occur. The training aims to empower bystanders to take action and prevent or diffuse potentially harmful situations. It typically focuses on […]

Try our social media knowledge check

Today, social media blurs the boundaries between our once distinct personal and professional personas, and the way we present ourselves online has rapidly become the marker of who we are in the real world. VinciWorks has a knowledge check to complement our course Social Media: Communicating at Work to help organisations test their staff’s knowledge […]

On-demand webinar: Diversity – Managing reasonable adjustments in the age of hybrid work

As COVID-19 restrictions are lifted and businesses begin to return to the office, companies are taking a variety of approaches to managing the transition. While some are staying at home for now and others have gone back full time, most are opting for a hybrid working policy. But many people are anxious, or at least […]