When it comes to compliance training, the antidote to boredom is relevance.

Training that isn’t relevant is boring, unengaging and of limited effect. Training that resonates with the user, that feels like it was written with his or her particular industry, practice area or job role in mind, works.

Content that isn’t engaging isn’t going to stick and will ultimately waste the learner’s time. Boring content, along with a lack of interaction, severely harms the effectiveness of training. With regulators increasingly taking a deeper look at the content of training, not just completion records, training that merely ‘ticks the box’ with a one-size-fits-all approach will ultimately fail.

Training is vastly more effective when it focuses on scenarios employees could realistically face. Very often, compliance training sticks with theory and which doesn’t offer relevant context. Going into legalistic definitions of archaic principles doesn’t help people do their job better. Employees need relevant information that helps them do their jobs, keep compliance in mind, and protect their organisations from criminals and harm.

Training that is based on a user’s role in an organisation, and that keeps a worker’s specific responsibilities, geographic location, and areas of expertise in mind, creates a training experience with relevance at its heart.

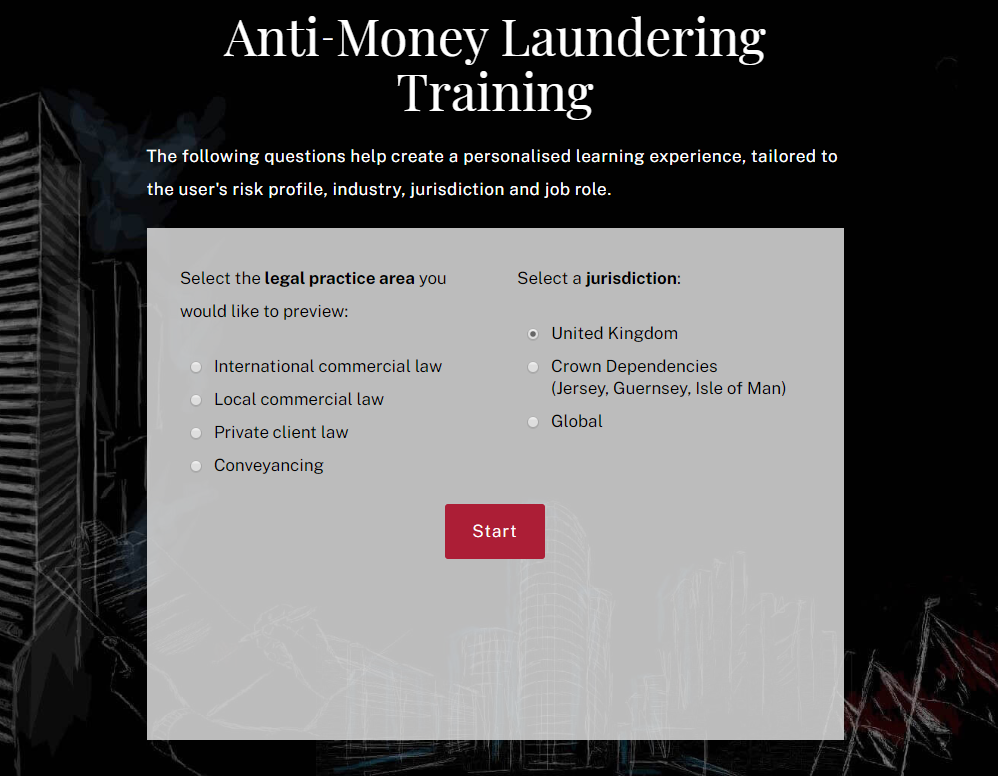

VinciWorks’ new anti-money laundering training takes relevance to the heart of training. Utilising realistic scenarios, role-specific content, laws and procedures applicable in the jurisdiction, real-life case studies and featuring a fresh, bold new design, VinciWorks anti-money laundering course is suitable for any business, any user, anywhere.

How can companies keep their AML training relevant?

Location and jurisdiction

Anti-money laundering regulations differ from country to country. While small businesses may get away with enrolling their staff in one course that covers the laws in one country, for global businesses this simply isn’t enough. The “course builder” in VinciWorks’ AML training allows all staff to select which jurisdiction they work in. The result? A course with guidance, scenarios and test questions relevant to their jurisdiction.

Industry and practice area

Presenting users with guidance, scenarios and test questions relating to their industry ensures they will be able to relate to the training. Such relevant training will drive home the fact that no one is immune to the risk of money laundering and will have a “wow, this could happen to me” effect.

In our “course builder”, users are prompted to select which industry they work in. The industries we currently offer are:

- Law

- Real estate

- Financial services

- Cryptocurrency

- Accounting

- Banking

- Other

Our commitment to delivering industry-relevant training does not stop here. Once a user selects that they work in the legal sector, they can then select their specific practice area. The practice areas include:

- International commercial law

- Local commercial law

- Private client law

- Conveyancing

Interactive relevant scenarios and questions

Thanks to the “course builder” we covered above, our training modules will include scenario questions related to the industry they work in, their jurisdiction and where relevant, their area of practice. This helps businesses take training beyond a “tick-box” exercise to taking a course because they feel it is important and relevant to ensuring they or their company is able to spot red flags and stay as far away from money laundering as possible.

Customisations

Our anti-money laundering training is fully customisable – every single word can be changed. Here are some of the most popular customisations our customers choose:

Contact people – Add your Money Laundering Reporter so that staff can report any red flags that come to mind while taking the course, or simply copy and paste the details and have it available when relevant.

Policies and procedures – Include links to your company’s anti-money laundering policies in the course. You can also add a link to company-specific anti-money laundering procedures to the course or add a custom-module that covers internal procedures.

Custom module – In addition to the standard modules in the course, you can create a completely custom module that includes your own text as well as multiple-choice questions. The process of adding a process is simple: just send us a word document via our customisations form and we’ll add it to your bespoke AML course.