Argentina is set to implement a new mandatory disclosure regime (MDR) aimed at reducing international tax evasion. The Argentinian law is modelled after DAC6, a European directive that requires lawyers, accountants, tax advisors, bankers and other “intermediaries” to report some aggressive cross-border tax arrangements. It is part of a broader OECD initiative to combat tax evasion, known as BEPS Action 12.

Argentina’s mandatory disclosure resolution, called General Resolution No. 4838/2020, was published in October 2020. The resolution requires reporting for domestic and international arrangements implemented since January 2019, or ones that were implemented before that but that are still active.

Which tax arrangements will be reported in Argentina?

A disclosure will be required by the Argentine Federal Tax Authorities (AFIP) when there is a domestic or international arrangement that generates a tax benefit in Argentina or any other jurisdiction and meets one of the following nine hallmarks:

- The arrangement uses legal entities to obtain double tax treaty benefits

- The arrangement uses strategies adopted to avoid triggering a permanent establishment

- The arrangement results in double international non-taxation

- There exists in the arrangement an intention to avoid compliance with an informative regime

- The arrangement involves a non-cooperating jurisdiction or a low- or no-tax jurisdiction

- There is a mismatch in the arrangement between two or more jurisdictions regarding the tax treatment of an entity or agreement that results in a tax advantage or other tax benefits

- The arrangement involves a foreign individual or entity holding double tax residency

- There is a taxpayer in the arrangement who is the beneficiary, grantor, or trustee of non-Argentine trusts, non-Argentine private foundations, or any other non-Argentine business

- The arrangement is one of those specifically listed on the AFIP’s tax arrangements microsites

What information must be included in the report?

The following information needs to be reported under Argentina’s version of DAC6:

- A complete description in clear and precise language that fully describes the arrangement and the way in which a tax advantage or other benefits result in the favour of any of the parties involved or of a third party

- The details of the parties involved in the arrangement

- Any other relevant elements or transactions of the tax planning arrangement

- A detailed analysis of the rules, including any applicable foreign legislation that applies to the arrangements

Who has to report?

- Tax payers that participate in any domestic or international tax planning arrangements that fall under the definition above of reportable tax arrangements.

- Tax advisors that participate, directly or through third parties, in implementing a tax planning arrangement, unless they claim professional secrecy. In that case, they must report that to the tax authorities. The taxpayer may wave professional confidentiality.

- When multiple parties are involved, all of them need to report. The report of one does not exempt the others, though it is not clear who has the primary obligation to report.

Reporting deadlines

- Domestic arrangements that were implemented since 20 October 2020 must be reported by the last day of the month following the end of the tax year in which the arrangements were implemented.

- International arrangements implemented since 20 October 2020 must be reported within ten days of implementation.

- Domestic and international arrangements that were implemented between 1 January 2019 and 20 October 2020, or those made before then but that were still relevant when the new legislation came into effect, must be reported by 29 January 2021.

How to report and who to report to

Reporting must be done in accordance with the instructions on the IPF microsite. Submissions must be made either through the IPF Regime service or via a “WebService” exchange. Once submitted, the system will issue an acknowledgement of receipt.

Penalties

Taxpayers and tax advisors that do not comply with the reporting requirements set out in the legislation may be subject to the following penalties:

- Fines as set out in the Tax Procedural Law

- Exclusion from the tax registry that provides tax benefits

- Being barred from obtaining tax credit certificates

- Increased risk of being audited or assessed

Note: the next version of the country by country guide will also include non-EU Member States who are implementing MDR.

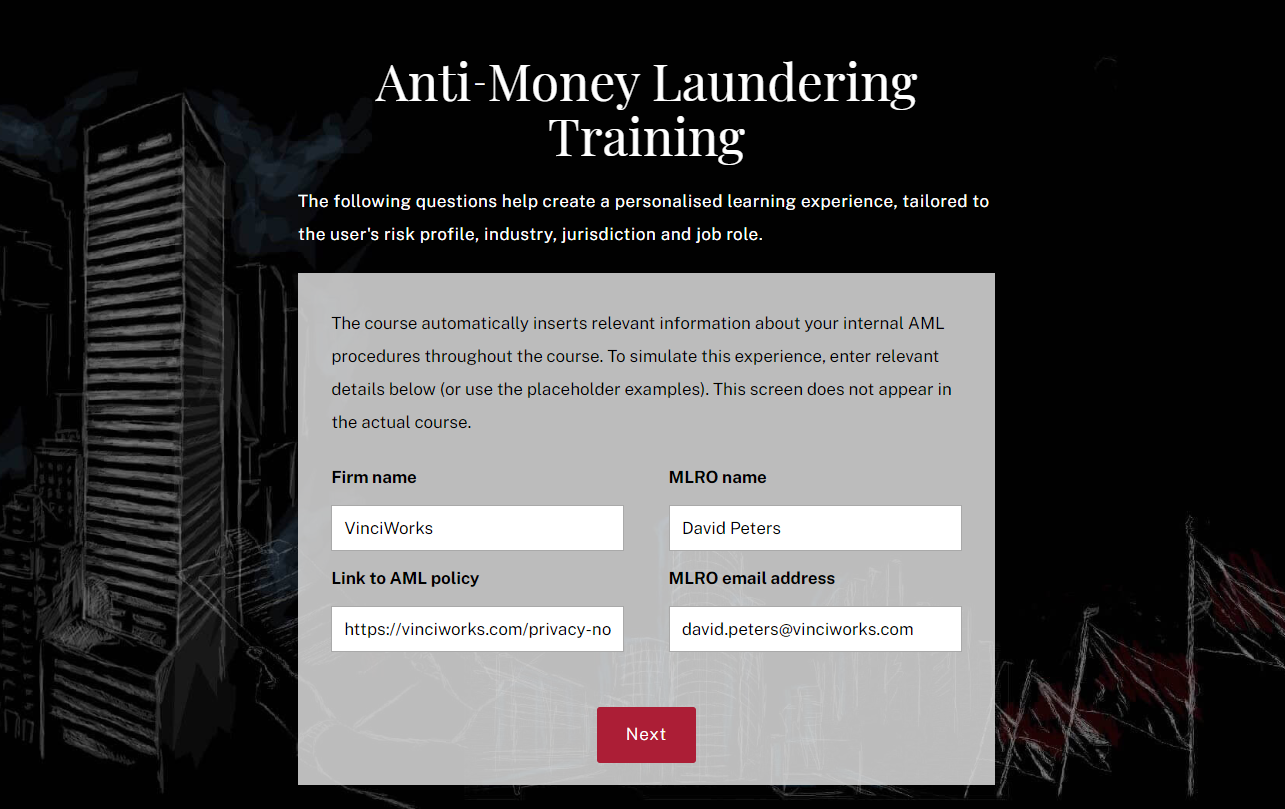

VinciWorks’ MDR reporting portal – Customisable workflows for all jurisdictions

VinciWorks’ Omnitrack is currently being used by many of our clients as a DAC6 reporting tool. Omnitrack can easily be adapted for use in Argentina.

Core features:

- Built for international firms with different workflows and reporting for every EU country

- Reminders for reporting deadlines and reviewing ongoing transactions

- Customisable dashboard to make it easier for administrators to stay on top of deadlines

- Customisable workflow to easily collect all pertinent data

- Choose from a number of hosting options, including cloud hosting and on-premises hosting