What is an Environmental, Social, Governance (ESG) Committee?

An ESG committee has overall responsibility for the effective operation of a company’s ESG policy, and has delegated responsibility for overseeing its implementation. The committee reviews data from across the business and then filters and summarises it for the board. The ESG committee is responsible for writing the ESG content in the company’s annual report and producing all information relating to ESG disclosures.

How Do You Know if Your Business is Ready to form an ESG Committee?

Forming an ESG committee is a crucial step to get started on your ESG journey. It can be informal and ad hoc, but bringing in more than one person or department will help to deliver on your ESG goals.

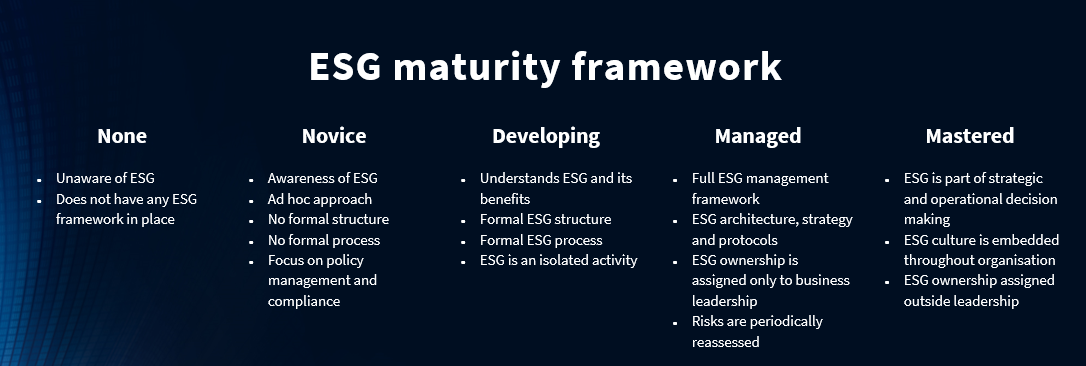

Before you decide to form an ESG committee, you should think about your ESG maturity. Understanding where your business sits on the ESG maturity framework will help ensure that you are doing things in the right order and at the right time. There’s no point in forming an ESG committee for example if your business is not planning any investment whatsoever in ESG efforts.

What is ESG maturity?

One of the first steps when getting started with ESG reporting is an honest and open assessment of where your organisation sits on the ESG maturity framework.

This VinciWorks ESG maturity framework can help companies assess where they are, where they’d like to go, and how to practically get there.

Where you sit on the framework can help determine next steps. For instance, moving from Novice to Developing could involve setting up a committee, putting a reporting process in place, and working towards a full ESG management framework to get to the next stage in the maturity framework.

For more on the ESG maturity framework, see our guide to Implementing an ESG Programme.

How to form an ESG committee

A strong ESG committee consists of executive leadership, budget decision makers, and middle and back office stakeholders. A committee would often be chaired or led by a designated ESG specialist. Using the committee structure for decision making helps ensure a coordinated ESG integration effort and generate broad-based support for the ESG programme.

The committee will ideally sit directly beneath board level in terms of seniority. The ESG committee should be able to gather and review data from broad parts of the business, then filter and summarise it upwards to the board. The ESG committee will likely be responsible for writing the ESG pages inside the annual report, or producing a separate ESG report which includes material disclosures.

You can cut, copy and edit this example for your own committee:

The ESG committee’s goal:

The aim of the committee is to establish a unified view of ESG, increasing understanding of all three aspects, environmental, social and governance, and to promote robust standards of corporate governance that integrate all these aspects for non-listed real estate vehicles. This will help the industry more effectively integrate ESG factors into the real estate investment decision-making process.

Key objectives of an ESG Committee:

- Emphasise importance of environmental measures, sustainability goals and performance, at all levels of the business.

- Provide best practice on the structure, policies and regulations that impact the business

- Increase understanding and awareness of corporate governance and social aspects that impact the industry

- Implement and promote common and workable standards of corporate governance for the business

VinciWorks’ ESG compliance solution

Our ESG compliance solution allows each business to choose the most relevant topics to cover in their ESG compliance package. There is no one-size-fits-all, so risk managers can tailor-build their own reporting dashboards, customise their own training or choose the products from our library. We will work with you to create a multi-year ESG plan according to the ESG framework that works for your organisation.

Complete the short form below to learn more or book a demo.