What is the EU list of non-cooperative tax jurisdictions?

The EU list of non-cooperative tax jurisdictions is a list of jurisdictions that do not comply with all international tax standards. The list includes jurisdictions that do not yet comply but have committed to implementing reforms that will bring them to compliance. The aim of the list is not to shame the countries that appear, but rather to encourage positive change in their tax legislation and practices. Once a jurisdiction does meet all criteria to be considered cooperative for tax purposes, it is removed from the list.

October 2021 updated EU list

On 5 October 2021 the Council of the European Union released a revised list of EU non-cooperative jurisdictions for tax purposes.

The EU list of non-cooperative jurisdictions for tax purposes is a tool to tackle:

- tax fraud or evasion: illegal non-payment or underpayment of tax

- tax avoidance: use of legal means to minimise tax liability

- money laundering: concealment of origins of illegally obtained money

The list contains non-EU countries that encourage abusive tax practices, which erode member states’ corporate tax revenues and underlines the importance of promoting and strengthening of tax good governance mechanisms, fair taxation, global tax transparency and fight against tax fraud, evasion and avoidance, both at the EU level and globally.

The updated EU list is important when considering DAC6 Hallmark D1 which captures arrangements where it is reasonable to conclude that these may have the effect of undermining reporting obligations under Council Directive 2014/107/EU (‘DAC 2’) and the Common Reporting Standard (‘CRS’), as implemented in the domestic legislation of EU Member States.

EU list as of April 2022

The Council of the European Union released a revised list of EU non-cooperative jurisdictions for tax purposes on 24 February, 2022. The document that includes the list states that it underscores the importance of advancing and strengthening good tax governance mechanisms, tax fairness, global tax transparency and the fight against tax evasion at both the EU and global level.

The council welcomes the ongoing tax cooperation between the EU Code of Conduct group and most countries and territories, welcomes the progress made in certain previously less cooperative states and territories, and invites the countries and territories that remain on the list to consult with the Code of Conduct group to resolve outstanding issues. The conclusions specifically mention Turkey, recognising the country’s progress and calling on them to continue to do the work necessary to become fully compliant with the requirements.

How VinciWorks can help?

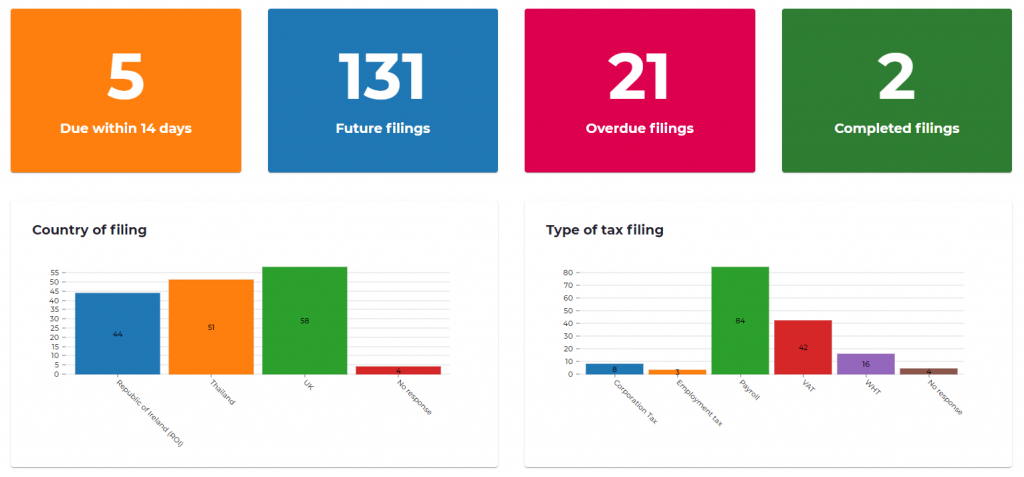

Tax departments in all organisations need to keep to strict deadlines for tax obligations such as corporation tax, payroll and VAT payments. This often gets even more challenging when dealing with multiple jurisdictions.

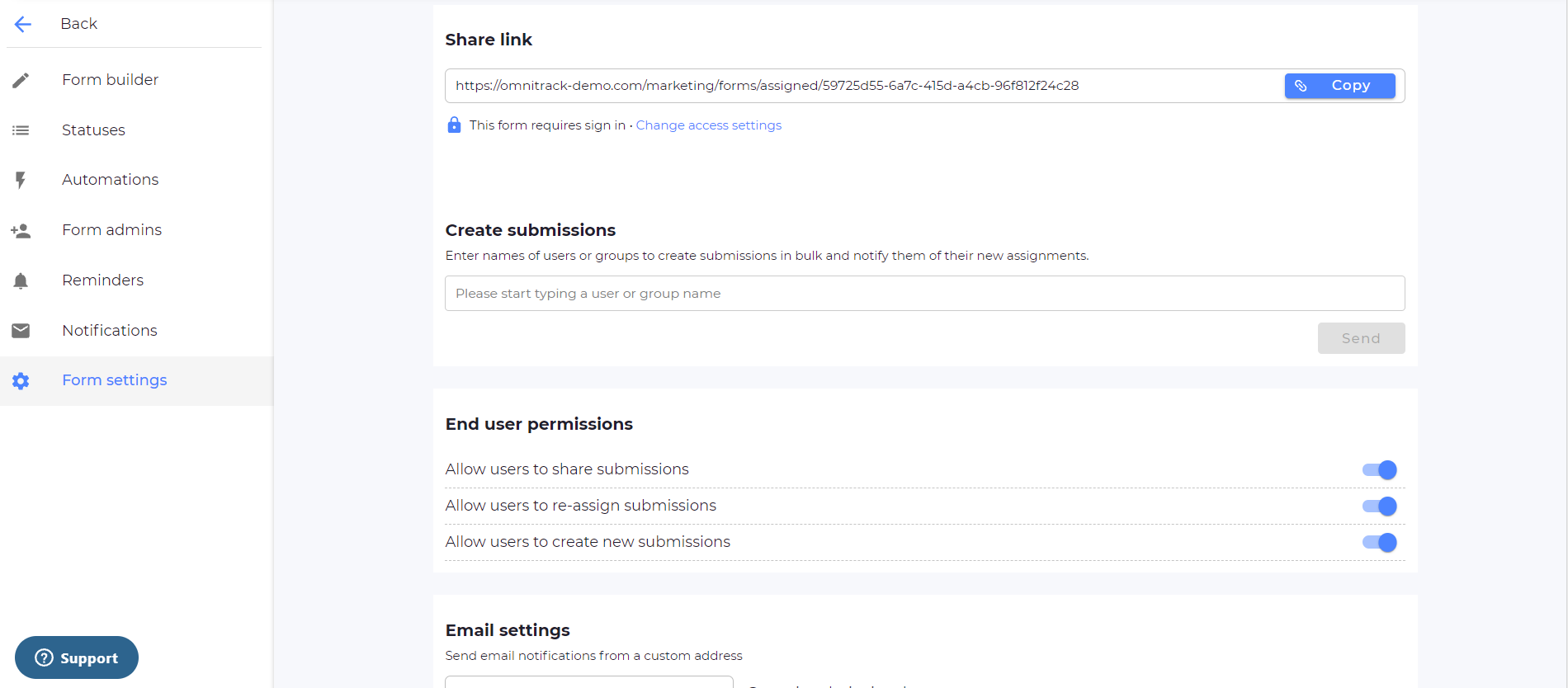

Omnitrack, VinciWorks’ data collection tool, allows you to record, manage and complete all tax filing requirements. From setting filing deadlines, choosing a warning notice period and recording the obligation fulfilment, Omnitrack has you covered. Get in touch with us to see how Omnitrack can help your business.