Omnitrack’s solution for ongoing monitoring

In our latest Omnitrack update, we have now built automated ongoing monitoring into the system. These automations can be based on the amount of time a submission has been in a specific status or based on the time since it was created or updated. This enables automated reviews of a submission after a period of time for ‘recertification’ or ‘ongoing monitoring’ of compliance.

In this post we will explain why this will be one of the most valuable tools in your customer due diligence (CDD) toolbox.

Are you conducting due diligence correctly?

Identification and Verification

Under the Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations, a process of customer due diligence must be carried out. Fundamentally, this involves two steps: identification and verification.

- Identification means understanding who your client is and their level of potential risk. If it’s a single individual this is a fairly straightforward matter. For corporations, the process is more complex. One needs to understand the structure of the organisation, its function, in what countries it is incorporated, etc.

- Verification involves gathering documentary evidence to prove everything from step one.

The reason for CDD is easy to understand. Knowing your client and understanding the reasons behind the instructions they give you makes it easier to identify whether you or your firm are being exposed to potential criminal activity. As Min Zhu, Deputy Managing Director of the IMF said, “Effective anti-money laundering and combating the financing of terrorism regimes are essential to protect the integrity of markets and of the global financial framework as they help mitigate the factors that facilitate financial abuse.”

For a more extensive explanation of what CDD involves, read our recent LSAG Blog.

What kind of criminal activity are we concerned with?

CDD is meant to determine the degree to which a client may expose you to money laundering and terrorist financing. Money laundering refers to any process whereby money gained illegally (dirty money) is brought into the legitimate economy. Terrorism financing is the process of getting money out of the legitimate economy into the hands of a terrorist organisation.

Ongoing Monitoring

Based on one’s findings from the due diligence process a customer is assigned a risk profile. Due diligence demands ongoing monitoring to determine whether a customer continues to match this initial assignment. It is important to remember that though no red-flags might be raised from one’s initial findings, a pattern of behavior over an extended period of time might indicate a different level of risk.

It is not enough to identify and verify your client at onboarding. It is likely that details will change over time. Ownership might change hands. New transactions might be initiated requiring further scrutiny. Any significant change reasserts the requirement for due diligence. Even without a significant change, due diligence must be conducted periodically.

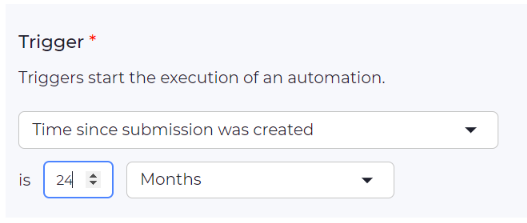

When it comes to CDD, Omnitrack has already set up automations based on best practice. However, all of the automations and reminders can be customised for the specific needs of your firm.Different time-based reviews can be set that will automatically be triggered according to the client’s risk level. For example, a client in the medium risk category can be set up to automatically send an email after 24 months to begin a review process. Then, if the review is not conducted, it can automatically escalate and trigger more frequent reminders to ensure that the review is done in a timely manner.

Other Use Cases

Omnitrack enables you to set up automations wherever there is a need for ongoing monitoring. For example:

- Annual compliance declarations

- Supply chain management

- Risk management

How to set up a time-based automation

Here’s how to set up an automation and reminder for a medium risk client.

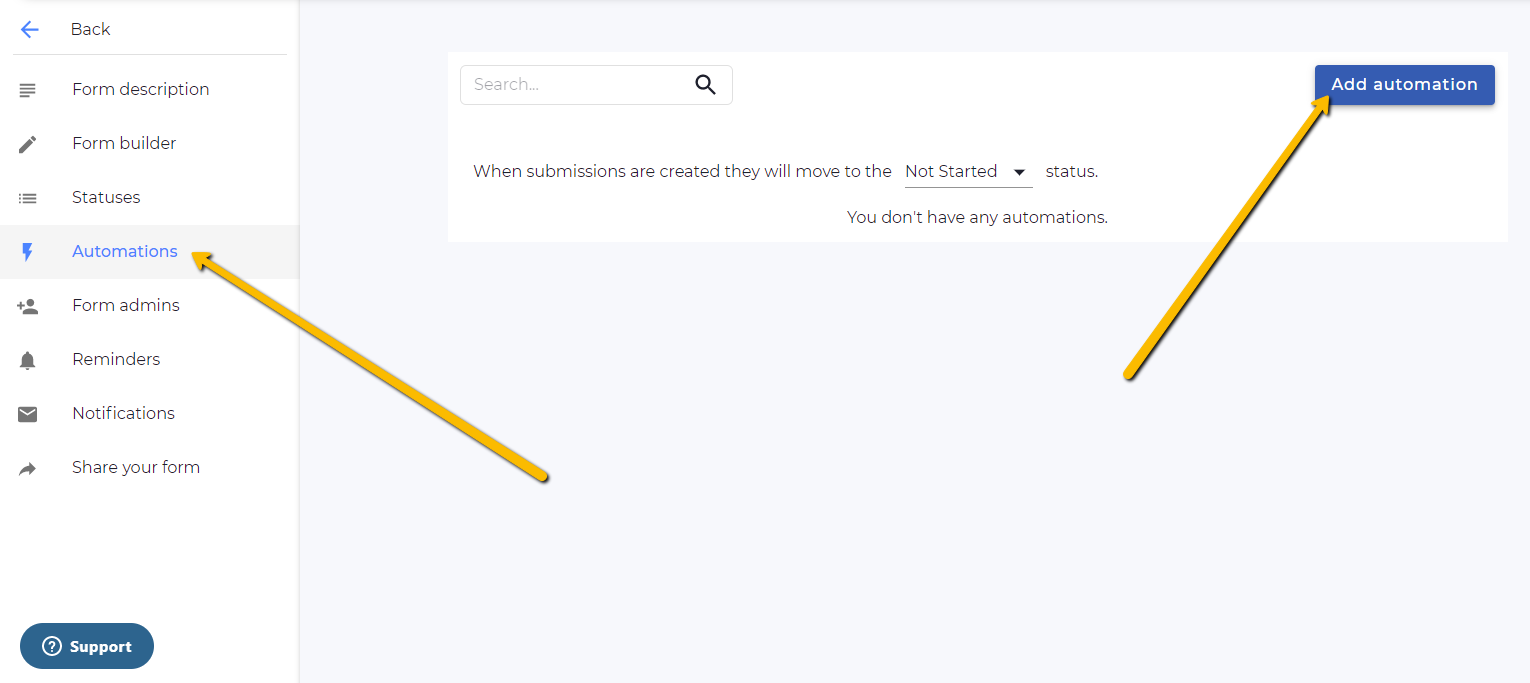

Step 1: Click on “Automations”, then click on “Add automation”

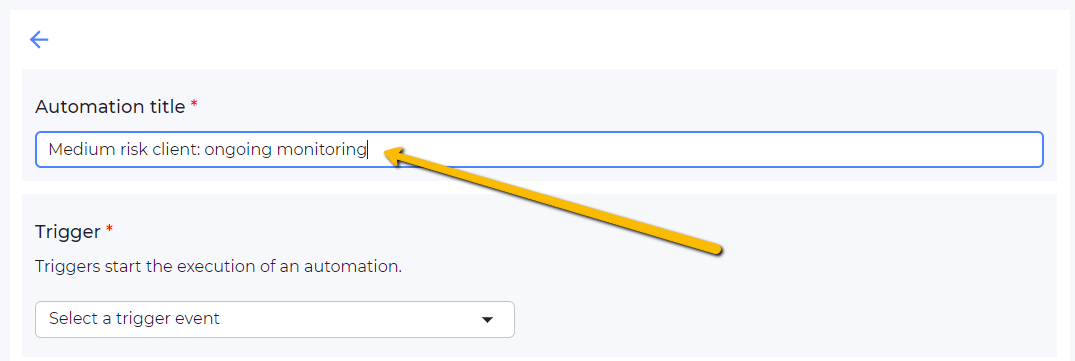

Step 2: Give the automation a title

Step 3: Select one of the time based triggers:

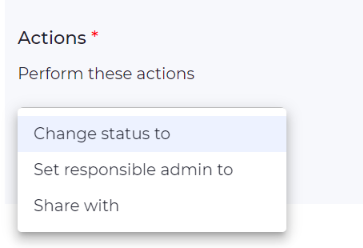

Step 4: Select what action should take place after 24 months:

In this example, we’ll select “Change status to”

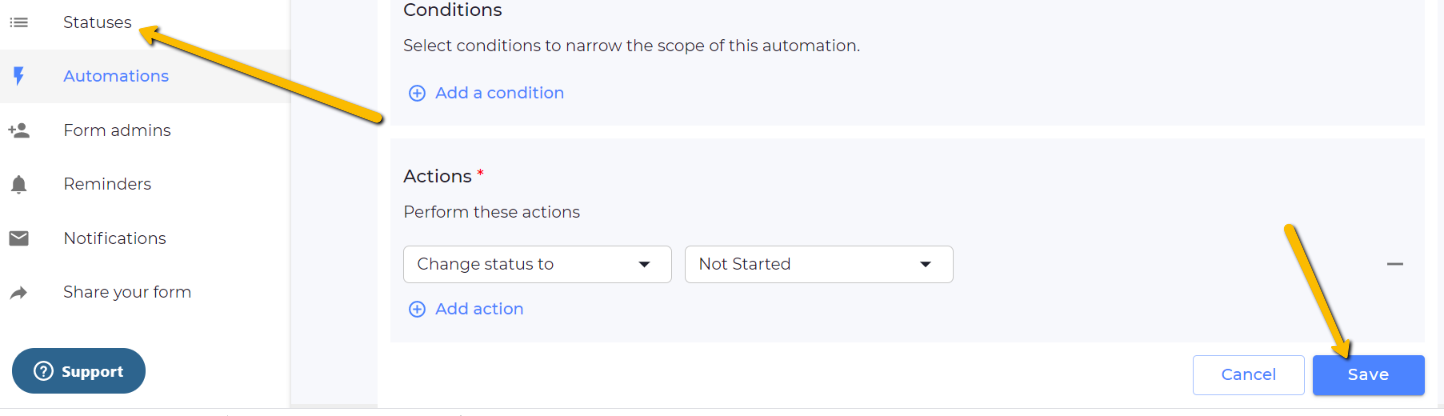

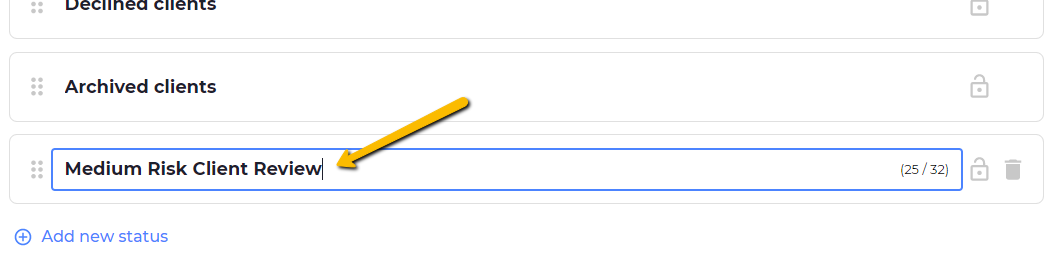

Step 5: Create a status to change the user to after 24 months.

It would make sense to add a status that indicates a review/renewal is required as opposed to one of the already existing statuses, like “Not Started”

Click on “Save” and then click on “Statuses”:

Add your new status:

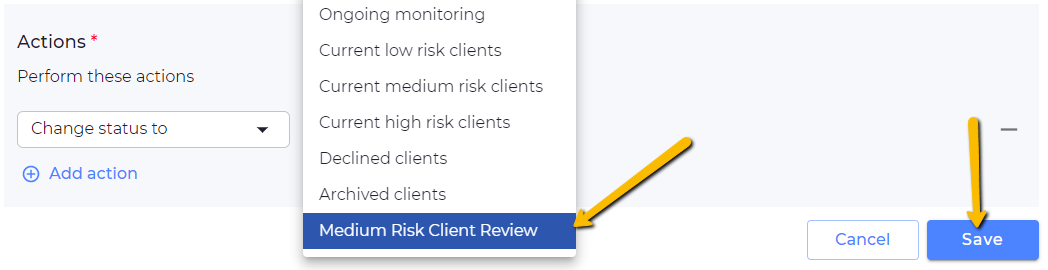

Step 6: Go back to “Automations” and now you can select as your action to change a user’s status to “Medium Risk Client Review” after 24 months.

Don’t forget to click “Save”

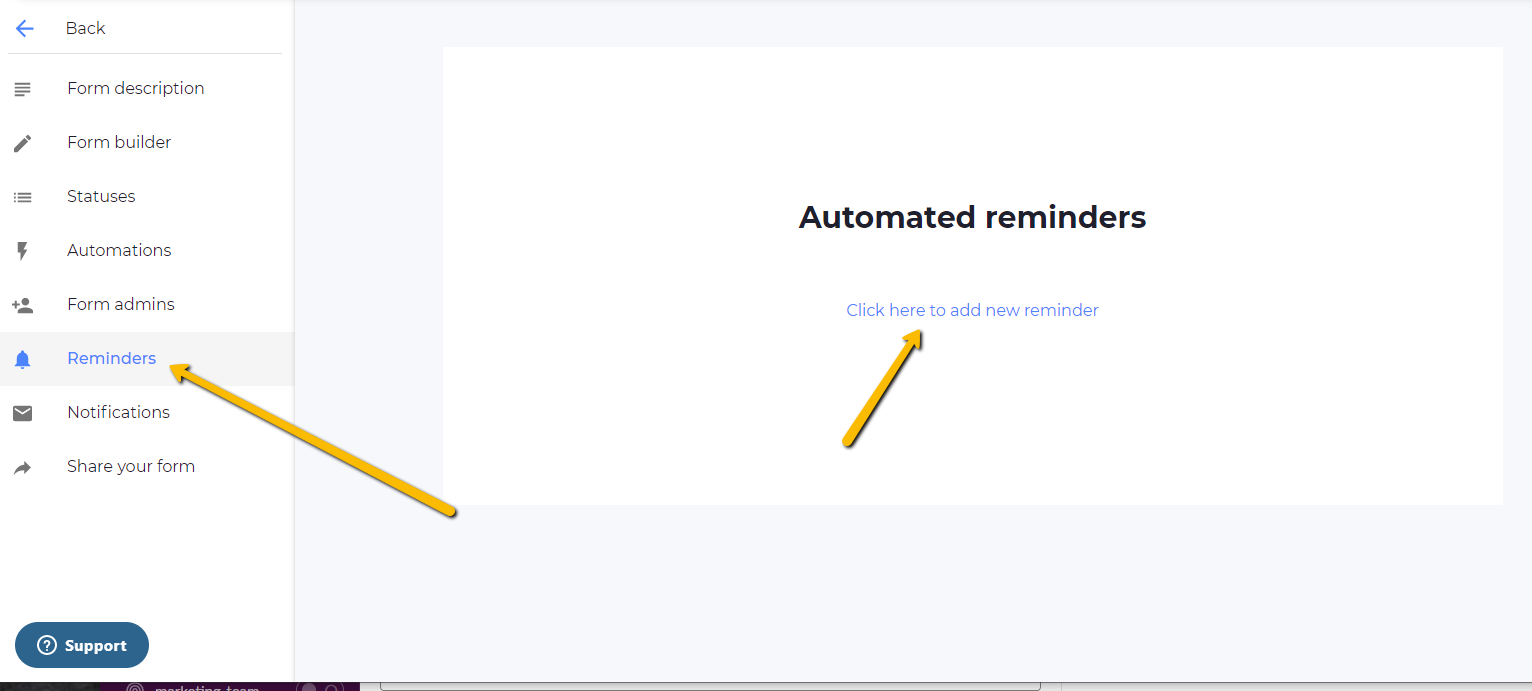

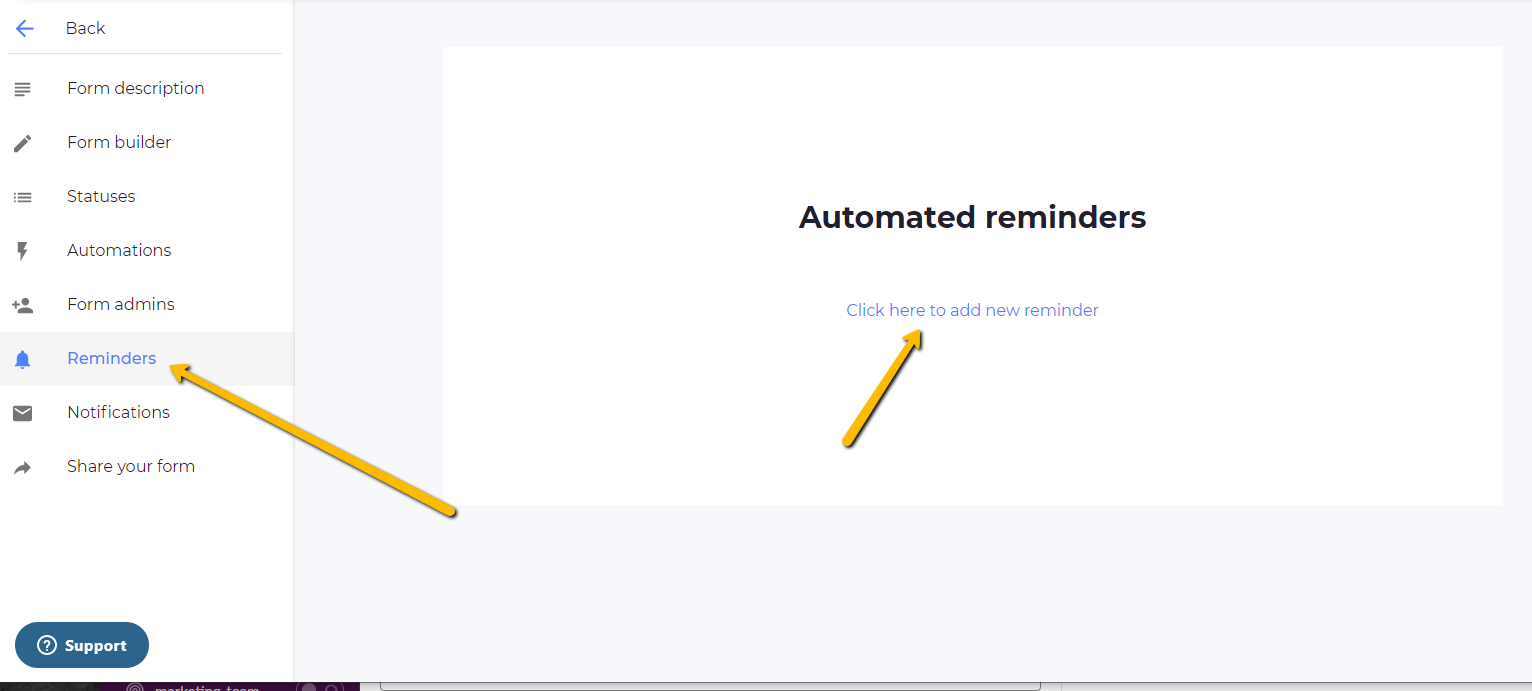

Step 7: At this point you’ll want this change in status to trigger a reminder. Click on “Reminders” and then on “Click here to add new reminder”

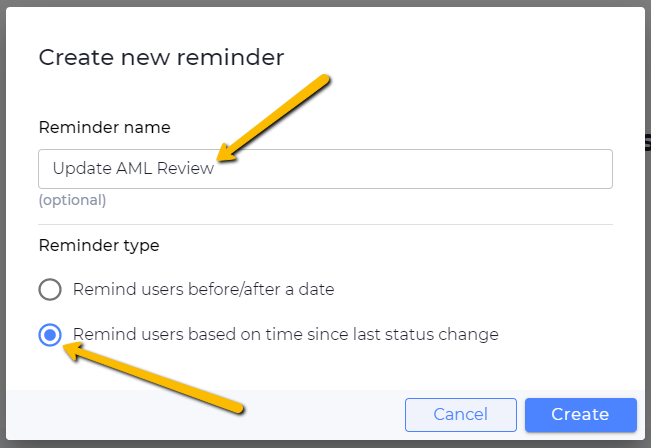

Give your reminder a title and click “Create” and make sure to select “Remind user based on time since last status change” (you can experiment with the other reminder type as well)

Now you can create your reminder.

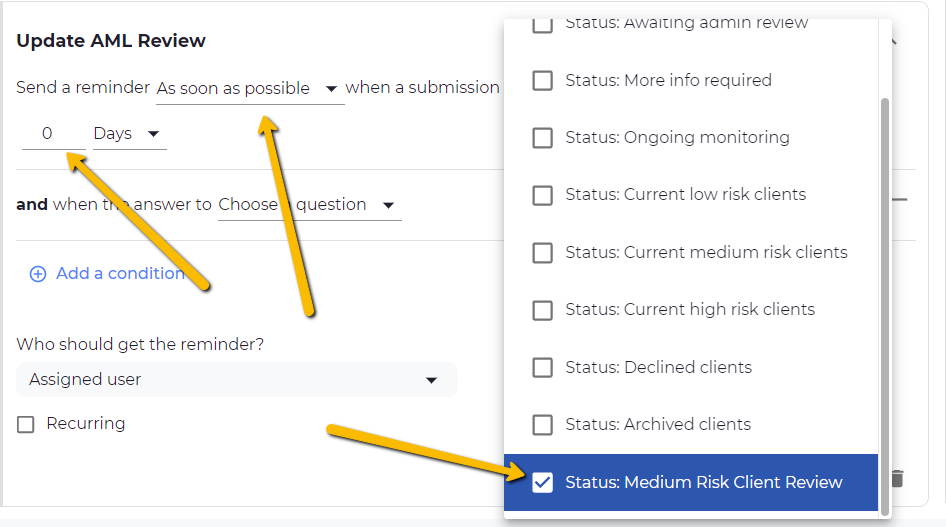

Here we’re creating a reminder that will be sent 0 days after the status changes to “Medium Risk Client Review”.

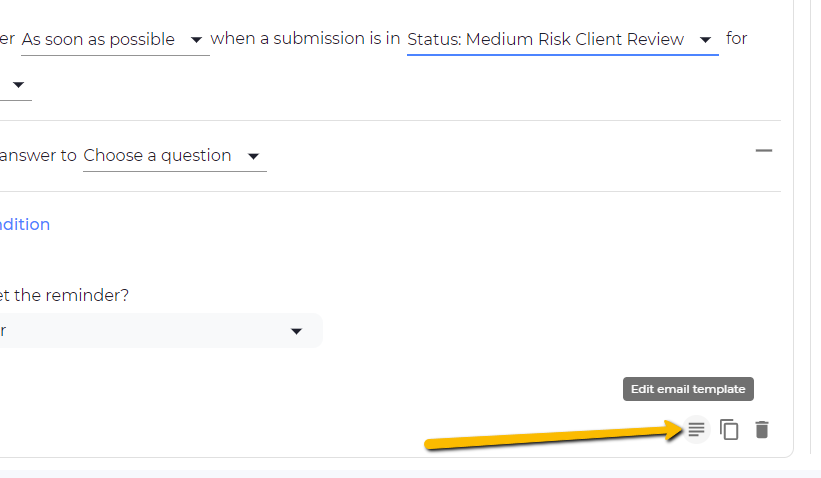

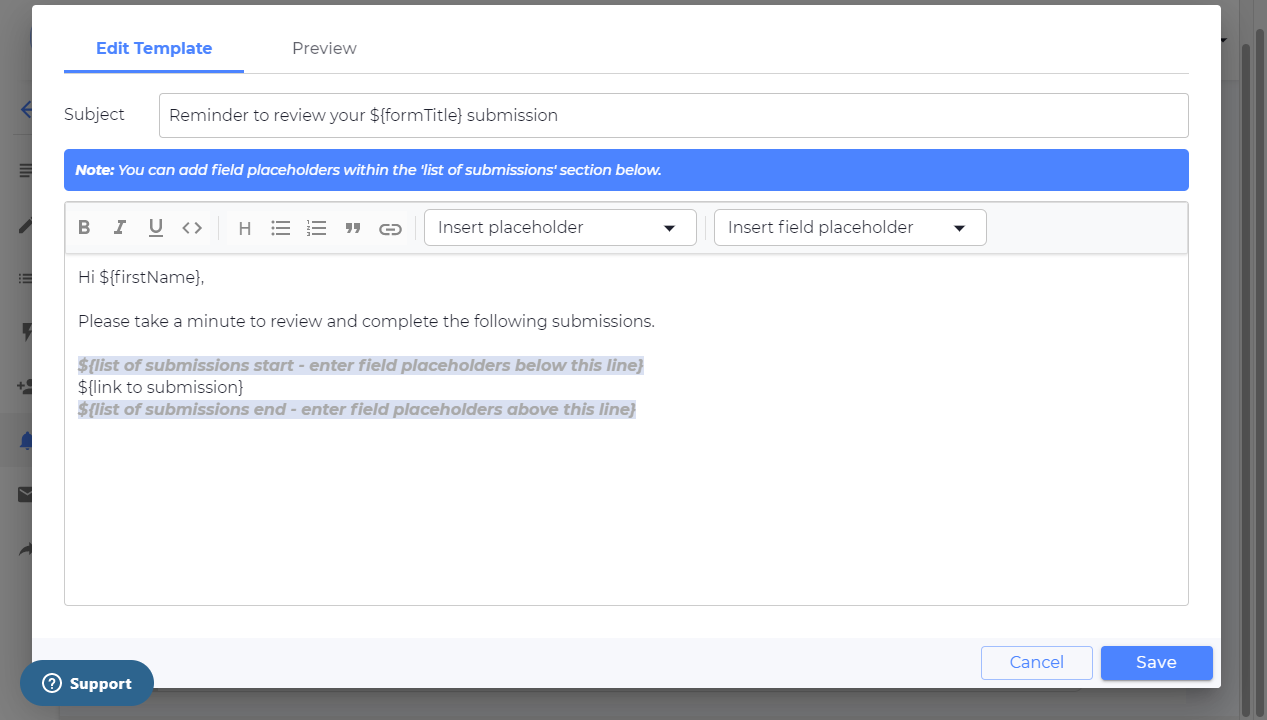

Next, it is possible to format an email that will be sent when the reminder is triggered.

Feel free to edit the email as you see fit.

And that’s it! (Don’t forget, as always, to click on Save)