Micro-Learning: Can you create an eLearning course in less than 30 Minutes?

Do you want to harness the power of eLearning for your organisation? Turn an existing PowerPoint into a SCORM Compliant eLearning Course Add videos and branding to your course Add an assessment (and determine the difficulty and pass mark) Automatically enrol or re enrol specific groups for refresher training Quickly identify those who fail to […]

Anti-money laundering – a guide to customer due diligence

Customer Due Diligence and Anti-Money Laundering Ensuring your staff are able to carry out effective customer due diligence goes a long way to ensuring your staff and clients are not are not facilitating money laundering. Such processes to be aware of and understand include submitting a suspicious activity report (SAR), understanding what is required to […]

Are you Risk Assessing Employees Effectively?

Health and Safety can be seen as an onerous task. There are forms to fill in and boxes to tick. Companies who view it in this way are failing on multiple counts. Not only should a responsible employer see it as part of their duty of care to provide a safe and healthy working environment, […]

Data protection checklist – is your business GDPR ready?

Article 5 of the General Data Protection Regulation requires demonstrable compliance with the new regulations. With GDPR now in force, ensuring your staff are aware of your organisation’s data protection policies is now more important than ever. Data protection changes under GDPR Are you familiar with GDPR? Does your organisation have a process for data […]

What’s in the new Sanctions & Anti-Money Laundering Act 2018?

The UK parliament recently enacted a new piece of sanctions and money laundering legislation designed to Brexit-proof the UK’s ability to implement international and European sanctions. To help organisations comply, VinciWorks has released a brand new scenario based training course Sanctions: Know Your Transaction. Following the success of our anti-bribery and anti-money laundering training, this […]

The role of eLearning in tackling the skills gap

Tune into any news channel on any day of the week and you’re likely to hear about the problems afflicting UK productivity. What’s causing them? One reason is a mismatch of skills. In this post, we look at the current skills challenges and the role eLearning can potentially play in addressing them. The challenge for […]

New release – Sanctions Knowledge Check

VinciWorks has just released a new five-minute knowledge check that tests users’ knowledge of the sanctions regulations and is in line with the Sanctions and Money Laundering Act. The knowledge check uses scenarios to help users understand the best course of action to take in different situations. The knowledge check is part of the Sanctions training […]

Are public beneficial ownership registers coming to the Crown Dependencies?

UK’s Sanctions and AML Act 2018 The UK’s Sanctions and Anti-Money Laundering (AML) Act 2018 is a legislative framework that strengthens the country’s ability to implement sanctions and AML measures. The act provides the legal basis for the UK government to impose and enforce sanctions on individuals, entities, and countries deemed to pose a threat […]

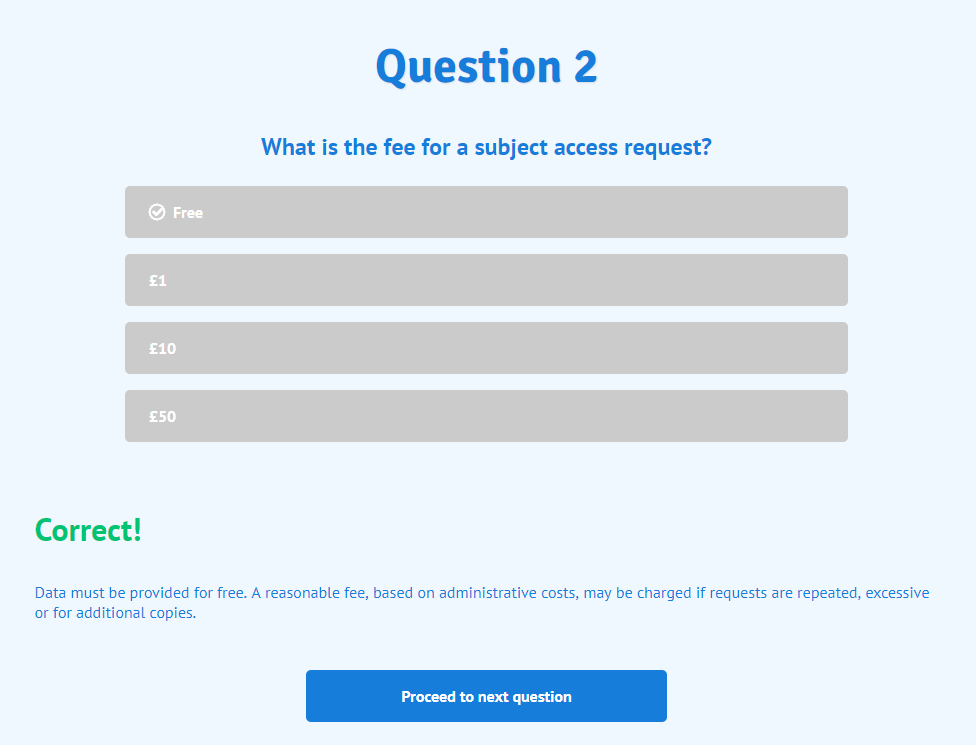

The VinciWorks knowledge check series

Verify and assess your staff’s knowledge of key compliance areas such as GDPR, anti-money laundering, anti-bribery and cyber security with our new series of five-minute knowledge checks. Each knowledge check presents 10 questions, with feedback automatically given after each question is answered. Distribute the knowledge checks across your organisation to evaluate the level of understanding, allowing […]

Top 5 reasons for using video for training

Training films are engaging and effective and support the way we learn and retain information. They are also flexible and let your people train ‘on the go’ and at their own pace – and it can save you money too. So what’s not to like?