How can Compliance Keep up with Fast-Moving FinTech?

New technologies have revolutionised how we do business, find love, travel and shop. And more recently, the digital age has shaken up the worlds of finance and banking. But as people move to innovative banking and saving formats, how can regulators protect the public while also providing a level playing field for established banks and […]

October News Roundup

Data breach: airport fined for lost USB memory stick An airport was fined £120,000 after an employee lost a USB memory stick containing sensitive personal information. A member of the public found the memory stick on the street and viewed the files on a library computer. The contents on the USB included the times guards […]

Competition law – Big firms fined for involvement in cartels

Businesses have a responsibility and a legal obligation to follow competition law as laid out in the Competition Act 1998. In recent years, many large companies have been fined for involvement in cartels, and it is important for businesses to be aware of the dangers and pitfalls to avoid falling foul of the law, and […]

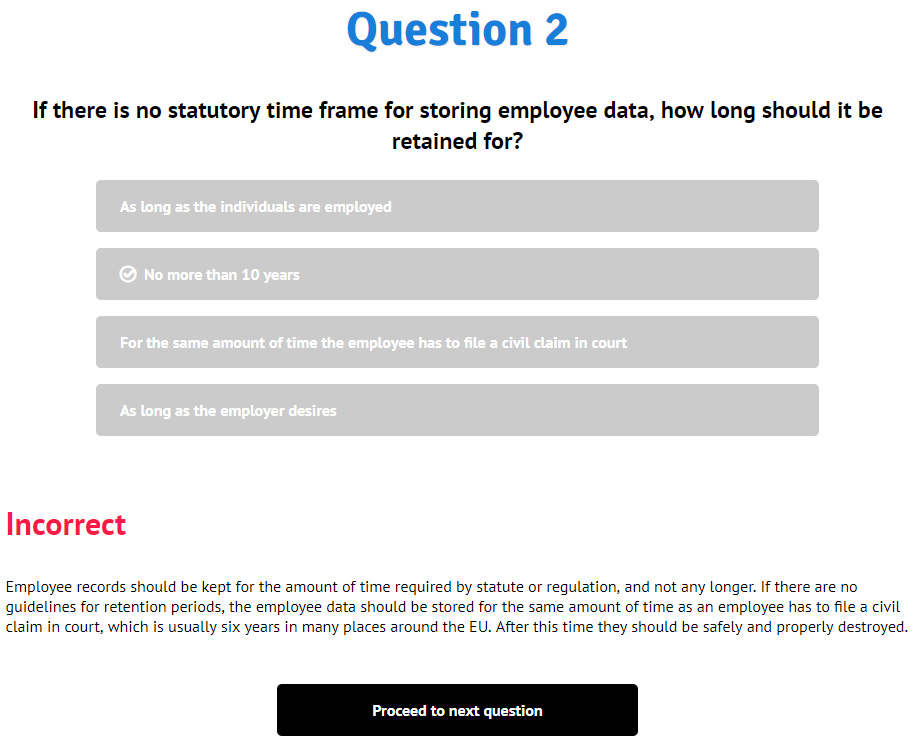

HR & HIPAA – Two new GDPR knowledge checks

VinciWorks’ knowledge checks are five minute courses designed to help you and your staff assess their level of compliance, allowing you to decide on next steps. Feedback is given after each question is answered, allowing users to improve their knowledge while completing the assessment. A score is given at the end of each assessment, meaning […]

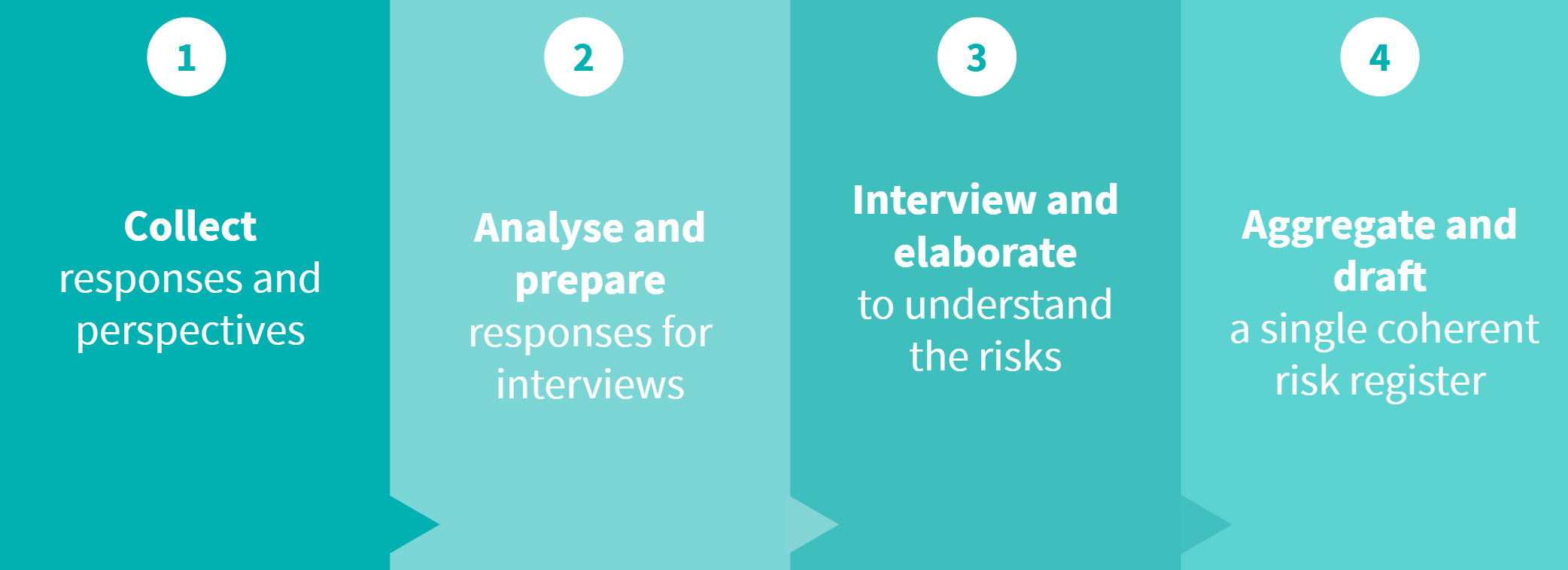

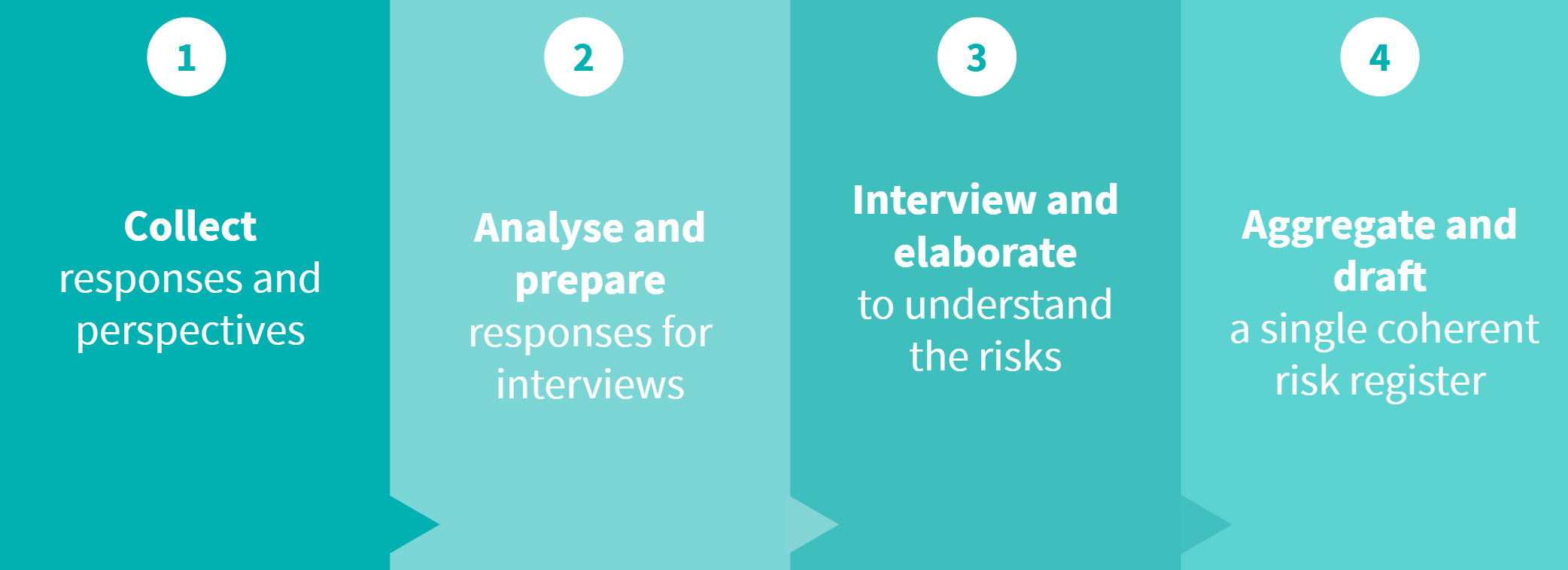

Transparent risk identification – the four step process

The risk identification process should involve your entire organisation, hence the phrase “everyone is a risk manager”. This means conducting surveys and interviews, analysing the responses and drafting a risk register based on those results. This is known as the transparent risk identification process because it requires everyone in the organisation to be transparent, includes […]

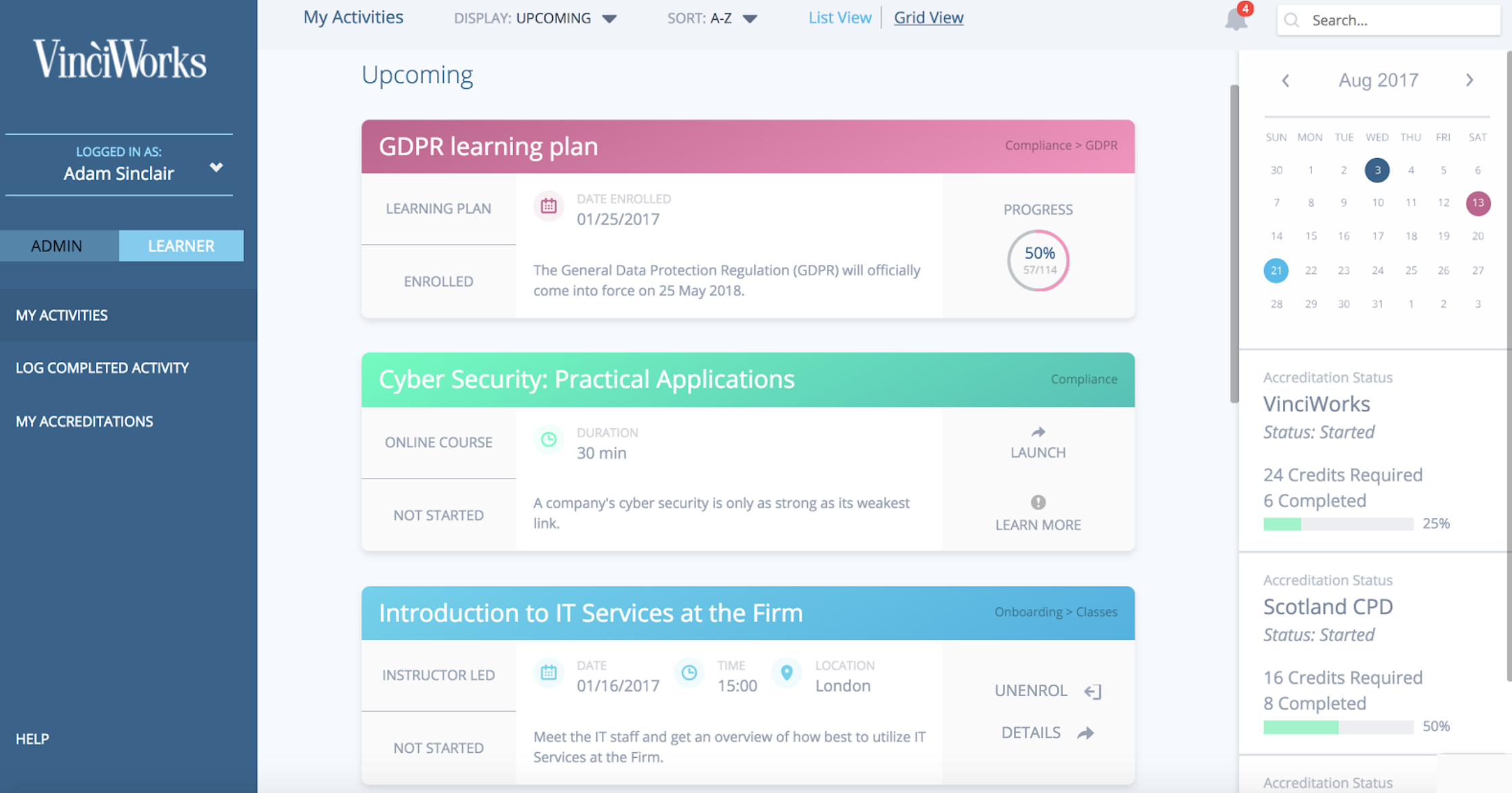

Learning Management Systems explained

What is a learning management system (LMS)? Who needs an LMS? How do they help with learning? While many have heard the term, for others it may be difficult to understand exactly what an LMS is and how it could be helpful to your organisation. Here is everything you need to know. What is a […]

New York sexual harassment whistleblowing policy template

Download the New York sexual harassment whistleblowing policy template When it comes to any potential foul play at work, it is important that employees understand when they should share their concerns, who they should share them with and how to do so. In order to ensure all your staff feel comfortable raising any concerns they have […]

In conversation with the SRA: What’s the latest on the SRA Handbook?

Director of Best Practice Gary Yantin and Legal and Research Executive Ruth Cohen recently travelled to Birmingham to meet with the SRA and discuss what’s coming up in the next 12 months. The new SRA Handbook is going to see some important changes in the regulation of solicitors, and we’re working hard at VinciWorks to […]

VinciWorks kicks off first risk identification masterclass

On Wednesday 17 October, VinciWorks ran its first risk identification masterclass in an impressive Central London venue, the Law Society. Facilitators, experts Dean Hughes and Karla Gahan, focussed on risk identification, one of the key steps of Enterprise Risk Management (ERM). They gave guidance to delegates on how to better facilitate risk conversations, reveal awkward […]

GDPR and Section 11 of the Criminal Finances Act 2017

Section 11 of the Criminal Finances Act 2017 amends the Proceeds of Crime Act (POCA) and affects the regulated sector. The new data sharing regime enables regulated persons to request and share information with their regulated peers, free in most respects from contravening the EU’s General Data Protection Regulations (GDPR). Any disclosure “made in good […]