Register for our DAC6 email updates

DAC6 is a European Directive aimed at tackling tax avoidance and strengthening tax transparency, as well as improving information sharing between EU member states. The Directive imposes mandatory reporting on lawyers, accountants, tax advisers, bankers, and other so-called “intermediaries”.

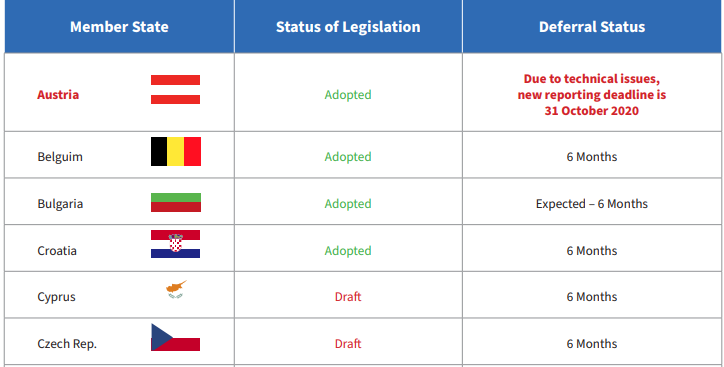

On 3 June, 2020, Member State representatives reached an agreement to allow an optional six-month deferral of reporting deadlines for DAC6.

On 19 June 2020, the European Parliament voted in favour of the EU Commission’s proposed deferral and on 24th June the European Union Council approved the postponement. 21 member states have postponed, most for the full six months. Notably, Germany, Austria and Finland have not.

We have created a downloadable chart presenting an up-to-date guide to how each country has decided to defer DAC6.

VinciWorks’ full country-by-country guide to DAC6 implementation

Not all EU member states have yet finalised their guidance and additional details, such as legal professional privilege and penalties vary between each state. To help firms save time and money on conducting their own research, VinciWorks has collaborated with Transfer Pricing Services to create a concise country-by-country guide to DAC6 compliance. The guide can be purchased either together with our DAC6 compliance solution or as a standalone tool.