When it comes to anti-money laundering training, relevant content has never been needed more. Content that isn’t engaging isn’t going to stick and will ultimately waste the learner’s time. Boring content, along with a lack of interaction, severely harms the effectiveness of training.

VinciWorks has released new anti-money laundering training. Featuring both an Advanced course for high-risk staff and a Fundamentals course for staff with lower exposure to money laundering risk, the new courses take relevance to the heart of training. With realistic scenarios, role-specific content, laws and procedures applicable in the jurisdiction, real-life case studies as well as a fresh, bold new design, our anti-money laundering training is suitable for any business, any user, anywhere.

Why is anti-money laundering training important?

Companies in just about every sector can serve as vital links in the money laundering chain, whether wittingly or unwittingly. With the correct training and risk awareness, every worker can break the chain and cut off the link that criminals and terrorists need to fund their enterprises. Every suspicious transaction reported or red flag spotted helps break the chain, bring criminals to justice and prevent innocent victims from being hurt by crimes such as human trafficking, drugs, violence, and terror. These risks have only been exacerbated by the COVID-19 pandemic.

The information in the interactive training, which has a fresh and engaging new design, will help users protect themselves and their companies from knowingly or unknowingly being involved in money-laundering related crime.

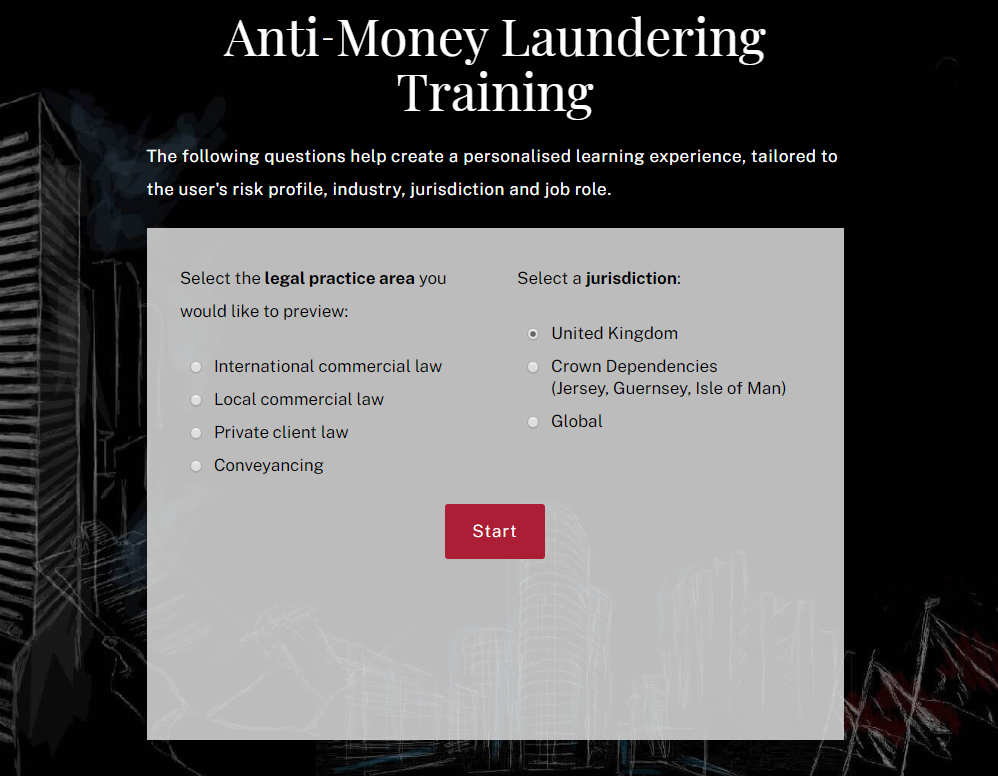

The training has been designed with relevance at the forefront, meaning every user who takes the training will receive tailor-made content specifically designed for their jurisdiction, job role, risk level and specific industry they work in.

Choosing which course to take

AML: Advanced is a 90 minute course geared towards staff with higher exposure to money laundering risk. This includes staff involved in client onboarding or due diligence. The course provides a detailed explanation of how money laundering works and how to conduct CDD. It also details all relevant laws and features an exhaustive list of red flags.

AML: Fundamentals is a 45 minute course that should be used for staff with lower exposure to money laundering risk. This course provides an overview of money laundering, explains how your organisation could inadvertently be used in the money laundering chain and who to contact in the event of any suspicions.

Relevant AML training for the legal sector

For the legal sector, we’ve taken relevance further than ever before with scenarios tackling a range of areas of legal practice, such as private client, commercial law and conveyancing. The course can be used in offices all around the world, bringing training up to the same standard required in the UK and EU member states. Users who practice law offshore also receive dedicated scenarios and information specific to the type of work they do.

VinciWorks has also expanded AML training to the rest of the regulated sector. So whether you work in a bank, in the accountancy sector, financial services, a regulated crypto-currency exchange, an art dealership or any other industry which is now regulated under the Fifth Directive, this course will provide the ultimate money laundering training solution you need.

What’s in the training?

The new training is designed to give all users, whether they are assessed as high or low risk, a tailor-made and relevant experience while providing firms with the peace of mind that their staff are up to date with their training requirements.

Training features:

- An innovative red flag assessment enabling your firm to track and assess the frequency of money laundering indicators to strengthen your defences

- How money laundering works delivered in compelling, real-life ways

- In-depth explanations of how money laundering works, accompanied by real-life examples, and how it affects a users industry

- The particular laws and offences surrounding money laundering and related offence

- How to conduct client due diligence and what the various levels of KYC requirements mean

- Counter-terror financing along with specific requirements placed on the regulated sector

You can learn more about our training or get a quote by completing the short form below.