When the clock struck 11pm on 31 December 2020, the UK stopped applying EU sanctions and its own autonomous sanctions regime came into force. While the UK sanctions regime substantially does the same thing as the EU one, the lists of sanctioned entities may not be exactly identical. Importantly, UK sanctions may apply to non-UK sanctions and non-UK nationals, so it is important to stay up to date.

Brexit means that a company that operates in the UK and the EU is subject to at least two separate sanctions regimes. Therefore sanctions compliance has never been more important.

The UK has been preparing for this change for several years. This preparation includes the 2018 Sanctions and Anti-Money Laundering Act and the Global Human Rights Sanctions Regulations 2020. Additionally, over 30 statutory instruments have been laid to ensure a smooth transition to the new UK sanctions regime.

Who is affected?

UK sanctions will usually apply to any conduct within the UK and the territorial sea of the UK. In addition, all UK persons (i.e., UK nationals and legal entities incorporated in the UK) must usually comply with UK sanctions wherever they are in the world. This may include compliance by UK companies’ branches irrespective of where their activities take place.

What’s new?

As well as the Consolidated List on financial sanctions, there’s a new UK sanctions list maintained by the Foreign, Commonwealth and Development Office which consists of all designations made under UK sanctions including financial, non-financial and human rights sanctions. It’s important for companies to consult both lists to ensure they comply with sanctions rules.

UK sanctions designations can now also be made by a description in circumstances where a person cannot be identified by name.

There are also some specific differences in the licensing regimes between the EU and the UK. These are:

- A reasonableness test has been added to the UK licensing ground for the Routine Holding and Maintenance of funds or economic resources.

- The UK Sanctions Regulations add an “extraordinary situations” grounds, which “enables anything to be done to deal with an extraordinary situation” (e.g., support of disaster relief) in relation to non-UN sanctions.

- The UK Sanctions Regulations allow the government to issue General Licences, which allow multiple parties to undertake specified activities which would otherwise be prohibited by the UK Sanctions Regulations without the need for a specific licence.

What have we updated in the course?

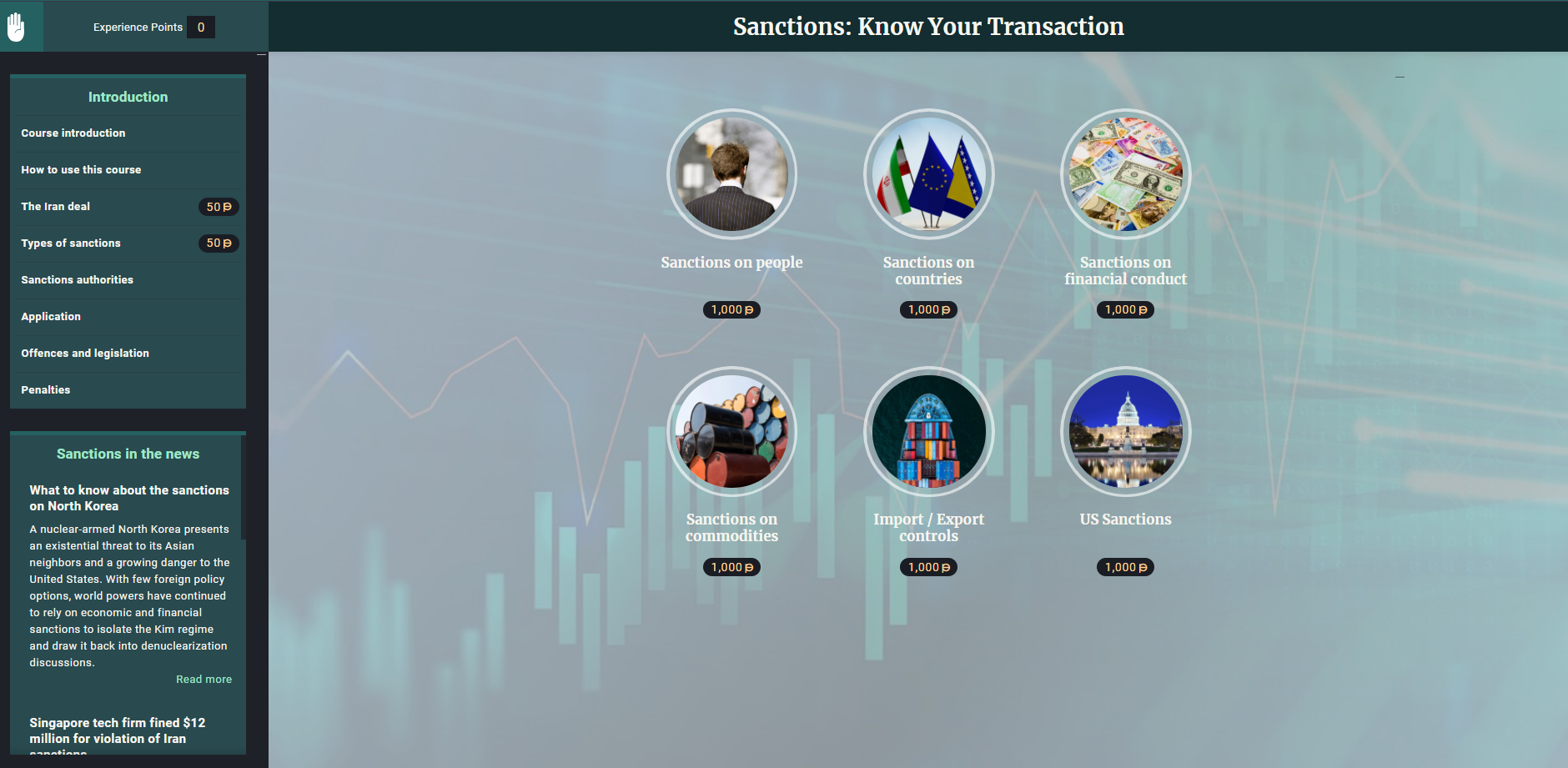

We’ve made sure all UK-referenced legislation is up to date, as well as the locations of the specific lists that all businesses must refer to when conducting sanctions due diligence. Sanctions: Know Your Transaction gives users real-life experience of using sanctions lists through a series of interactive scenarios and real-life case studies and prepares them using the sanctions lists in their day-to-day jobs.

What to do now?

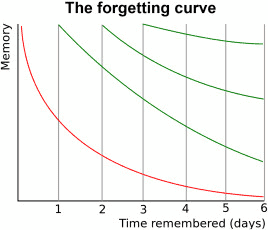

It is worthwhile putting staff through sanctions training as soon as possible given the implementation of the UK sanctions regime. All businesses are required to screen for sanctions compliance when conducting due diligence, but in particular, regulated entities should make sure everyone is up to speed on the new sanctions rules.

For businesses also operating under EU sanctions, VinciWorks will shortly be releasing a specific EU version of the sanctions course. Please contact us for more information.