On 30 November 2021, HMRC published its draft UK Mandatory Disclosure Rules (MDR) and released its consultation which seeks views on the design of the draft regulations. The consultation will be open until 8 February 2022. The UK MDR is expected to come into force in summer 2022, replacing UK DAC6.

MDR requires advisers (and sometimes taxpayers) to report information to the tax authorities on certain prescribed arrangements and structures, including those that could circumvent existing tax transparency reporting rules known as the Common Reporting Standard or hide ownership of assets.

For this webinar, we were joined by John Sandeman, HMRC’s policy official for Mandatory Disclosure Rules, who helped attendees get to grips with the UK MDR and how it applies to your organisation. John also answered attendee questions.

The webinar covered:

- Who does UK MDR apply to?

- Top challenges firms are facing

- Best practice for submitting reports under MDR

- Approaches to legal professional privilege

- What guidance HMRC are planning to release

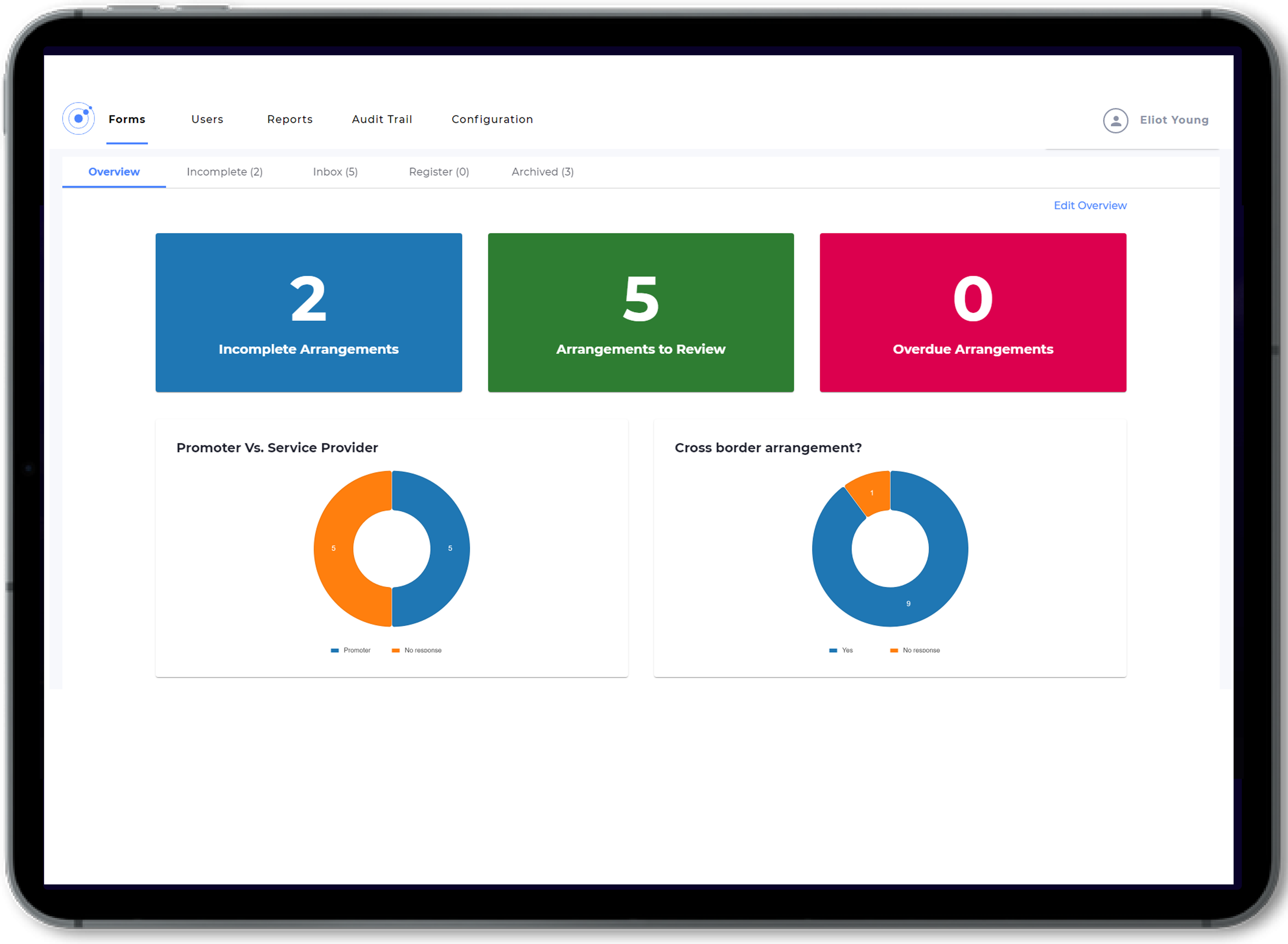

VinciWorks’ MDR reporting solution

VinciWorks has built a robust MDR reporting solution providing intermediaries, such as law firms, accounting firms and multinational businesses, with the expertise, knowledge and technical infrastructure to report and manage cross-border transactions. From one centralised system, organisations can fulfil their reporting requirements across every EU member state as well as every country that has introduced the OECD’s MDR into law.